- July 2, 2025

- Posted by: Shane Daly

- Categories: Day Trading, Trading Article

You’re facing a critical challenge in your trading journey: the potential for costly mistakes that can damage both your capital and confidence. While the draw of quick profits might tempt you into quick decisions, statistics show that 90% of day traders lose money due to common errors like emotional trading and poor position sizing. Understanding these issues, along with using proven risk management strategies, will determine whether you’ll join the successful minority who consistently profit in the markets.

TLDR

- Poor position sizing can rapidly deplete trading capital when losses exceed sustainable risk thresholds.

- Emotional trading decisions bypass rational analysis and often result in impulsive entries and exits.

- Failing to set or honor stop-loss orders exposes traders to catastrophic losses during adverse market movements.

- Trading without a systematic verification process increases the likelihood of costly execution errors.

- Overconfidence leads to overleveraged positions and excessive risk exposure that can devastate account balances.

2 Types Of Trading Mistakes

The first type of trading mistake is really a trading error.

A trading error is somewhat of a glitch in the system –not something caused by a choice but is a lack of skill in using your trading platform.

An error can be something like:

- selecting the wrong price

- executing the wrong size

- using the wrong order type

- buying instead of selling.

The key part to trading errors is that whatever they are, they are done unintentionally.

Fat finger errors are generally more common in newer traders but you shouldn’t think if you’ve been trading for a while, it won’t happen.

Tracking and actively working to improve your error rate is part of honing your skills in this craft.

The second type of trading mistake is an intentional mistake.

You intentionally choose to trade in a way that is outside of the rules of your trade plan

It could be trading outside of your normal hours, doubling up on a position or trading over an economic release for example.

Biggest difference?

One mistake you mean to do and those that are a legitimate error.

The Psychology Behind Trading Mistakes

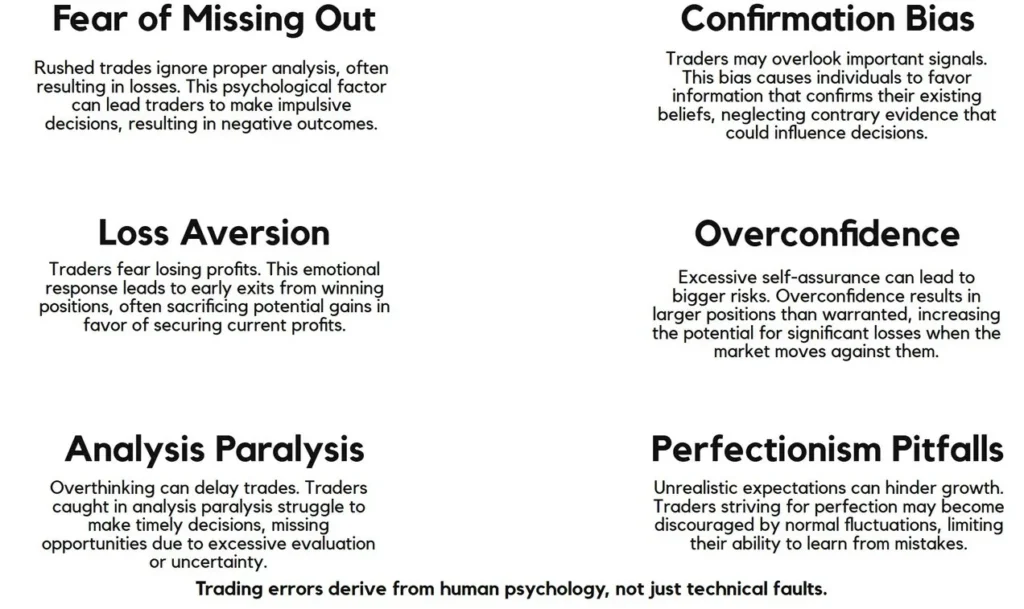

Trading mistakes stem from more than just technical errors or market misunderstandings – they’re deeply rooted in human psychology. Your mind’s cognitive biases can lead to impulsive decisions, while “perfectionism pitfalls” often create unrealistic expectations about trading performance.

Understanding these psychological factors helps you develop better trading habits and emotional control.

- Fear of missing out drives rushed, poorly planned trades

- Confirmation bias leads to ignoring contrary market signals

- Loss aversion causes premature exits from profitable positions

- Overconfidence results in excessive position sizing

- Analysis paralysis prevents timely trade execution

You’ll make better trading decisions by recognizing and managing these psychological challenges.

Unrealistic Expectations Are Not Helpful

If you don’t account for the possibility of trading mistakes, that is a big problem.

You may feel like you have a good understanding of the markets and enough of a decent enough strategy to be successful based on a run of simulated performance.

But even if your simulator is close to being an accurate depiction of live performance, people are quick to remove losing trades from their results when they are because of errors and even quicker to forget that they’ve done it.

In this type of scenario, it’s easy to see that a trader funding their account with $5,000 is in danger of being severely undercapitalized.

Bottom line? Don’t treat simulated as if you will replicate the results. Account for mistakes and intentional errors because you will make them.

Seeking Perfection Is Dangerous

While it’s possible to be angry with yourself and still make good decisions, for many traders, anger often leads to a downward spiral.

A single mistake can cascade into multiple errors and, over time, significantly deplete your trading account.

The real issue is that if you haven’t identified and anticipated your common trading mistakes, you’re essentially expecting perfect performance.

This creates two problems.

You’ll be much less tolerant when mistakes inevitably occur.

This is a dangerous mindset.

Thinking Logically

If you think logically and understand that mistakes happen, there shouldn’t be a problem.

When you react this way, failing to achieve perfection often leads to fear or aggression.

Fear manifests as getting out of trades too early or setting extremely tight stops (leading to death by a thousand stop-outs), while aggression shows up as revenge trading – both of which only lead to more costly mistakes.

Emotionally driven errors, in my experience, are also harder to address effectively.

Someone who demands perfection every time is likely to believe they can achieve it. With this misconception, traders often fail to track their mistakes or work to address them.

If you know your mistakes, track their impact, and have techniques for managing them, they’re less likely to cause catastrophic results when they occur.

Success in trading depends as much on understanding yourself as having a working trading strategy.

You Will Make Mistakes – It’s OK

Planning for the possibility for trading mistakes can help you to be realistic in assessing the potential performance of a strategy and identify an amount of account capital you might need.

Being able to let go of trading mistakes when they do happen but still working to reduce their frequency, can save you a huge amount in account equity and emotional capital. Once you mentally being to unravel, trading can become incredibly painful.

Finding the balance of acceptance of trading mistakes and trying to minimize them isn’t always the easiest thing, but if you fail to address this at all, it will be more than likely cost you every dream you have with trading.

Risk Management Strategies to Minimize Losses

Even the most skilled traders can’t eliminate market risk entirely, but implementing strong risk management strategies helps protect your capital from devastating losses.

Start by determining appropriate position sizing based on your account balance, ensuring no single trade risks more than 1-2% of your capital. Set clear drawdown limits to prevent catastrophic losses, and stick to them religiously.

You’ll want to diversify your positions across different assets and sectors, while maintaining strict stop-loss orders for each trade.

Remember to regularly review and adjust your risk parameters as market conditions change, keeping your overall exposure in check.

Building a Robust Error Prevention System

To effectively prevent trading errors, you’ll need a comprehensive system that combines technology, routine checks, and disciplined processes.

Your error detection methods should focus on implementation strategies that protect your capital while maintaining trading efficiency.

Suppose a trader wants to buy 1,000 shares of a stock but accidentally enters an order for 10,000 shares. In a robust error prevention system, several safeguards would activate to prevent this mistake:

- Automated trade verification alerts would immediately flag the unusually large order size before it is executed, prompting the trader to confirm or correct the order.

- A detailed checklist for position sizing and risk parameters would require the trader to review the order against pre-set risk limits, ensuring the trade matches their capital allocation rules.

- A two-step confirmation process would require an additional approval or confirmation for any trade above a certain threshold, adding another layer of review before execution.

- Pre-trade risk controls, such as maximum order size limits, would automatically reject the order if it exceeds the trader’s risk tolerance or the limits set by the broker or exchange.

- Regular system maintenance and testing protocols ensure that these controls are functioning correctly and are updated as market conditions or trading strategies evolve.

- Documentation and review of trading errors would allow the trader or firm to analyze any near-misses or mistakes, identify patterns, and refine their processes to prevent similar errors in the future.

With this systematic approach, even if the trader makes a data entry mistake, the error is caught and corrected before it can impact their capital. By combining technology, routine checks, and disciplined processes, the system protects the individual trader.

Emotional Intelligence in Trading Performance

While technical skills form the foundation of trading success, emotional intelligence plays an equally important role in your performance. Building emotional resilience helps you maintain trading confidence through market volatility and unexpected losses.

You’ll need to develop a balanced mindset that combines analytical thinking with emotional control.

- Practice self-awareness to recognize emotional triggers during trades

- Develop stress management techniques for high-pressure situations

- Build patience by following your trading plan consistently

- Learn from losses without letting them affect future decisions

- Create a support network of experienced traders for guidance

Learning From Past Trading Mistakes

Even the most skilled traders make mistakes, but it’s what you learn from those errors that shapes your long-term success in the markets.

By implementing thorough analysis techniques and dedicating time to mistake reflection, you’ll develop stronger trading strategies and avoid repeating costly errors.

Start by documenting each trade’s entry, exit, and emotional state in a detailed journal.

Review your mistakes weekly, identifying patterns that led to losses.

You’ll often find that emotional decisions, rather than technical analysis, drive poor outcomes.

Transform these understandings into concrete rules for your trading plan, and you’ll steadily improve your performance.

Creating a Sustainable Trading Framework

Building a sustainable trading framework requires careful attention to both risk management and consistent execution protocols.

You’ll need to establish sustainable practices that support long-term success while developing strong trading habits that withstand market pressures.

- Implement a systematic approach to entry and exit points

- Maintain detailed trade logs to track performance metrics

- Set clear risk parameters for each trading session

- Develop a routine for pre-market analysis and preparation

- Create accountability through regular strategy reviews

Your Questions Answered

How Long Does It Typically Take for a Trader to Recover From Major Losses?

Your recovery timeline from major trading losses depends on several factors, including your recovery strategies and emotional resilience.

Most traders need 6-12 months to rebuild their capital through disciplined trading.

You’ll need to focus on risk management, maintain smaller position sizes, and rebuild confidence gradually.

Can Trading Mistakes Lead to Legal Consequences Beyond Financial Markets?

Yes, your trading mistakes can trigger serious legal implications, particularly if they involve market manipulation or fraud, even unintentionally.

You’ll face regulatory scrutiny if you engage in unauthorized trades, mishandle client funds, or violate securities laws. Financial regulators like the SEC can impose hefty fines, trading restrictions, and even criminal charges.

Additionally, you’re liable for any losses caused to clients through negligent trading decisions.

What Percentage of Successful Traders Have Experienced Significant Trading Errors Early On?

While exact statistics vary, research suggests that approximately 80-90% of successful traders have encountered significant initial mistakes during their early trading careers.

You’ll find that these error learning experiences often become stepping stones to later success.

Most professional traders report losing 30-50% of their capital in their first year, but they’ve used these setbacks to develop more resilient trading strategies and risk management protocols.

Are Certain Personality Types More Prone to Making Repeated Trading Mistakes?

You’ll find that perfectionists and impulsive personalities often struggle most with repeated trading mistakes.

Perfectionists can’t accept normal market losses, leading to overcompensation and poor decisions, while impulsive traders lack the emotional resilience needed for consistent success.

Your trader psychology plays a big role, as anxious or overconfident types may ignore risk management principles.

Understanding your personality type helps you develop targeted strategies to overcome these tendencies.

How Do Cultural Differences Affect Trading Error Patterns Across Global Markets?

Your trading error patterns are significantly influenced by cultural norms and risk perception across different markets.

In Asia, you’ll often find more conservative approaches leading to hesitation-based errors, while Western traders typically make aggressive overtrading mistakes.

These cultural differences shape your decision-making, affecting everything from position sizing to exit strategies.

Understanding these regional trading behaviors can help you adapt your risk management approach accordingly.

Conclusion

You’ve learned that trading mistakes can devastate your portfolio, but you don’t have to fall victim to common errors. By implementing proper risk management, maintaining emotional discipline, and developing a structured trading framework, you’ll safeguard your capital. Remember, successful trading isn’t about avoiding all mistakes, but rather about minimizing their impact through preparation, continuous learning, and systematic execution of your strategy.