- December 8, 2022

- Posted by: Shane Daly

- Category: Trade Recaps

A protective put is a type of options contract that gives the holder the right to sell a specified quantity of an underlying asset at a predetermined price, known as the strike price. This strategy can be used to hedge against potential losses if the underlying asset decreases in value.

As an example, you owned 100 shares of ABC company stock. You could buy a protective put with a strike price equal to or slightly above the current market value of your stock. If the stock was then to decrease in value, you can exercise your put option and sell your shares at the higher strike price, limiting your losses. Some traders will buy a put with a strike price less than the current stock price.

The protective put is like insurance to protect you if the downside picks up steam.

On the other hand, if the stock increases in value you have the choice to either keep your shares or sell them on the open market for a profit. Protective puts can therefore provide peace of mind and protection against market volatility. However, it is important to note that there is always a cost associated with buying options contracts, so this strategy should only be utilized if deemed necessary.

How Does A Protective Put Work

The purpose of a protective put is to protect a stock portfolio from losses in the event of a downturn in the market. You will buy put options for each 100 shares of stock in the portfolio. If the market were to experience a sudden drop, these put options would increase in value, offsetting potential losses in the rest of the portfolio.

It’s important to note that while a protective put can offer some degree of protection, it may also limit potential gains if the market were to rise instead. As with any investment strategy, it’s crucial to weigh the potential risks and benefits before implementing a protective put.

A protective put is generally a slightly bullish strategy used in options trading when the trader believes that the underlying stock will increase but wants to insure against potential losses.

The key to this strategy is to find the right strike price for the put option so that it meets your needs in terms of downside protection while not being too expensive. When you purchase a protective put, you are buying both an insurance policy, as mentioned previously, and the right to sell the underlying stock at a set price.

Best case: your stock rallies high and the put expires worthless.

Worst case: the stock drops and the put option offsets some of the losses you incur.

The best time to buy a protective put is usually when there is high implied volatility or when you expect some kind of market-moving event. There are risks associated with purchasing a protective put, including time decay and opportunity cost, but overall it can be a valuable tool for hedging your portfolio against potential losses.

How Do You Purchase A Protective Put

When considering a protective put strategy, it’s important to understand your own investment goals as well as the current market conditions.

First, select the stock or commodity you intend to protect and determine the desired strike price and expiration date of the option. You must own the underlying for the protective put.

Second, set up the trade as you would when buying a put just confirming what strike price you want to use.

Protective Put Example

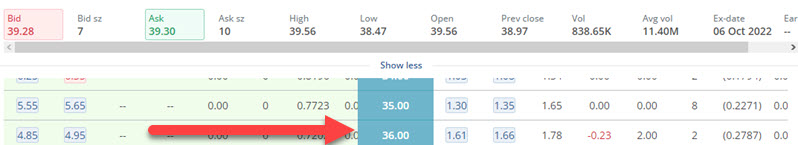

Assume you have purchased 100 shares of MRVL stock at $39/share and you want to buy protection for your position.

You would buy an out of the money put option with a strike price of $36.00 (32 days to expiration) and assume it cost you $1.66 premium OR $166.00.00. This gives you the right to sell your shares for $36.00 anytime leading into the expiration date. It does not matter if price drops to $31 because you have the right to sell at $36.00.

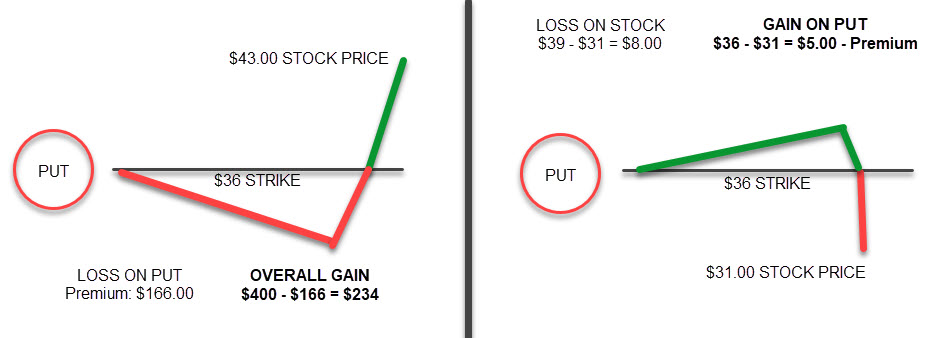

Continuing with the example, if the stock price rises to $43.00, you have made $43-$39 = $4.00 gain per share or $400.00 if you sell. However, since the put expired above the strike price, you would take a loss based on the premium you paid or $166.00. Your overall gain is $234.00 (if you sold) which is the gain in the stock price minus the cost to enter the trade.

Prices also can go down.

If the stock price is under the strike price by falling to $31.00: you would book a loss of $8/share.

The $36 strike is in the money by $5.00 since the stock price is $31.

Because you bought the protective put, you’ve mitigated your loss to $3/share or $300. Remember, you also had to pay $1.66 to enter the trade (insurance) so your loss is capped at -3 – 1.66 (premium paid) or $4.66.

Overall, while you have taken a loss, you also took a lighter loss. Instead of $800, you lost $466.

When Is The Best Time To Buy A Protective Put

When deciding whether to buy a protective put, it is important to consider the current market conditions. Generally speaking, a protective put is a good option for investors who have a stock that they want to hold onto for the long term but are worried about short-term market volatility.

It can provide peace of mind in case the stock sharply declines in value. However, timing is key in purchasing a protective put. If the stock’s value has already dropped significantly, it may not be worth it to invest in protection at that point. It may be better to wait and see if the stock rebounds before buying a protective put.

On the other hand, if the stock’s value is currently strong but there are signs of potential market turbulence on the horizon, buying a protective put beforehand can help hedge against potential losses.

Ultimately, doing a thorough research and keeping an eye on market trends can help inform when the best time is to purchase a protective put.

What Are The Risks Associated With Purchasing A Protective Put

One potential risk associated with purchasing a protective put is the cost. The price of the option plus any commission fees can add up, potentially eating into any profits gained from exercising the option.

In addition, there is always the chance that the stock will not fall as far as anticipated, or may even rise, rendering the protective put useless.

There is also the risk of timing – for example if a stock drops suddenly and the option has not yet been purchased, it may be too late to effectively protect against loss.

However, for smart investors who can accurately predict declines and properly time their transactions, a protective put can help mitigate risk and maximize profit potential in a volatile market.

Ultimately, it is important to carefully weigh the potential benefits and drawbacks before deciding whether or not to purchase a protective put. Depending on the size of your portfolio, having protective puts as insurance could go a long way in protecting your accounts from a deep decline in value.

Quick Hits

What is a protective put?

A protective put is an options strategy that involves buying a put option on a stock or other asset that you already own. The purpose of the protective put is to hedge against potential losses if the stock price falls.

What are the benefits of a protective put?

A protective put can help mitigate risk and maximize profit potential in a volatile market.

What are the risks associated with a protective put?

One potential risk associated with a protective put is the cost. The price of the option plus any commission fees can add up, potentially eating into any profits gained from exercising the option. In addition, there is always the chance that the stock will not fall as far as anticipated, or may even rise, rendering the protective put useless.