- September 18, 2020

- Posted by: CoachMike

- Category: Options Trading

Over the last week we have taken a closer look at the components of the Nasdaq ETF (Symbol: QQQ) and the S&P 500 ETF (Symbol: SPY).

These two ETF’s are at the top of my watch list on a monthly basis as they are great products to trade. They have very liquid options making them easy to trade in many types of market conditions.

Russell 2000 ETF

The third index ETF that I want to take a look at is the Russell 2000 ETF (Symbol: IWM). While not as liquid as QQQ or SPY it does tend to provide bigger moves back and forth in many cases.

It can be a little trickier to trade at times especially when using the weekly options as the liquidity isn’t as good in the options as the other two index products.

We like to trade the index products for their flexibility and diversification. However, as discussed in the previous articles with the growth in the tech names the last few years it’s now harder to get the diversification that we are ideally looking for.

QQQ and SPY are both heavily influenced by the stocks in the tech sector.

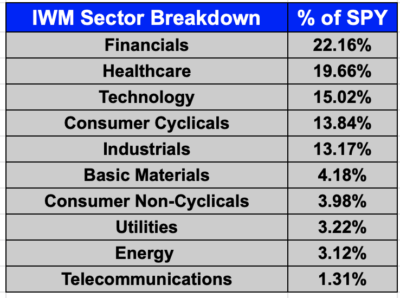

IWM on the other hand is not as exposed to the movement in the tech sector. 22% of the index is made up of the financials and 20% from the healthcare sector. As a result, we are able to get exposure to completely different areas of the market than what the SPY and QQQ offer. This allows us to get more diversification in our trading.

IWM – Data You Should Know

Overview

iShares Russell 2000 ETF (Symbol: IWM). IWM tracks the market cap weighted index of U.S. small cap stocks. It tracks the 2000 stocks in the Russell 2000 index. The 2000 stocks that are part of the index are very broad based which allows it to be a more diversified index when compared to the Dow, Nasdaq, or S&P 500.

Since it does follow the small cap and micro-cap stocks, it can be very active with bigger moves back and forth.

Performance

IWM does provide good diversification as it is exposed to many areas of the market other than focusing exclusively on the tech sector. The ETF is down 1.50% over the last month. It is up 7% over the last 3 months and down 6% year to date. It is down just under 1% over the last year and up 4% over the last 3 years.

IWM can be very volatile due to tracking the small cap stocks. The swings back and forth can make it a great product to trade for active traders looking for shorter holding times. If looking for a buy and hold approach you will find SPY a much better Index ETF to use.

Components

IWM does track the performance of the 2000 individual stocks that make up the Russell 2000 index. 22% of the ETF comes from the Financial sector and 20% from the Healthcare sector.

As you can see in the screenshot below the ETF will also provide exposure to:

- Technology

- Consumer Cyclicals

- Industrials

- Basic Materials

- Consumer Non-Cyclicals

- Utilities, Energy, and Telecommunications.

When you compare this list to what we discussed with SPY and QQQ previously, you will see that we get access to different areas of the market which can make IWM a great complement to the other index products.

A big difference between IWM and the other two index ETF’s that we have discussed is the weighting of the top 10 products in the ETF.

While the ETF tracks the 2000 stocks in the Russell 2000, the weighting is spread across a bigger list of markets. If you look at the top 10 stocks in QQQ, they represent 56% of the ETF. When looking at SPY the top 10 stocks represent 28% if the ETF.

However, the top 10 stocks in IWM only make up 3.5% of the ETF. We like the fact that a small group of stocks won’t dominate the performance of IWM like you see the tech stocks do for QQQ.

While the diversification is a great feature with IWM, it doesn’t make it a perfect product. With the tech sector such a big part of the overall market, it’s important to have exposure to the tech stocks that are found in QQQ. We find IWM to be a great component of any watch list as long as you are willing to use a wide range of options strategies which we will talk more about in a moment.

Liquidity

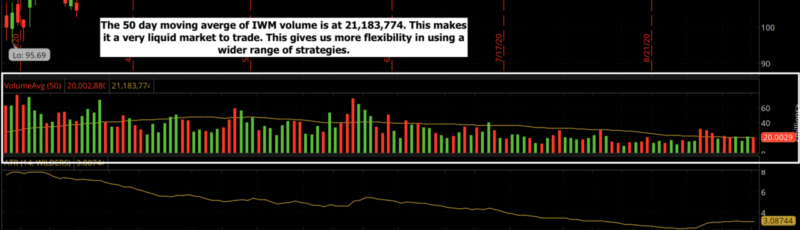

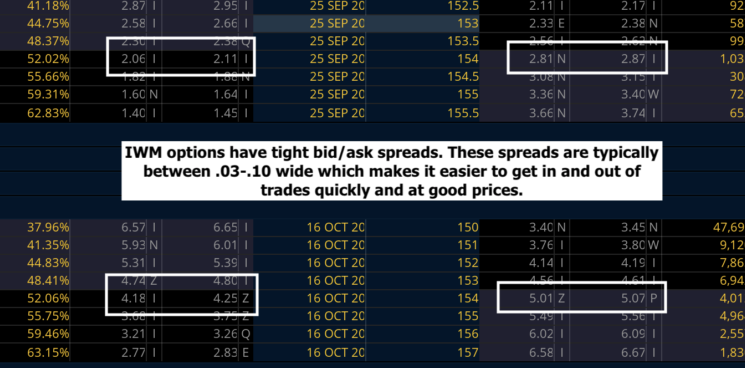

IWM is not going to be as liquid as SPY or QQQ but it does have plenty of volume and open interest to trade the options with any type of options strategy. I find the monthly options easier to trade than the weekly options.

The monthly options will have more volume and open interest to work with which will lead to tighter bid/ask spreads. This makes it easier to get in and out of trades quickly and at good prices.

Looking at the 50-day moving average of the volume on IWM it typically trades 21,183,774 shares on a daily basis. While we prefer to trade the options instead, it’s important to see decent volume in the shares of stock as it will typically mean you will have an easier time trading the options.

As you can see from the screenshot below, IWM will typically have Bid/Ask spreads on the options anywhere from .03-.10 wide. This makes it easier to use strategies like vertical spread when trading options on IWM.

Best Options Strategies to Use

We love trading the Index ETF’s because the liquidity allows us to use a wide range of options strategies. We can use any type of options strategy including long calls and puts, debit spreads, and credit spreads.

We find the monthly options easier to trade than the weekly options. The weekly options aren’t as liquid in many cases which can make them trickier to use if trading a vertical spread.

Our sweet spot is to look for between 20-60 days left to expiration on the options the we are trading.

IWM is a more diversified ETF which is a great feature. However, since it does track the small cap stocks which tend to be more volatile it can lead to choppy stretches of trading. Due to this fact, we prefer to use more credit spread when trading IWM. Selling premium allows us to get a more forgiving trade that can make money multiple ways.

Below you will see a screenshot showing our preferred options strategies depending on how aggressive our outlook is.

IWM Conclusion

IWM is one of our favorite markets to trade long term. We find it to be a great complement to either SPY or QQQ. It will provide an easy way to get diversification into areas like the Financial sector and the Healthcare sector. As always, it’s important to keep the risk small and focus on building a sample set of trades. If you do that the odds will stack up in your favor long term.