- February 6, 2017

- Posted by: Mark S

- Categories: Day Trading, Trading Article, trading videos

One of the worst times to day trade is during the time when many traders take lunch and this is a good time for you to stand aside. To go on further and elaborate a little on why I say this and to make the point, I wanted to focus more on specific time periods within the primary day trading session.

This applies to intraday traders more than anyone else, although when anyone enters or exits a trade, they are acting on an intraday basis.

So why do I think lunchtime trading is the worst time to day trade? Like everything in trading, it has to be determined based on your strategy and your personality. If it works for you, then by all means do it.

But for me and the vast majority of traders we know, the difficulties with trading over lunchtime are clear. This is the time during our trading day where we should take the opportunity to take a break and clear our mind.

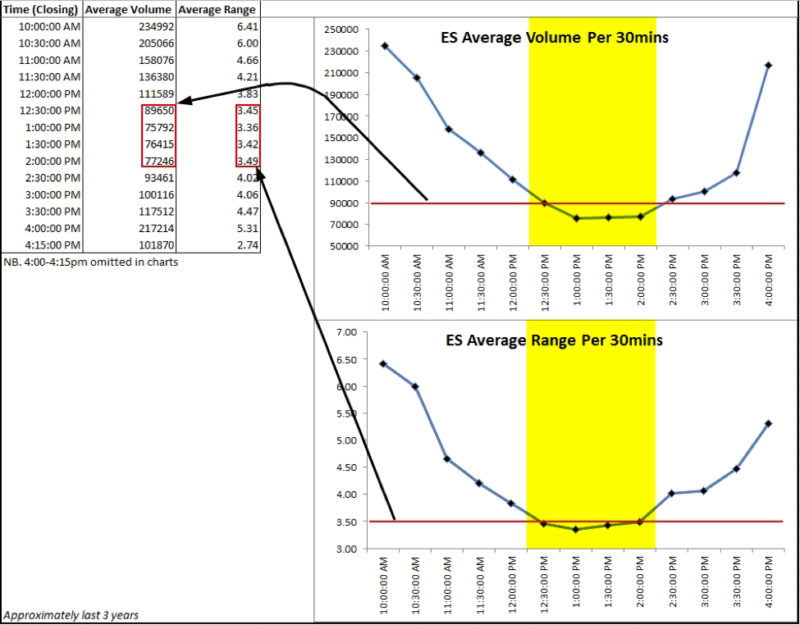

The E-mini S&P500 (ES) is where I will focus as many day traders are already familiar with this market. I have put together some basic average statistics spanning a 3 year period to help illustrate my point about lunchtime trading.

Worst Time To Day Trade: 12 – 2 P.M.

The statistics clearly show that the average 30 minute volume and range bottom out between 12-2pm EST i.e. LUNCHTIME. The specific time a particular market’s activity hits it’s low point with its primary session will in fact vary from product to product and clearly is likely to be very different for markets traded on exchanges in different parts of the world.

But these stats are specifically for the ES.

The other important note to make is that this is average data. There will of course be outliers on either side of the figures shown and sometimes it may be the case that market activity is actually good during this period and the length/start of the period can also vary.

From these stats we can draw some obvious conclusions:

- We can say that range potential is generally quite a bit lower than earlier and later in the day.

- We can also say that lower volume might mean there is less interest. If you look at average volume per point over the course of the day, during this period it is roughly 1/3 – 1/2 lower than at the start and end of the session.

Pitfalls Of Trading During Doldrums

What does this mean? Harder fills perhaps, although bid/ask sizes are also likely to be lower. Also there’s less likely to be directional movement. Getting into a day trade and being chopped up by random price action during a time you should not be trading can be devastating to our emotional capital.

These basic statistics give a general feel for what it might be like over lunchtime, but to show the kind of movement, it’s a little clearer in the video below. Again, there are always going to be days when there are outliers in the data and there are some great opportunities during lunchtime.

However, if you’re a person who’s day trading and not an algo or automaton, you’ll need some sort of break during a day trading session – you can’t focus and trade effectively for the whole day so it’s better to focus your efforts on windows of opportunity during the day where you find the highest probability of good trading opportunities occurring.

Finally, I will say that trading can be draining at the best of times and for me, being stuck in a poor position over lunchtime is one of the most frustrating things especially if you know this is a bad time for day trading. So when you are in a trade, think about what the time of day is and the kind of potential the market might therefore have.

What Is The 10 a.m. Rule In Trading?

This is a general rule of thumb which means waiting until around 10 a.m. to place trades. After the initial orders have cleared from the open, the market may continue to rally (or decline) or take a sudden reversal.

By adhering to this rule and simply watching price during the period between market open and 10:00 a.m., you may avoid being caught on the wrong side of the market. This could obviously be considered a bad time to trade however lunchtime still takes first place in that regard.

1 Hour Trading Strategy

While not a specific strategy here at Netpicks, we do follow a trading rule that often times has us out of the market quite quickly. We call it “The Power Of Quitting“. What this means is simply setting a trading rule when you will stop trading for the day.

As an example, your Power Of Quitting (POQ) may have you take 1 winner and ending positive on the day. Some traders may prefer 2 wins and positive. It really depends on your system and the goals you have set for yourself.

By analyzing your trading logs and journals, you will find the best combination of wins/losses that will have you ending up positive on most days. I can tell you that often times, our day trading strategies are actually 1 hour trading strategies (or less) simply by following a trading plan that has the POQ as a rule.

Worst Day Of The Week To Trade

Unless your system takes advantage of the volatility surrounding news releases, any day that has a significant amount of important releases (even inventory reports) would be a day you should approach with caution.

There may even be days where your system, for whatever reason, just doesn’t preform well. The only way you can decide this is through comprehensive tracking of your trading actions.

Your stats may find that on Monday, your system would be better if it followed more of a momentum style of trading. Perhaps on the Wednesday, mean reversion strategies work better as this is the day that those who bought on Monday begin to take profits.