- January 2, 2023

- Posted by: Shane Daly

- Category: Trading Article

The short straddle options strategy is a tactic that is used by investors and traders when they anticipate little to no movement in the underlying asset’s price. It is generally employed when you believe that the market is stuck in a range or it might experience low volatility in the near future.

In this blog post, we will take a closer look at how the short straddle options strategy works and what benefits it can offer investors and traders alike

How the Short Straddle Options Strategy Works

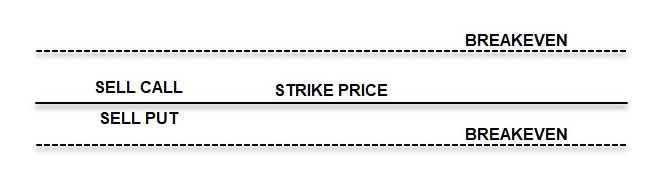

The short straddle options strategy involves simultaneously selling a put and a call with the same strike price and expiration date. The investor collects the premiums from these two options as their initial profit.

If the underlying asset’s price does not move much before expiration, both options will expire worthless and the trader will keep the entire premium as profit.

However, if there is a sharp move in either direction, the trader may be forced to buy or sell the underlying asset at an unfavorable price, resulting in a loss.

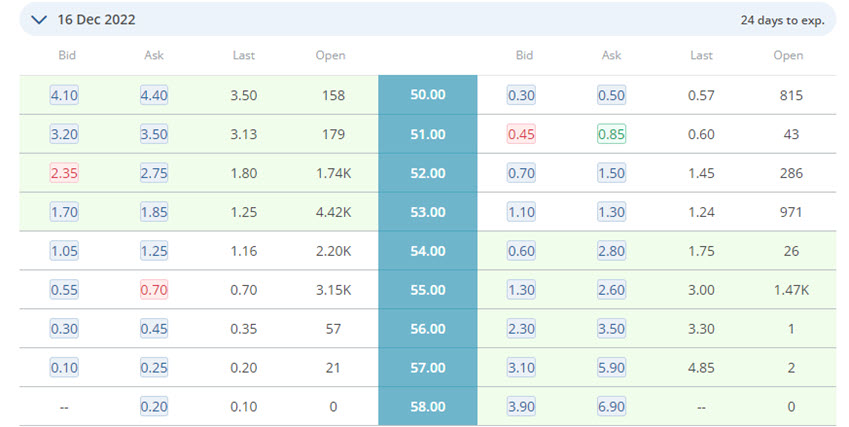

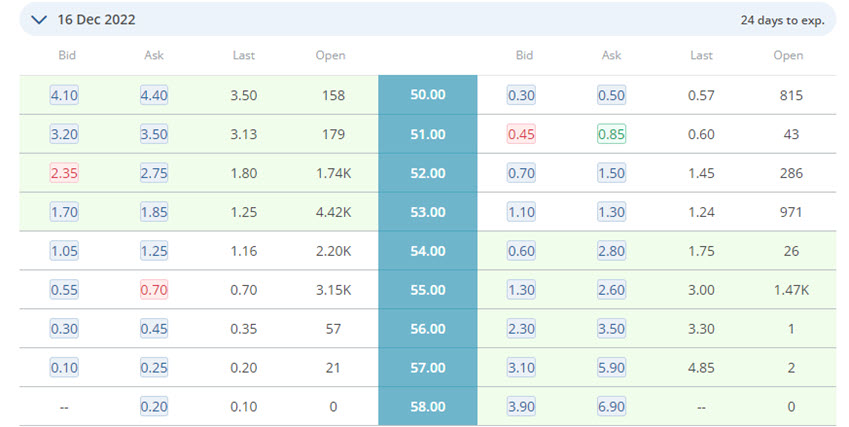

Imagine your strategy is telling you that EWW is going to be range bound for the next few weeks.

EWW is currently trading at $53.85 and you are looking to sell one call and one put contract.

You choose the Dec 16 expiration date and the $54.00 ATM strike price.

You choose the Dec 16 expiration date and the $54.00 ATM strike price.

We will use the ASK prices and assume you short:

1 54 Call @ $1.25

1 54 Put @ $2.80

You collect $4.05 in premium per share or $405.00 for one options contract.

How Do I Profit With A Short Straddle?

The potential for profit with a short straddle is limited to the total premiums received minus commissions. The maximum possible gain can be realized if the position is held until the expiration date, and the underlying asset’s price closes at its strike level with both options becoming worthless.

In the case of our EWW example, the maximum profit you can receive is the premium you collected of $405.00 (minus commissions).

What Is My Risk With A Short Straddle?

A short straddle carries unlimited risk on the upside since the underlying stock price can increase, hypothetically, to any price level. Conversely, there is a substantial potential for loss on the downside, as the stock price can reach zero.

How To Find The Breakeven Price Of A Short Straddle

The breakeven price is simple to calculate and I won’t include commissions in the example.

On the upside, EWW has a breakeven price of $54 strike + $4.05 premium = $58.05.

On the upside, EWW has a breakeven price of $54 strike + $4.05 premium = $58.05.

To the downside, the breakeven price is $54 strike – $4.05 premium = $49.95.

Potential Impacts Of Holding To Expiration

At expiration, there are three potential outcomes for a short straddle position. Most options trades are closed before the expiration date but a trader should know what can happen if they forget to close.

If the stock price is at the strike price of the contracts you sold, both the call and put expire worthless and no stock position is created. This is the desired outcome and is the only way you can keep 100% of the premium you received for selling the contracts.

On the other hand, if the stock price is above the strike price, the put expires worthless while the short call is assigned, resulting in a short stock position. To avoid this outcome, the call must be closed (purchased) before expiration.

Conversely, if the stock price is below the strike price at expiration, then the call expires worthless while the short put is assigned, leading to a long stock position. To avoid this result, the put must be closed (purchased) before expiration.

When To Close Your Straddle Position

Rarely will you ever want to hold your option trades into expiration even though that is the only way to potentially collect the entire premium

You should have in your trading plan an amount you are willing to keep of the credit received. A popular approach is to keep 50-80% of the premium.

This means, using our EWW position if you can close your position and keep anywhere from $202 – $324, you consider that trade a win.

Strangle VS Straddle

One big benefit of trading a straddle against trading a strangle is the amount of premium you can make. In a strangle, we are selling out-of-the-money options which have a cheaper premium.

Using EWW as an example, assume we sold the $55 call for $.70 and the $53 put for $1.30. The most we could make on that trade would be $2.00/share or $200 per contract. Compare that to our potential credit of $405.00, straddles can have a bigger payday.

The big drawback of the straddle is the breakeven prices are closer than they would be with the strangle. This means that there is very little breathing room for the price to move without eating away at our profits.

5 Key Short Straddle Faqs

A short straddle is an options strategy that involves the simultaneous selling of a call and a put at the same strike price.

The potential for profit with a short straddle is limited to the total premiums received minus commissions.

A short straddle carries unlimited risk on the upside, with substantial potential for loss on the downside.

The break-even prices are calculated by adding or subtracting the option premium from the strike price.

Straddles can potentially bring in a bigger profit than a strangle, however, they also have closer breakeven points which leaves less room for price movement.

Would you like to make money in any market condition?

You can with our free options strategy guide. It’s a step-by-step blueprint that shows you how to profit from volatility – no matter which way the markets are moving.

Inside you’ll find everything you need to know, including when and how to trade options for maximum profits. Plus, we’ll show you how to use this powerful strategy even if you have little or no experience with trading options.