- October 20, 2022

- Posted by: CoachShane

- Category: Trading Article

As an options trader, it is crucial to have a good set of mechanics in place for creating order, opening orders, and closing orders. Done incorrectly and at worse price levels, this can lead to lost money.

In this article, we will review the different order types that we use most often when placing our options trades. We will also discuss some of the potential risks and rewards associated with each type of order.

By understanding the different order types and how they work, you can help make sure that your options trading strategies are executed in a way that minimizes risk and maximizes rewards.

Types Of Orders For Options Trading

When it comes to options trading, there are a variety of different order types that can be used. Each type of order has its advantages and disadvantages, and it’s important to understand the differences before making any trades. Some of the most common order types for options trading include limit orders, market orders, and stop-loss orders.

Limit orders are one of the most popular types of orders because they help to protect traders from large losses. A limit order is an order to buy or sell a security at a specified price or better.

In a buy limit order, your purchase order will execute at the limit order or lower

In a buy limit order, your purchase order will execute at the limit order or lower

A sell limit will be filled at the limit price or higher.

The advantage of a limit order is that it guarantees a certain price for the security, but the downside is that the trade may not be executed if the security doesn’t reach the specified price leaving you out of the trade. Often we will adjust our limit price up or down to ensure we are filled quickly.

Market orders are another popular type of order. Market orders are simply orders to buy or sell a security at the best available price. The advantage of market orders is that they’re usually executed quickly, but the downside is that you may not get the exact price you’re looking for. In fast-moving market conditions or thin markets, you could get slippage on your order and get filled much higher than anticipated.

For example, you place a market order to buy at $50, but due to slippage, you may have an execution price of $52 or higher. Depending on the number of contracts, this could skew your risk profile for the trade. Bad fills equal less potential profits.

When Do We Use Limit Orders vs Market Orders?

With the options available for choosing how to enter a trade, what makes one chosen over the other? It’s quite simple.

Limit orders are best used when you want to control the price at which your trade is executed. For example, let’s say you’re buying a stock for $50 per share. You could place a limit order at $50, which would ensure that you only pay that price (or less) for the stock.

However, there is no guarantee that your trade will be filled at that price. If the stock isn’t trading at $50 or below when your order is placed, it won’t be filled until (and unless) the stock price drops to that level.

Market orders, on the other hand, are executed at the current market price. So, if you’re wanting to by a stock for $50 per share and it’s currently trading at $50, your market order will fill at $50 per share or higher. The advantage of market orders is that they’re guaranteed to fill; the downside is that you don’t have any control over the price.

In general, limit orders are best used when you have a specific price in mind and you’re willing to wait for the stock to reach that level before your trade is executed. Market orders are best used when you want to ensure that your trade is filled immediately and you’re not overly concerned about the price moving too quickly when you enter.

I have used market orders in the past when I wanted the trade and would not be able to monitor the account to see if filled on a limit order. This is the last resort and can end up costing more in the long run.

Day Orders vs GTC Orders (Good Till Cancelled)

Order types for options trading also include day orders and GTC orders (good till canceled). Each type of order has its advantages and disadvantages and will depend on your approach to trading.

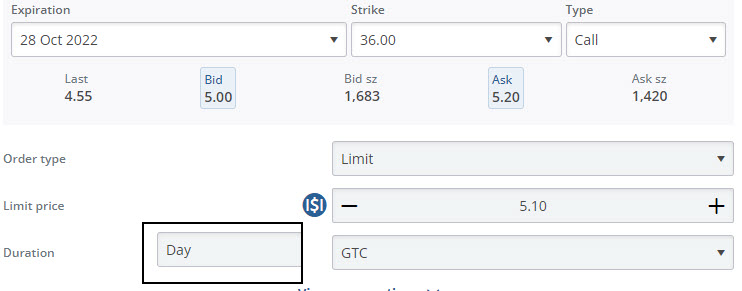

Day orders are only valid for the day that they are placed. This means that if your trade is not executed during the day, it will be automatically canceled at the end of the trading day.

For us, we’d rather have the order canceled at end of the day and evaluate the potential trade the next day. After all, we had a full trading session to get filled and we didn’t. The situation that created the setup may be no longer in play and we may no longer want to be in the trade.

GTC orders, on the other hand, remain open until they are either executed or canceled by you. This means that your trade could be executed at any time, even if the price moves against you. We’ve all seen days where we get spiked into a trade and then we see an immediate reversal.

The advantage of GTC orders is that you don’t have to keep track of them since they will remain open until they are executed or you cancel them. The disadvantage is that you may end up paying more for your trade than you intended if the price moves against you.

The advantage of GTC orders is that you don’t have to keep track of them since they will remain open until they are executed or you cancel them. The disadvantage is that you may end up paying more for your trade than you intended if the price moves against you.

Depending on your trading strategy, one type of order may be better suited for you than another. It’s important to understand the differences between each type of order before deciding which one to use.

On a side note, all our profit targets and stop loss order targets will be set to GTC orders. We want out of the trade when our preferred price is hit. Rarely will you get a bad fill on orders to close the trade as you do upon entering the trade.

What Trigger Price Should We Use for Our Limit Orders?

Now that we know limit orders are the preferred entry method, what price would we use?

As with all trading, we want the best entry price we can get. If buying a call option, for example, we want to pay the lowest premium we can. The seller of that call option wants the highest price they can get.

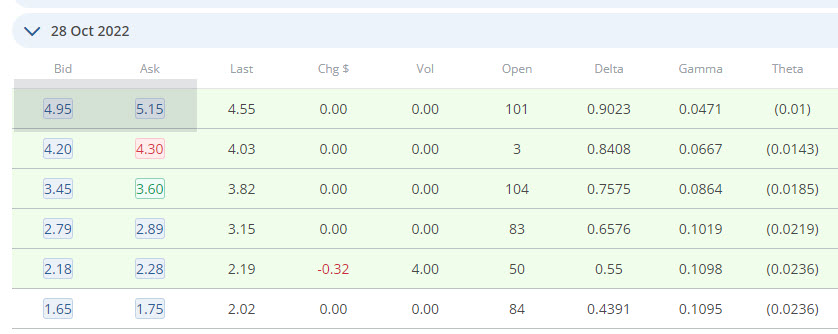

Our first approach is looking at the bid price and the ask price and looking to find the middle value.

On this option chain for WFC, we see the difference between the bid and the ask price is .20. We would look to set our limit order at the mid-point of $5.05. Remember, we have no guarantee of being filled at this order, if these options are liquid, there is a good chance of a fill.

If we must adjust up to get a fill, we will do it in increments of pennies, not quarters and bills. Simply increasing the limit price to $5.06 – $5.08 gives you a good shot at a fill at still a good price. If bigger jumps in the limit price is needed, we’d rather skip the trade.

Don’t take fill prices lightly. Over the months and years of your trading, bad fills can rob you of profits that are better served in your trading account.

Conclusion

Being disciplined in how you enter trades is critical to long-term trading success. In our opinion, for most traders, limit orders are the best way to enter a trade.

Day orders are only valid for the day they are placed and will be automatically canceled at the end of the trading day.

GTC orders remain open until they are either executed or canceled by you and can be executed at any time.

The advantage of GTC orders is that you don’t have to keep track of them since they will remain open until they are executed or you cancel them.

When using limit orders, look to set the order at the mid-point between the bid and ask price. If a fill is not possible, adjust in increments of pennies.

Want To Trade Options?

You’re probably like most people, feeling uncertain about trading options and whether or not you should be trading.

Trading Options can be a little scary. There’s so much information out there, how do you know which sources to trust? And even if you do have a good strategy, it’s hard to stick to it when the markets are constantly moving.

With our Dynamic Duo guide, you’ll get two high-performing markets plus our unique 1 Day options trading strategy. This means that you can start trading today and exit tomorrow by following a very simple plan.