- May 9, 2021

- Posted by: CoachMike

- Categories: Options Outlook, Options Trading, Trading Article

Over the last few months, we could have used the same Weekly Options Recap Video each week as the markets continue to follow the same pattern.

We get a little selling during the week down to test support levels, and then we ramp higher into the end of the week to close near the highs.

That is exactly what we saw this past week. We saw the market try selling off a few times early in the week before rallying Thursday and Friday to close up at the highs of the week and also making a new all time high.

Massive Stimulus

The strength in the market over the last 12 months can be tied back to the massive stimulus that the Fed and global central banks have thrown at the market.

This past week we had rumors floating around that the Fed would start to pullback on the emergency stimulus measures due to the economy showing signs of recovering. That led to a few short rounds of selling as traders took the opportunity to book some profits.

However, we had the monthly employment report out Friday morning before the market open and the number failed to hit expectations.

A Million Jobs?

The market was expecting close to a million jobs being added but the number only came in at 266,000. While this isn’t a bad number in the grand scheme of things since it’s still showing jobs being created after the nightmare losses from early last year, it still is showing a slowing pace from the gains of previous months.

As a result, traders rallied equities into the end of the week on hopes that the fed will continue their support of the economy through massive stimulus in the months to come. Don’t fight the fed has been the mantra of many traders over the past number of years.

That continues to be the case as the Fed remains in complete control of this market. While we would love to see a pullback in equites, it will be difficult to see the follow through on the downside that we need until the Fed stops stepping in at the first sign of trouble.

Key SPY Levels For Next Week

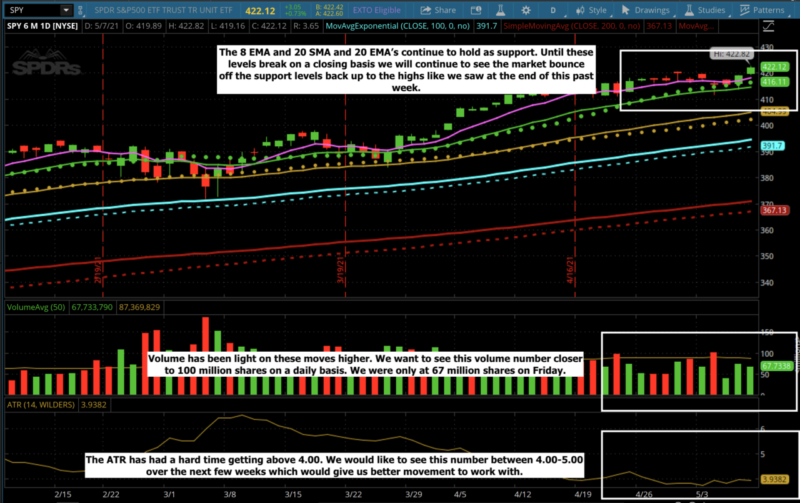

If we are going to get the move lower that we have been patiently waiting for, we need SPY to break through key support levels on the daily chart. We are watching the 8 EMA and 20 SMA and EMA’s closely as those levels have been rock sold areas of support for months now.

They were tested again last week, and the bulls defended them into the end of the week which led to the rally Thursday and Friday. The 8 EMA is sitting at 418.24, the 20 SMA is at 416.11 and the 20 EMA is at 414.70. Those are the areas below us that we will be watching into next week should we get any selling pressure.

On the upside, with markets closing the week at all time highs we don’t have any previous swing levels to look at.

We will shift our focus to the .50 and .00 levels on the upside. That means we are looking at 423.00, 423.50, and 424.00 going into early next week should the rally continue higher.  We are looking for a pullback off these overbought levels going into next week. We don’t expect a massive move lower, but a healthy pullback into the support levels mentioned is the move we are expecting during the first half of the week.

We are looking for a pullback off these overbought levels going into next week. We don’t expect a massive move lower, but a healthy pullback into the support levels mentioned is the move we are expecting during the first half of the week.

Volume and Volatility

Market wide volume was light again last week with SPY volume struggling to hit 70 million shares. We ideally like to see this number closer to 100 million shares, but in order for that to happen we will need to see selling pressure. T

he Average True Range (ATR) is still struggling to get above 4.00. We have been talking about needing this number between 4.00-5.00 going forward but it will take a downside move in equities to get the pop we are looking for in the ATR. A higher ATR gives us better movement to work with intraday.

Volatility has also been hit hard again over the last few days with the VIX closing the week down at 16.69. This makes perfect sense with all fear being sucked out of the market. Going into next week we would like to see this number jump back up to the 20.00 level. This will open up the playbook more and give us more to do on the options side.

Trades for Next Week

In this week’s Weekly Options Recap Video we take a look at a few of our trades that we closed out of last week. We closed out of 8 winning trades on our credit spreads throughout the week. GLD was a nice 100% winner for us on our long call options in just over a weeks time.

The GLD position below was taken with our brand new setup that we have been working on for months now. It has been doing a great job identifying moves in both directions.  We also take a look at new trades setting up on UBER, JPM, and TLT for next week. Make sure you take a look to see how this new setup has been changing the way we trade at NetPicks. If you have any questions while reviewing the video below feel free to email me. Mike@netpicks.com. We will be back on Wednesday for our next live video.

We also take a look at new trades setting up on UBER, JPM, and TLT for next week. Make sure you take a look to see how this new setup has been changing the way we trade at NetPicks. If you have any questions while reviewing the video below feel free to email me. Mike@netpicks.com. We will be back on Wednesday for our next live video.