- November 25, 2018

- Posted by: Mark S

- Categories: Basic Trading Strategies, Trading Article

Trading for a living has such an appeal that many people “give it a shot” to see if they can mimic the lives of those posted on social media.

That is a terrible goal.

The lives you see on social media with the money flowing like champagne, are fake. The reality that most traders will lose and get out of the business doesn’t make for inspiring memes.

- You can make money from trading

- You can make a living from trading

- Your trading office can be any place in the world with an internet connection

Most won’t get there. But some will.

5 Reasons You Will Fail To Reach Your Trading Goals

Netpicks has been in business for over two decades and in that time, there is nothing we have not seen. In fact, we can trim down the reasons that traders fail into five faults and that is not including the biggest one – not having a trading edge.

We have seen far too many traders looking for a career in day trading only to come up short of their goals.

Greedy Traders Looking For Perfection

It would be great if you could find a trading strategy with a win rate of 80-100%. There is a trade-off when it comes to win rate and in general, the higher the win rate, the worse the reward/risk equation is.

You should not be focusing only on the win rate to determine your trading strategy. When you take into the expectancy of your trading strategy, sharpe ratio, average wins and losses, you can get a better understanding of how good the strategy is.

Get out of the simplistic win rate percentage and dig deeper into the metrics of your trading strategy through proper testing of your strategy.

Looking For Exceptional Reward To Risk Outcomes

We’ve all had it drilled into our heads to look for the magical 3:1 RR ratio for a perfect trading strategy. Much like insisting on a high win rate without other metrics involved, looking for the perfect reward to risk trade is also a reason traders fail.

Taking a trading strategy and stretching out the targets while keeping a tight stop loss to reach the magical ratio, is a disaster waiting to happen. Markets ebb and flow and it is a very real risk that your stops will easily be hit or your stretched target will be missed as the market pulls back against you.

It may be difficult for a trader to accept a 1.5:1 reward risk ratio or even a 1:1, but accept that other factors come in to play. A 55-60% win rate with a 1:1 reward to risk ratio will make you money over time. If we consider the psychological factors that come into play with traders, looking for this type of scenario is golden.

Power Of Quitting Your Trading Session

Traders love to trade. Some do it for the excitement. The great traders know when enough is enough in the market.

Take day trading as an example where you can get numerous setups during the trading session. Even after a profitable first trade, many traders will continue to trade throughout the session and many will see those profits evaporate.

These traders would do well to learn about our “POQ” (power of quitting is in every trading plan we have)

You have to learn to hit the stop button when you’ve done well. It’s the same thing when you get a large price spike in the direction of your trade. For some, greed sets in and they sit in the spike expecting another one.

It doesn’t come and as fast as price moved in their direction, it takes back all the profits it just gave them.

Great traders will see that momentum spike as a gift, take the profit, and enjoy the large reward to risk ratio win they just had.

Bottom line – know when to pull the plug on the trading session. It will save your profits and can avoid a run of bad trades when the good moves are already done for the day.

Not Accepting A String Of Losing Trades

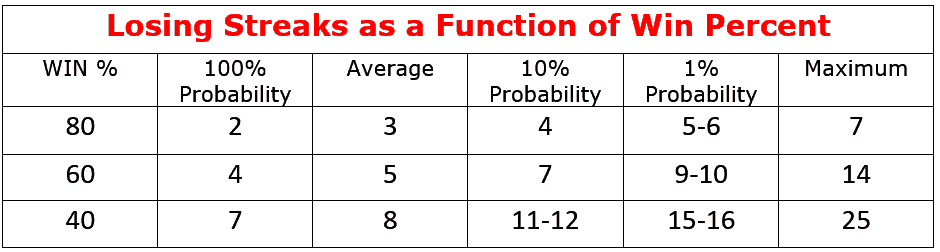

We’ve seen many traders who just can accept that they will have losing streaks regardless of how great their trading strategy is.

To combat the losing trade, these traders let emotions take over and at the first sign of market momentum, they jump into a trade outside of their trading rules.

We all know how this will end.

This is the reality and if you don’t accept this, if you don’t apply risk management strategies to account for it, your will have a short trading career.

It can be tough as you hit the fourth losing trade in a row but consider it a test of character. Do you have what it takes to take the next trade that sets up according to your trading rules?

If not, then you should step away from trading. When our minds are screaming to not do something in trading, if it follows the rules of your tested strategy, you’d be a fool to not ignore the mind.

You don’t know when the losing streak will come to an end and that trade you skip out of fear, could be the one that will erase the prior losses.

Committing Too Many Trading Mistakes

From our experience, trading mistakes is the top cause of traders failing. What constitutes a trading mistake can be wide ranging and impossible to cover all examples in this post.

What I want to do is cover how you can actually monitor for any trading mistake and this could actually turn your entire trading business around.

I want to gear this to a certain group of traders but those just starting to trade can take a lesson from it. The group who has experience, but just can’t seem to go from break-even or slight losses to profitable, is doing just enough wrong to lose their edge, is the ones I want to talk to.

How To Go From Almost Successful In Trading To Succeeded

You must get a handle on your trading mistakes if you are ever to reach the goals you set for your trading.

Mistakes can take a 60% winning system combined with other solid metrics, and mistakes push it to a 50/50 trading strategy. Add in trading costs, smaller profits, bigger losers and any other overhead, there is no chance to come out on top.

“But it is just an occasional mistake”.

Traders will consider an occasional mistake to be:

- Missing a trading entry

- Placing a stop loss order incorrectly

- Chasing an entry as they missed the original entry point

- Ignored big news events or not even checking for them

- Breaking any rule of the trading plan

These trading mistakes make seem minor considering they are not consistent errors – but they do make a difference between a winning trader and a losing trader.

Mistakes can become easy to prevent because you learn to control the controllable. Clean up the mistakes and you become the minority in this business – a trader that makes money.

Say No To Trading Mistakes Now

You’ve heard people talk about keeping a trading log and I admit I’m not one for detailing my “feelings” while trading.

However, each and every day I go back and review my trades. My expectation is that I should be 100% flawless. That doesn’t mean profitable.

100% flawless for me means:

- No greed trades

- No revenge trades

- No distractions

- No missing entries, profit targets, or stop loss

- No deviation from my trading plan

If I am not flawless, I know right away that if that continues, my profits are doomed. But I will never know what I need to do unless my trading log is updated with every trade I took.

The Real Truth On Losing Traders – Lazy

They simply do not want to do the work.

Often, the same people who have spent 12 years in school, 4 years in college and maybe a few years more pursuing an advanced degree will literally buckle at the first sign of work to master trading.

You’ve probably heard the theory that it takes 10,000 hours to master anything. Well, I would argue it doesn’t have to take that in trading if you have the right mentoring. However, it’s not going to take a couple of hours either.

The most successful traders in the NetPicks world are definitely the ones who put in the work upfront. We have seen it!

They do not quit at the first sign of adversity or confusion and they push through until that big breakthrough occurs.

Want to be a mistake-free trader? Sure, it takes some work. Maybe a lot of work. But I would argue there might not be a better profession on earth then being a profitable trader. Talk about a skill you can use for life, from anywhere in the world, that will never be outdated.

Worth some effort, right?

The good news is NetPicks is committed to taking the losing trader (which are sadly, the majority) and transforming them. That’s why you’re reading this article and why you are putting in the time.

We stand with you on this journey and hope you continue to strive for what’s in-sight… profitable trading.