- December 12, 2021

- Posted by: Shane Daly

- Category: Trading Article

After the recent correction and subsequent market bounce back, there are many traders who a suffering FOMO – fear of missing out.

In fact, they did miss out on some large pops in stocks like Apple, Baidu, Facebook (Meta Platforms), and Walmart.

- They will go back over the instrument to find what they missed

- What could have alerted them that a trade was near?

The truth is, you don’t need to catch the move. In fact, you are not responsible to catch that initial move.

How can you?

You Know What You Know

There are many times that a large move will come out of nowhere. It may be news driven, the words of a politician, or any number of reasons.

Regardless of why a move happens, it is unreasonable to pressure yourself with the feeling that you “should have known”.

There are a lot of things in trading we don’t know. We play the odds through an edge we may have and over a basket of trades, we do well.

Looking at this chart of ABNB, that was an 11% jump in price in one day.

As you flip through your charts, you may see this move, draw a few lines, and assume you could have caught it.

I can say this this about this chart:

- Broke an upsloping trend line.

- Price came into an area that acted as support

- Expecting a retest of the underside of the trend line

That is all easy to say in hindsight because this move happened. If this move never happened, I’d probably ignore price sitting at support and in turn, ignore this chart.

Even if this was a ticker I usually traded, I still may have missed the trade. It’s not like there was much to see in price that gave me a heads up in terms of how I approach the markets.

You Are Responsible For This

With the last chart, that was a strong move up and any further move up is the one I am now responsible for.

I know that when price puts in a strong move to the upside (or downside), my job is to find a pullback.

But not just any pullback.

I need to see low momentum in the pullback to consider another leg up.

Using one of my trade entry techniques, I can find a way into what I consider to be a bull flag.

If this stock is on my list, I can forgive myself for missing that first move. The first move is not my concern.

If I miss the next move, that is on me.

Here is a gap down in Paypal.

If you see the circled consolidation, there are many of you that would think you could have positioned inside of that.

“If only I placed a trade during the pause!”

Yes, you absolutely can position inside of ranges before breaks. But would you be saying that if price remained in the range and didn’t gap down?

Probably not.

You are not responsible to be in that move.

But the next leg down was a good setup for a bear flag:

- Strong momentum in the first leg down as shown by the gap

- Low momentum rally

The gap down alerted you to a change in market state

The low momentum pullback alerted you that buyers are not strongly stepping in. That is a higher probability trade to the downside and that is what happened.

Here is a 19% pop in Oracle.

In fairness, this was an earnings jump but these moves happen without any fundamental news as well.

If you had a simple call option on this ticker, you did very well on this day.

Some traders will now be on alert for a gap fill play because they didn’t trade the gap up. Gap fill traders will be responsible to trade the move down.

Just as with the Paypal move, it is easy to say you could have bought inside the consolidation. My own method of trading gave me no indication of a potential move in Oracle.

I don’t say “look at the move I missed”, because I didn’t miss it.

I wasn’t even looking for it.

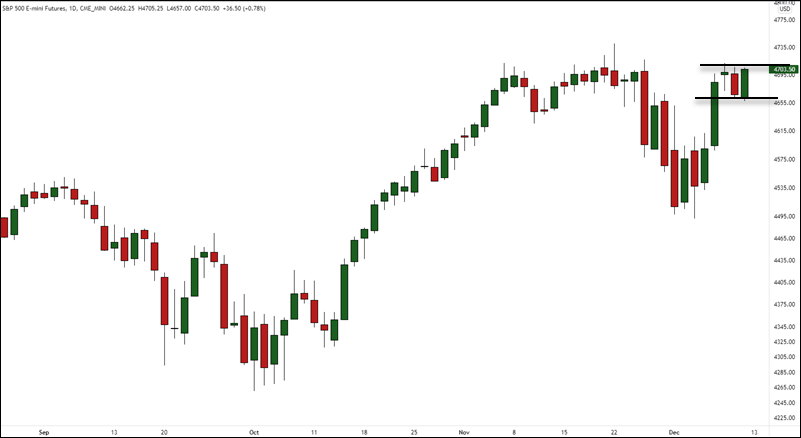

Here is a daily chart of ES Futures.

This push into resistance is not something I am upset about because I didn’t catch it.

But what is setting up now, is my responsibility.

The strong move up and a consolidation near highs gives an edge to an upside breakout. If I was an ES trader, my responsibility is to get the next move.

With a long bias, any breakdown below or strong momentum to the downside would have a rethink of the break to highs.

But a move out of here to the upside, is my concern.

Know Your Setups

One of the best ways to avoid the destructive process of beating yourself up for missing a move, is to know your setups.

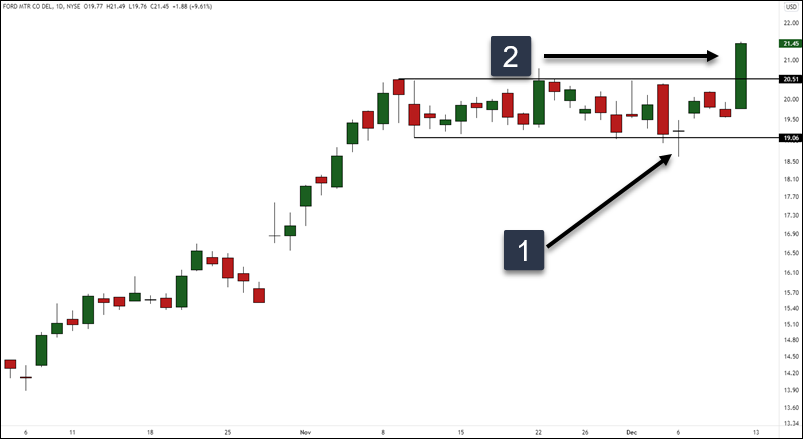

This is the daily chart of Ford.

One trade I look for is called a failure test. This is when price will probe the highs or lows and get rejected.

Ford was in a consolidation at the highest highs since 2001. At #1, price dips below support of the range and is bought up. That is a trade entry that can either be used to trade a range, or position before a breakout.

At #2, price breaks out of the range with momentum.

Unless you have a setup that gets you in before the break, you did not take part in the move up.

That is not something you missed. It wasn’t on the radar.

Trading Breakouts

If your style of trading a breakout is the following, you are now responsible for the next move:

- Allow price to break out of the range

- Take a position during any consolidation outside the range

Until this happens, any large price move is not to be concerned about. You didn’t miss anything.

If the price breaks out and continues running, you didn’t miss it. You don’t trade breakouts that way.

But if price pulls back, consolidates, and then breaks to the upside, it is your job to catch it.

Why Is This Important?

Trading is tough.

Flipping through charts and seeing big moves you didn’t trade is the worse type of review you can do.

Large moves can come out of the blue and it is not realistic to think you can catch all of them.

The “I could of done this” mentality can cause a trader to do stupid things. Jumping into moving price because you think it’s about to run, will hit you with losses.

The best advice I ever got was to focus on a small group of instruments.

Within that group, focus on a momentum or mean reverting strategy – or both. I favor both because I would rather be able to play both sides instead of being biased in one direction.

You will not catch everything.

But when you see a move in price that can lead to your preferred setup, that is what you are responsible for.

So what is the secret to catching every big move?

Do it in hindsight because that is the only place you will catch them.