- July 13, 2023

- Posted by: CoachShane

- Categories: Day Trading, Stock Trading, Trading Article

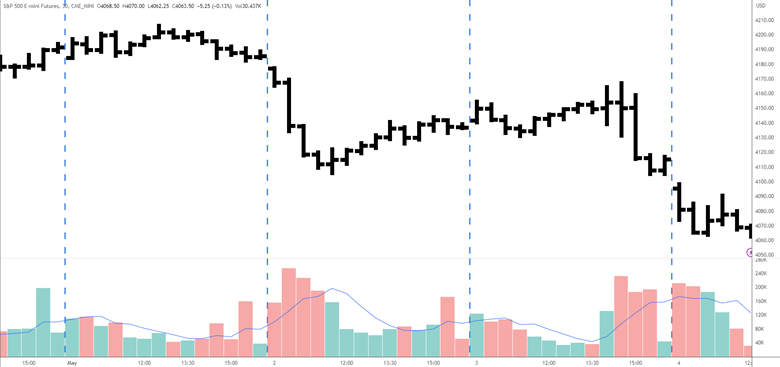

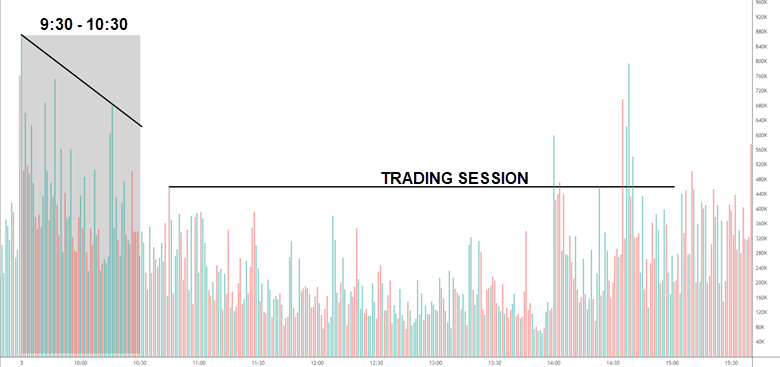

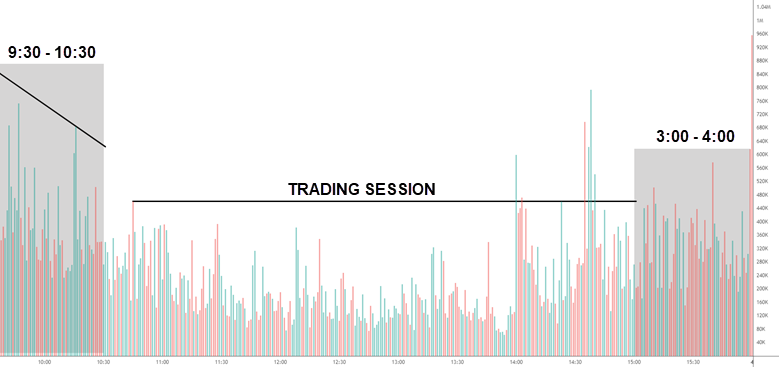

The Stock Market Power Hour is the final hour of trading (or the first hour depending on who you ask) in the stock market, typically from 3-4pm EST (9:30 – 10:30), where there is often increased volatility and trading activity as traders make last-minute trades before the market closes.

This intense hour of trading is the perfect opportunity for those looking to maximize their profits and manage risk because you know you are only live in the market for the hour. During this hour, market volatility tends to increase as traders rush to close positions before the end of the day.

What Is Power Hour In Trading?

Power Hour generally refers to the final (or first) 60 minutes of trading when the market experiences a surge in activity. Day traders are rushing to buy or sell stocks before the close, hoping to capitalize on any last-minute changes in price.

During this time, even minor fluctuations can significantly impact profits. Traders must stay focused and alert, constantly monitoring their investments while looking for potential opportunities.

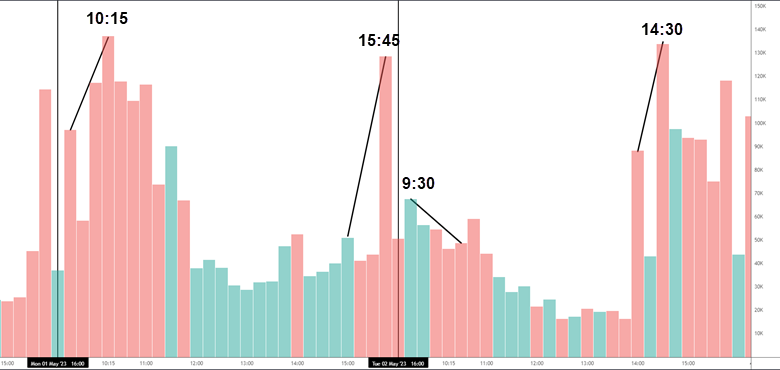

Some traders will include the first hour of the trading day in their definition of Power Hour, as this is another time when the market can experience increased volatility and activity. This time period is known as the Opening Bell or the Morning Rush.

Power Hour and the Opening Bell are both important times for traders to pay attention to, as they can provide opportunities for quick profits. They can also be risky times to trade, as the market can be unpredictable and volatile.

It is important for traders to have a solid strategy and risk management plan in place before participating in these high-pressure trading periods.

Morning Power Hour (Opening Bell): First Hour Of Trading

This important period falls within the first hour of the trading day, and it can set the tone for how investors make decisions throughout the rest of the session.

During this time, professional traders are often most active in executing trades based on overnight news events or pre-market developments. Swing trades may also be made during this window as a result of price movements from previous days.

While some traders prefer to wait until later in the day to make trades, others believe that getting ahead of potential trends early on can lead to better profits.

To take advantage of this time, traders must have solid trading strategies in place and stay vigilant when monitoring market activity. It’s essential to keep an eye out for sudden shifts in price or volume that could signal changes in market sentiment.

- The morning power hour sets the stage for trader decisions throughout the trading day.

- Professional traders often execute swing trades during this time frame.

- Monitoring sudden shifts in price and volume is key to identifying potential opportunities.

As always with trading, there are risks involved no matter what strategy you use. However, understanding and utilizing specific periods like the morning power hour can help increase your chances of achieving greater returns while minimizing losses.

Afternoon Power Hour: What You Need To Know

The Afternoon Power Hour is the time of day when traders can take advantage of quick trades and scalp trades. It’s a period that comes after the morning trading activity slows down, typically between 3 pm to 4 pm Eastern Standard Time.

Power hour stocks are those with high trading volume, providing ample liquidity for investors to buy or sell shares quickly. Traders who missed out on profitable morning trades should look at afternoon power hours as another chance to capitalize on market movements.

Day trading during this period of time requires discipline and knowledge about events affecting the markets’ behavior. Trading patterns involving momentum and technical analysis strategies may provide insight into how best to trade stocks during this time frame.

With proper planning and execution, traders can achieve success by taking advantage of quick trades that arise throughout these periods without sacrificing long-term goals.

4 Trading Strategies For Power Hour

During the stock market power hour, market participants can take advantage of the most volatile time in the trading day. It is believed that roughly 40% of daily trading volume occurs during this one-hour period.

This presents both high-risk and high-reward opportunities for those who are willing to make quick trades. To succeed in power hour trading, it’s important to have a solid strategy if you intend to day trade.

| Trading Strategy | Description |

|---|---|

| Momentum Trading | Identifying stocks with significant upward or downward momentum and making quick trades based on that movement. Traders using this strategy typically look for stocks that have been trending in one direction for a sustained period and aim to capitalize on the continuation of that trend. |

| News-Based Trading | Reacting quickly to breaking news announcements and their potential impact on specific stocks or sectors. Traders using this strategy monitor news sources for information that could impact the market and specific stocks. They look to make quick trades based on their interpretation of the news and its potential impact on the price of the underlying security. |

| Technical Analysis | Using charts and technical indicators to identify patterns and trends that suggest future movements in price. Traders using this strategy analyze price and volume data, as well as technical indicators such as moving averages and relative strength, to identify patterns that suggest future movements in price. |

| Scalping | . Traders using this strategy typically hold positions for only a few minutes or seconds and aim to make small gains on each trade. They rely on high-frequency trading techniques and often use automated trading software to execute their trades quickly and efficiently. |

While these strategies can provide great market opportunities, they also require discipline and risk management. Always set stop-loss orders and be prepared to cut losses if your trade isn’t turning out as expected.

3 Tips for Power Hour Trading

If you are intending to trade during this period of intense market activity, keep these three things in mind:

Watch out for Red Flags

One red flag to look out for during Power Hour trading is sudden spikes or drops in trading volume. Rate hikes and inflation rates can influence price movement. While a surge in volume may seem like an opportunity, it can also mean that institutional traders are entering or exiting positions quickly, causing significant market volatility. Economic news released during this time can cause sharp movements in stock prices as traders adjust their positions accordingly.

Master Swing Trading

For those practicing swing trading, it’s important to note that Power Hour can be particularly volatile due to its short-term nature. Ensure you follow your trading plan as strong price moves may tick you out of positions or surge in your direction. I have used the power hour in the morning to position in swing trades that have last several days to weeks.

Caution and Consideration

Caution and careful consideration must always come first before jumping into any trade blindly. Make sure to have a clear plan and set realistic goals before entering any trades, and always be ready to adjust your strategy based on market conditions.

Growing Industries For Power Hour Stocks

Power hour stocks are those that have seen increased activity during this time, making it an excellent opportunity for traders looking to capitalize on any potential gains.

To maximize profits during power hour, it’s smart to keep an eye on industry trends and overnight news that could impact companies’ performance. Growing industries present exciting market opportunities but do your homework and have a list of candidates you are looking to trade.

Trading power hour stocks within the sectors you have identified could prove profitable if timed correctly.

Company news can also play a role in determining which power hour stocks are worth looking at especially in the morning hour.

Positive announcements such as new product releases or partnerships can significantly boost share prices.

Negative developments like missed earnings expectations or legal troubles can lead to sharp declines. Traders should closely monitor company news leading up to the final hour of trading to stay ahead of potential shifts in share prices.

Things To Consider When Trading During Power Hour

One of the most important factors to keep in mind is your positions’ size and options because they significantly impact your profits and your loss potential.

Short-term trading can be an excellent strategy for those who want to make quick money from stock market opportunities. However, it comes with risks that need to be managed effectively. Traders should always have a well-defined plan before entering any trade during the power hour. .

When trading during power hour, timing is everything, as even seconds could mean significant gains or losses. The market moves fast during this period, which means you must stay focused and disciplined at all times. In addition, keeping up with breaking news stories that are relevant to your trades can help give you an edge over other traders.

4 Strategies For Handling Power Hour Trading

You don’t have to always trade during this time frame. Here are four ways to take advantage of the power hour.

| Tactic | Description |

|---|---|

| Monitor Morning Power Hour Sessions | One strategy for making the most out of the morning session is to monitor morning power hour sessions closely and not position during this time. These initial hours of trading often provide clues as to how price action will unfold during the rest of the day. By keeping an eye on these trends, you are better equipped to take advantage of any opportunities that arise later in the day. |

| Using First 30-60 Minutes to Gauge Market Action | The first 30-60 minutes of the trading session can inform you about the market action for the day. Traders can determine whether it will be a trending day or a range-bound session. By observing the market during these first minutes, traders can take advantage of the opportunities that arise and make informed trading decisions. |

| Impact of After-Hours Trading on Power Hour Trading | After-hours trading sessions can impact power hour trading. Traders must stay informed about any significant news or developments occurring outside regular trading hours as they could influence market sentiment and affect stock prices. Earnings reports are often released after hours, and traders must keep up-to-date with such releases to make informed decisions throughout power hour and beyond without missing critical information. |

| Importance of Staying Informed About After-Hours Trading | Staying informed about all aspects of after-hours trading allows traders to make informed decisions throughout power hour and beyond without missing critical information. By being aware of significant news or developments outside regular trading hours, traders can better understand market sentiment and adjust their trading strategy accordingly. Keep up-to-date with any information that could impact the market and stock prices. |

Is Power Hour Trading Right For You? Factors To Consider

While power hour trading can be thrilling, it’s important to keep a level head and not get too caught up in the excitement. Increased activity can also mean increased volatility, so make sure you have a solid trading plan in place.

The first factor is your ability to handle market volatility. Power hour is famous for being unpredictable with sudden swings in prices due to news or rumors. You must be prepared to manage risks and make decisions quickly without getting caught up in emotions like fear or greed.

Having a well-defined trading plan can help mitigate losses during volatile times.

Power hour trading may not work for everyone depending on their lifestyle. If you have a full-time job or other commitments during power hours, then it might not be an approach for you.

Power Hour Trading: Pre-Market Movement

One question that comes up when discussing power hour trading is whether or not pre-market movements can be used as an indicator of how the rest of the day will unfold.

Pre-market movements may not always accurately predict the direction of the market once regular trading hours begin. Many factors, such as news releases, economic data, and geopolitical events, can impact the market and cause sudden shifts in direction.

It’s important to not rely solely on pre-market movements and to constantly monitor the market throughout the day. Experienced traders often use a combination of technical analysis and fundamental analysis to make informed trading decisions.

Successful power hour trading requires a disciplined approach, patience, and a willingness to adapt to changing market conditions.

Frequently Asked Questions

What is Power Hour, and why is it called that?

Power Hour is the last hour of the trading day, from 3 pm to 4 pm EST, (or first 60 minutes) where the market experiences high trading activity. The name comes from the intense trading activity during this hour, with traders looking to make quick trades and the market experiences a surge in prices.

When is the cheapest time to buy stocks?

The cheapest time to buy stocks is during the opening bell at 9:30 am EST, when the market opens for the day, and prices tend to be lower as traders adjust their positions from the previous day’s trading.

What is the 10 am rule in stocks?

The 10 am rule in stocks suggests waiting until after the first 30 minutes of trading before making any major trading decisions. By this time, the market has settled down, and traders can make better decisions based on the day’s trends.

Do stocks always go down during Power Hour?

No, stocks don’t always go down during Power Hour. It can be a time of stability or a surge in prices, depending on the day’s trends and the specific stocks being traded. Traders should keep a close eye on the market and make informed decisions based on the day’s activity.

How can I maximize my gains during Power Hour trading?

To maximize gains during Power Hour trading, traders must manage risk, make informed decisions quickly without getting caught up in emotions, and have a solid understanding of technical analysis and risk management strategies. Having a well-defined trading plan and using risk management strategies like stop-loss orders can help mitigate losses.

Conclusion

Trading during Power Hour requires discipline, patience, and an understanding of the market. Traders should keep an eye on market trends, understand technical analysis and risk management strategies, and make informed decisions without getting caught up in emotions. With a strategic approach and careful planning, traders may be able to capitalize on the last hour of activity and increase their chances of success.

Power Hour trading may not be suitable for all traders. It can be a high-risk strategy that requires experience and a deep understanding of the market. Traders should always consider their own risk tolerance, financial goals, and trading style before implementing any new strategy.