- April 24, 2023

- Posted by: CoachShane

- Categories: Basic Trading Strategies, Trading Article

Are you a trader seeking to maximize gains? Do you know what swing highs and lows are but uncertain as to their purpose or how to incorporate them into your trading?

Swing high and low points exist on charts as potential entry and exit points for trades. When traders understand these concepts, they can help identify trends in the market, create profitable trading strategies, and increase their chances of success.

We cover why swing highs and lows form, what fractals are in trading, finding trends with swings highs & lows ,and using those same swings for successful trade entries.

What is a Swing High and Swing Low?

A swing high is a price action point in the stock market where an asset’s value reaches its peak before reversing direction. This can happen on any time frame chart including intra-day to monthly charts. Swing highs and lows are important technical tools used by traders to identify trends in the markets.

The opposite of a swing high is a swing low, which marks the lowest price level reached before prices move in the opposite direction and begin trending upward again.

These two points form what’s known as an “inflection point” or trend reversal pattern on a chart that can be used to anticipate future movement of price.

These two points form what’s known as an “inflection point” or trend reversal pattern on a chart that can be used to anticipate future movement of price.

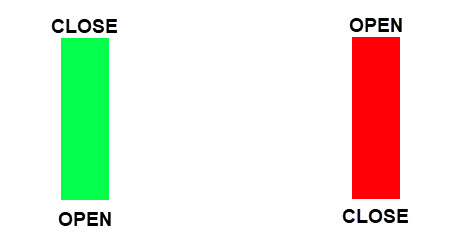

Swing highs and lows are usually determined using candlestick charts, which display data for each trading session over time periods ranging from minutes to weeks or months. A candle represents four different pieces of information: open, close, high, and low prices for that particular period (day/week).

The difference between the opening price (open) and closing price (close) forms either a red candle if it closes lower than it opened or green candle if it closes higher than it opened. This indicates whether there was buying pressure (green candles) or selling pressure (red candles).

The highest point during that session is marked by the highest high while the lowest point during that session is marked by the lowest low on this chart of TSLA.

The highest point during that session is marked by the highest high while the lowest point during that session is marked by the lowest low on this chart of TSLA.

These points represent potential points where price may bounce from (support or resistance levels). This trading day ended up to be a range day as price closed inside the high/low zones.

These points represent potential points where price may bounce from (support or resistance levels). This trading day ended up to be a range day as price closed inside the high/low zones.

Why Do Swing Highs and Lows Exist?

Swing highs and lows exist in trading because they are a natural part of market behavior. Whether we are talking about stocks, forex, or commodities, prices are constantly fluctuating as buyers and sellers take action in the instrument.

Swing highs and lows are created as a result of these price fluctuations, and they represent important points where the market has changed direction. When the market is trending upwards, swing highs are formed when the price reaches a peak before reversing course and heading back down.

Similarly, swing lows are formed when the price reaches a bottom before reversing course and heading back up.

Traders use swing highs and lows to identify potential support and resistance levels in the market, as well as to confirm trends and potential reversals.

Traders use swing highs and lows to identify potential support and resistance levels in the market, as well as to confirm trends and potential reversals.

For example, if the instrument is trading upwards, traders may look for swing lows to identify potential entry points for buying. These swing lows may act as support levels preventing price from dropping further.

If the market is in a downtrend, they may look for swing highs to identify potential entry points for selling. These would be called resistance zones.

Traders may also use previous swing highs to take profits at when in an uptrend. The same is true for previous swing lows during a downtrend.

As long as there is more buying interest in the instrument, price will continue to make higher highs and higher lows. Traders are buying at higher prices and sellers are unable to take control and push too far to the downside.

Overall, swing highs and lows are an important part of technical analysis in trading, and can provide valuable insights into potential future price movements.

What are Fractals in Trading?

Fractals in trading are a set of repeating patterns that occur in financial markets. Fractals can be used to find probable entry and exit points, as well as speculate on the course of price movements. Fractal analysis is based on the concept that all market activity is cyclical, meaning it will repeat itself over time and on different timeframes.

A fractal pattern consists of five consecutive bars (or candles) with the highest high at the center and two lower highs on either side. The lowest low also appears at the center with two higher lows on either side. This creates a “W” or “M” shape when plotted out on a chart – why they are often referred to as “Waves” or “Mountain Tops/Bottoms”.

When this pattern occurs, it usually signals a change in trend direction from bearish to bullish or vice versa depending on which way prices move after forming the pattern.

When this pattern occurs, it usually signals a change in trend direction from bearish to bullish or vice versa depending on which way prices move after forming the pattern.

Fractals in trading are a powerful tool for recognizing patterns and trends, allowing traders to make better informed decisions. With the knowledge of swing highs and lows, we can now use fractal analysis to identify market momentum shifts more accurately.

Finding Trends with Swing Highs and Lows

These points on a chart indicate when the price of a stock or other asset is reversing direction, either up or down. By recognizing these swing highs and lows, it’s possible to identify trends in the market.

But why do these swings exist?

The answer lies in human psychology:

Humans tend to act similarly under similar conditions, regardless of whether they’re trading stocks, options, commodities, currencies or anything else. When people see prices rising rapidly (or falling), they become more likely to buy (or sell). This causes more buying pressure (or selling pressure) which drives prices even higher (or lower).

Eventually this cycle will reverse itself as buyers become exhausted and sellers enter the market again; this creates what we call “swing highs” and “swing lows” on charts.

Such patterns tend to repeat themselves across multiple time frames, enabling traders to pinpoint potential areas where support/resistance levels could form or breakouts may occur as trader sentiment towards an instrument fluctuates.

This knowledge helps traders make more betters decisions based on their own analysis of price action, rather than blindly relying on technical indicators.

By using swing highs and lows, traders can identify trends in the market which may be needed for their trading strategy. With this knowledge, they can then explore different ways of applying these swings to create profitable trades.

Using Swing Highs and Lows for Trading Strategies

Traders seeking to capitalize on stock market trends can leverage swing highs and lows for a trading strategy. They can be used to identify areas of support and resistance, as well as potential entry and exit points for trades.

The first step in using swing highs and lows is to identify them on a chart. Swing highs are created when prices move higher than the previous high point; similarly, swing lows occur when prices fall below the previous low point. This creates an area of support or resistance that may indicate a trend reversal or continuation depending on which direction price moves next.

On this chart, I’ve used a swing high swing low indicator found in the Tradingview charting package.

Once you’ve identified these points, it’s important to consider what type of trade you want to make – buy or sell?

Once you’ve identified these points, it’s important to consider what type of trade you want to make – buy or sell?

If you think the trend will continue in its current direction then buying at a swing low could provide good returns if the market continues up; alternatively selling at a swing high might yield good profits if prices fall further. We want to see a continuous stair stepping type pattern of higher swing highs and higher swing lows for an uptrend as seen here.

On the other hand, if you think there may be an upcoming reversal then entering into positions just before this occurs (at either side) could also prove profitable depending on how quickly markets react after your entry point is hit. This would be considered counter trend trading and is a trading skill you can learn.

Once you’ve found a trending instrument, we want to see the classic “breakout and pullback” scenario. Price will break a swing high and then pull back to the former swing high zone. If a reversal happens, we may plot an objective swing low depending on how many candlesticks you need in the pattern.

This indicator is set to a 5 candle pattern and is adjustable.

Price pulls back to the former swing high zone and then we turn to the 3/10 Oscillator in the bottom panel on the chart.

We look for the slower line to be trending upwards indicting bullish momentum. We can use a flat line but we don’t want to see it curling to the downside when buying.

Turning to the fast line, we see it hook to the upside and we place a buy stop order above the candlestick that turned it.

Our stop loss will go below the low point prior to the reversal.

Technical indicators, including moving averages (MA), Bollinger Bands (BB) and Relative Strength Index (RSI), can also help confirm possible breakouts from established ranges between two particular swings.

FAQs

What is swing high and low in market structure?

Swing high and low are terms used to describe the highs and lows of a price trend in market structure. A swing high is a price level where price has reversed, whereas a swing low is made when price reverses a downtrend. These swings can be used to identify trends, support/resistance levels, or potential reversals within markets.

How do you define swing points?

They can be identified by looking for areas where the price has reversed in the past, or by using technical indicators such as moving averages or oscillators. Swing points provide traders with key information about potential entry and exit points in a trade. Traders will define how many lower highs/higher lows they need on either side of the middle bar. The common approach is 2 bars on either side of the middle bar making a 5 bar pattern.

How do you use a swing high low support and resistance indicator?

Swing high low support and resistance indicators can used to identify potential areas of price reversal. By monitoring the highs and lows of a given instrument, traders can gain insight into where prices may reverse or continue in its current trend. These indicators also help traders recognize key levels where they should place stops or take profits as well as determine entry points for new trades.

By utilizing swing high low support and resistance indicators, traders have the beginnings of an objective trading strategy.

Conclusion

By understanding how these trends form, identifying them on a chart, and using them as part of their trading strategy, traders can increase their chances of success.

As with any type of trading approach though, it’s important to remember that swing high and low strategies come with risks too – so make sure you do your research before putting your money at risk.

Tired Of Trading With Overused Indicators?

Try something different and get the

“Ultimate Guide to Price Pattern Trading” – ABSOLUTELY FREE!

Learn how to trade with precision accuracy, find ideal entry points,

and create a lifetime of trading income using patterns and price action.

Download your FREE guide now and start mastering the art of successful trading!