- September 4, 2023

- Posted by: Shane Daly

- Categories: Options Trading, Stock Trading, Trading Article

Are you leaving your investments vulnerable to market downturns? The protective put can be your safety net when it comes to risk management in the stock market.

But why would you buy a protective put.

The answer lies in its ability to provide insurance for your investments. By purchasing a protective put option, you have the right to sell your shares at a predetermined price, known as the strike price, within a specified time frame. This means that even if the stock price plummets, you can still sell your shares for a profit or limit your losses.

But like any strategy, there are costs and benefits to consider. While protective puts can provide peace of mind, they also come with a price tag. It’s important to weigh the costs against the potential benefits and evaluate whether this strategy aligns with your investment goals and risk tolerance.

Key Takeaways

- Protective puts provide insurance for investments by allowing the sale of shares at a predetermined price

- They are effective in managing downside risk and offer more flexibility compared to stop-loss orders

- Protective puts enhance diversification and provide additional protection in volatile market environments

- They can shield investment returns from potential losses, protect the portfolio, and provide confidence in uncertain markets

Understanding Protective Puts

A protective put is typically purchased by investors as a means of safeguarding their portfolios against potential downside risk. It is a hedging strategy that offers downside protection in the stock market, particularly in options trading. By purchasing a protective put, investors have the right to sell a specific number of shares at a predetermined price, known as the strike price, within a specified time frame.

This provides a level of risk management, as it allows investors to limit their losses if the stock price declines. The cost of buying the protective put is the premium, which is paid upfront. This strategy is often used by investors who are concerned about market volatility or uncertain economic conditions, as it provides a way to protect their investments from significant losses.

Protective Put Example

Let’s consider a scenario involving the example of ABC stock:

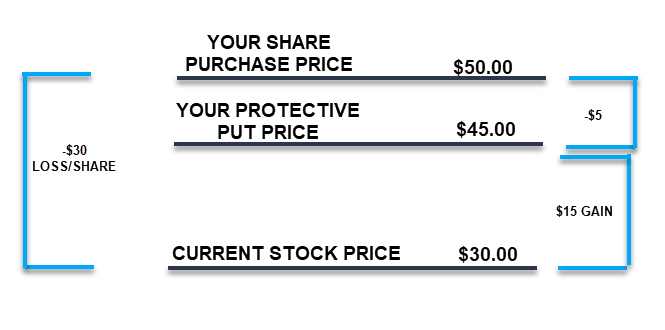

Suppose you have 200 shares of ABC stock that you purchased at $50 per share. To protect against potential downside risks, you decide to buy a put option on ABC with a strike price of $45, for which you pay a premium of $3 per option contract.

The price of ABC stock starts to decline, reaching $30 per share. Without the protective put, your loss per share would be $50 – $30 = $20. With 200 shares, your total loss would amount to $20 * 200 = $4,000.

Due to the protective put, you have the right to sell at the strike price of $45. Your total gain from exercising the put would be $15 * 200 = $3,000 ($45 – $30 = $15 per share).

Due to the protective put, you have the right to sell at the strike price of $45. Your total gain from exercising the put would be $15 * 200 = $3,000 ($45 – $30 = $15 per share).

Taking into account the premium paid for the put option ($3 * 1 contract = $3), your net loss would be:

$5/SHARE @ 200 shares = $1000 instead of $20/SHARE @ 200 = $4000

Risk Management Strategy

To effectively manage your risks, using a protective put is a popular strategy.

Here are three key factors to consider when implementing this risk management strategy:

Hedging effectiveness: Protective puts are an effective hedging tool as they provide downside protection by allowing you to sell your stocks at a predetermined price, regardless of the market price.

Long term vs short term risk management: Protective puts are suitable for both long-term investors looking to protect their investments over an extended period and short-term traders aiming to mitigate risks during volatile market conditions.

Protective put vs stop loss orders: While stop loss orders automatically sell your stocks at a specific price, protective puts offer more flexibility, allowing you to benefit from potential upside while still limiting downside risk.

Costs and Benefits

When deciding whether to buy a protective put, it is important to conduct a cost analysis. The cost of purchasing the put option is the premium, which is typically a percentage of the stock price.

You must weigh this cost against the potential benefits of the strategy.

The protection level offered by a protective put depends on the strike price you choose. A higher strike price provides greater downside protection, but it also increases the cost of the put option. On the other hand, a lower strike price offers less protection but can be more cost-effective.

In terms of profit potential, a protective put allows you to benefit from any increase in the stock’s price while limiting your downside risk. If the stock price decreases, you can exercise the put option and sell the stock at the strike price, minimizing your losses. However, if the stock price increases, you can still sell the stock at the higher market price, making a profit.

| Pros of Protective Puts | Cons of Protective Puts |

|---|---|

| Provides downside protection | Cost of purchasing put options |

| Limits potential losses | Reduces potential profits |

| Offers flexibility in uncertain markets | Requires ongoing monitoring |

Suitability for All Investors

Investors of all levels can benefit from incorporating protective put options into their portfolio strategy, as it provides a valuable tool to safeguard against market volatility and potential losses. When considering the suitability of protective puts, it is important to evaluate your investment objectives and risk tolerance.

If you have a low risk tolerance and are concerned about market volatility, protective puts can offer downside protection by limiting potential losses. This strategy allows investors to participate in the potential upside of their investments while mitigating downside risk.

To better understand the potential benefits, consider the following table:

| Investment Objectives | Risk Tolerance | Market Volatility | Portfolio Diversification | Downside Protection |

|---|---|---|---|---|

| Growth | High | High | Moderate | High |

| Income | Moderate | Moderate | High | Moderate |

| Preservation | Low | Low | Low | Low |

By aligning your investment objectives, risk tolerance, and market conditions, protective puts can be a valuable tool in managing risk and achieving your financial goals.

Comparisons with Other Strategies

When comparing protective puts to other strategies, it’s important to consider their advantages and disadvantages.

Protective puts provide downside protection for investors by allowing them to sell their stock at a predetermined price, regardless of how far the stock price may fall. This can be beneficial in volatile markets or when holding a stock with uncertain future prospects.

However, protective puts also come with a cost, as investors must pay a premium for the option. It’s important to weigh these factors against other strategies such as stop-loss orders or buying put options outright to determine the most suitable approach for managing risk.

An alternative to a protective put is a strategy known as a “collar” or “collar strategy.”

A collar involves combining a long position in the underlying stock with the purchase of a protective put and the sale of a covered call. This strategy provides a limited downside protection similar to a protective put while also generating income from the sale of the call option.

Here’s how a collar works:

- Long Stock: You start by owning the underlying stock.

- Protective Put: You purchase a put option with a strike price below the current stock price. This put option provides downside protection by allowing you to sell the stock at the strike price in case of a significant drop in the stock price.

- Covered Call: At the same time, you sell a call option with a strike price above the current stock price. By selling the call, you generate income (premium) from the option sale. However, the call option limits the potential upside gains on your stock position as you would be obligated to sell the stock at the strike price if the stock price rises above it.

The combination of the protective put and the covered call creates a collar that provides downside protection while limiting potential upside gains. It can be an alternative strategy for investors who want to limit their downside risk while generating some income from their stock position.

Frequently Asked Questions

Conclusion

Buying a protective put can be a smart move for investors looking to mitigate risk and protect their investments. By using this strategy, you can limit potential losses and provide downside protection during volatile market conditions.

While there are costs associated with purchasing a protective put, the benefits of protecting your investment far outweigh the expenses. It’s important to evaluate your investment goals and assess whether a protective put aligns with your risk tolerance and investment strategy.