- May 4, 2020

- Posted by: Mark S

- Categories: Advanced Trading Strategies, Trading Article, trading videos

Day trading has the potential to keep you glued to the screen the entire day as you punch in and out of trades.

It can actually be addicting as you watch the increase in your trading account – perhaps not so addicting when the losses come.

But even with the losing trades, many traders will continue to day trade in the hopes of making back what they have lost.

- Keep on trading because the account increase is addicting

- Keep on trading because you want to make back what you have lost

I am going to tell you something we tell all of the traders who come through our virtual door to learn how to trade: we would all be better day traders if we only knew when to stop trading each session.

I Was In That Trap

Before I discovered NetPicks, I wound up giving back a lot of my trade profits. It actually felt worse giving back hard won profits than it did just losing outright.

I don’t even want to start talking about looking for the best Forex trading system every time I had a streak of losing trades.

The real problem was that I had no intelligent or effective way to actually know when to stop trading.

- If I quit too soon, I would miss a bunch of good winners.

- If I traded too much, I gave away my profits.

Like most of the coaches at Netpicks, I started as a customer and for me, it was 2008. One of the first things I was told was how important it was to utilize the ‘The Power of Quitting, (yes, we’ve been talking about long before many people started trading)

To be blunt, it made absolutely no sense to me!

If the trading strategy was so good, then why would I want to quit trading?

It is such a counter intuitive concept and later, as I learned more and actually began to turn my trading around and had bigger profits, much of the new found success was largely a result of actually empowering myself to stop trading.

Quitting actually made me more money over time!

Yet, to this day it remains one of the least understood necessities to ongoing success but for those that understand it, it is a big part of their trading plan.

Power Of Quitting Explained

The Power of Quitting (POQ) is a dynamic goal setting strategy that allows you to take what the market wants to give , while allowing you to quit with positive results on ‘most’ sessions.

In its most basic form, you need to get a winning trade plus have a positive result.

What is really exciting is that at times this can be accomplished with the very first trade sometimes. Other times it may require more trading but that all depends on what the goals are with that trading plan.

There are also different formulas that you could use:

- POQ 2 means that you need to have TWO winners and a positive result.

- POQ 3 means three winners and positive on the day.

- The PTU Trend Jumper actually needs a full target winner for one of its winning trades to qualify for POQ.

One issue that gives many traders problems is knowing when to stop trading when the session is not going very well (this happens often when important news events are pending).

There will be sessions with ALL strategies that just will not get positive.

- How long should a trader continue trying to get positive?

- What’s a good circuit breaker?

- Should I even open the chart today?

This is one of the most difficult questions to answer because so much of it depends on the trader.

- How long can he or she trade?

- How much capital do they have?

- How much stamina and attention span do they have?

- How much skill? Etc..

The only way to really know that answer is to actually conduct your own back tests so that you can come to the best answers based on actual research and understanding.

- Each strategy is different

- Each market is different

Some traders love finishing a session, one and done; that is, winning on the first trade to satisfy the basic POQ 1.

POQ 2 might yield more net profits but it is actually less profitable and a lot harder, day in and day out.

Why work harder when working smarter makes more sense and improves the bottom line?

If you can increase the average profit per trade, all you have to do is increase the position size as the trading account grows. You do not need to trade more to make more money.

It’s In The Back Testing Of Your Strategy

Any trading strategy you use must be back tested with both in sample and out of same data. From the data, you learn if you have a trading strategy has an edge – a positive expectancy over time.

You also, without over optimizing, find what type of exit strategy offers up the most opportunity with the least downside.

Here is an example of where your power of quitting comes from back testing so we are clear on what we are talking about.

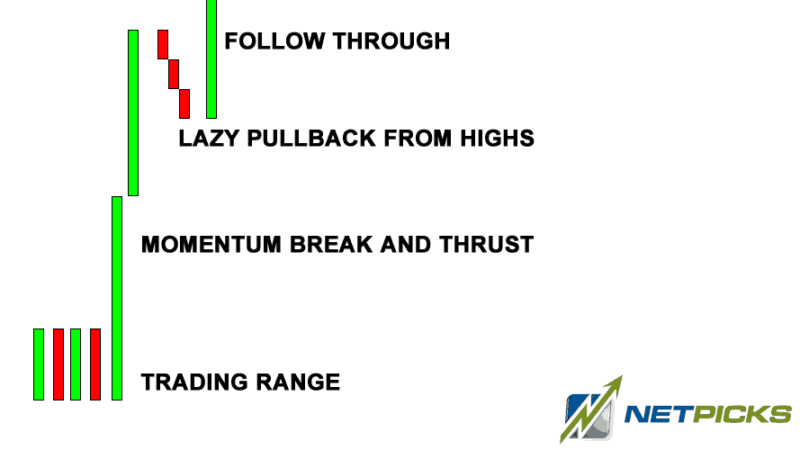

The market is in a trading range and price breaks to the upside with two candlesticks showing obvious momentum. If you are trading futures, perhaps you see an increase in the volume which tells you objectively, that there is interest in higher prices.

One price reaches a peak, profit taking ensues or maybe traders are shorting what may be perceived as overbought condition. Regardless of the reason for the pullback (and it does not matter why), we want to see a lazy pullback in price which shows that the interest to the down side is not pressing and you place a buy stop and trail it down until hit.

You then get a strong push to the upside and at the first sign of a pullback, you exit.

The reason for the trade is the impulse leg showing momentum is, through your back testing, a strong variable for a successful pullback setup.

Your testing also shows that the first time price pulls back in a lazy fashion, is the higher probability trade. Subsequent pullbacks, according to your testing, do not show the same edge and consistency as the first.

You also find that if the pullback fails into a trading range, it has a low probability of setting up this price action and therefore is not longer a viable trade.

Your Power of Quitting is one trade and done because any more than one trade will damage the expectancy over time of the trading system.

How You Can Trade More Often

Some traders want to trade more. Maybe they like the action or they are trading for income but they also see the benefit of a POQ concept.

Diversification is certainly a smart thing to work into your trading too but how does one satisfy all three while still remaining consistently profitable?

Here are two ideas that have a lot of merit.

Diversification

You could begin trading one market and as the session progresses, stagger in other markets.

- Crude Oil or a Forex pair could start at a certain time in the pre-market.

- When the US market opens, you could trade an e-Mini or a grain futures, for example.

- You could also include some swing trading into the mix to diversify that type of trader you are.

Mini-Sessions

To find success with mini-sessions, you must know the best times to trade each market you are interested in. Some markets have various pockets of time that are more productive than others and this should have been determined in your back testing of your trading strategy.

Taking that idea to the next level, you can treat each ‘pocket of time’ as a unique session, each with its own start time, stop time and POQ goals, typically, POQ 1, with a full winner being necessary to qualify.

That means you have to have a full winner and be positive before you could quit the mini session.

You can also combine it with:

- A maximum number of trades

- A maximum number of losses

- A hard stopping time, which would end the mini session.

Then just wait for the 2nd mini session to begin. The second mini session has its own unique trade plan and POQ, just as I described with the first.

What Not To Do

One of the most vital traits as a trader you must have is not to be lured into over trading even with a high probability Forex trading system. Combining a smart and dynamic goal setting strategy to your overall trade plan is essential to success.

Anyone can make a winning trade. The hard part is hanging on to your hard earned gains on a steady basis and consistently growing your account.

That’s why we trade.

Remember, it’s not the quantity of trades that we take. It’s the quality! It’s being able to keep our profits and controlling one’s risk exposure to the market is critical to success and the Power of Quitting is the perfect solution.

But it might not be for you.

Understanding that, consider the concept of trading a mini-session and focus on the most productive times to trade each market.

Consider the idea of the mini session and learn to focus in on the most productive times of day to trade while still controlling your exposure and keeping your profits.

Whatever method you decide on, the key is to ensure that you are not turning a winning day into a losing day because you were undisciplined in your trading.