- April 1, 2020

- Posted by: CoachMike

- Categories: Options Trading, Trading Article

Options traders love volatile markets.

I would much rather trade in active market conditions with big moves back and forth rather than a slow market like we saw for most of 2019 and early 2020. However, with volatility returning the last month, it does bring some challenges when placing trades.

We like to focus on the most active stocks and ETF’s that show a track record of good movement back and forth over time and also have a track record of good volume and open interest in the options.

Good volume and open interest will lead to tight bid/ask prices when trading options. The tighter the spread between the bid/ask prices the easier it will be to get in and out of trades at good prices.

When markets explode like they have recently one of the issues that options traders face is the bid/ask spreads will start to get wide. As the difference between the bid/ask prices gets wide it can become more difficult to get filled quickly and at good prices.

Option Trades And Order Fills

Let’s take a look at a few examples so you can see this idea in motion. We will look at buying a long call as well as a long call spread on Google (Symbol: GOOGL).

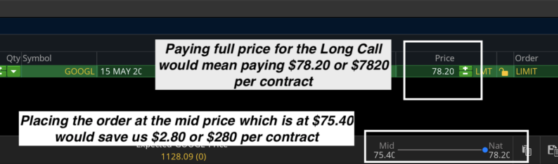

Long Call

For the first trade, we will take a look at putting on a bullish trade with a long call option. Looking at the May 1125 call option you can see bid price is at 72.60 and the ask price at 78.20. That is a difference of $5.60.

If you place a market order to get into the trade and you get a higher price, you will potentially give up hundreds of dollars of profit potential which also makes it more difficult to make money on trade.

Instead of placing a market order, I highly recommend using a limit order and starting it at the mid price of the bid and ask which is at $75.40. If you get filled at the mid price it will save you $2.80 or $280 per contract.

That kind of savings can add up over a whole series of trades.

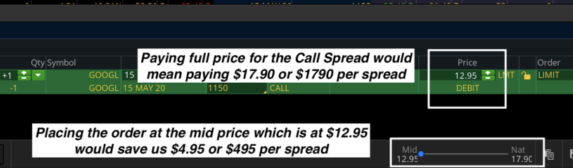

Long Call Spread

With volatility so high the options prices are also extremely expensive. One way to lower the cost of the trades is to use a vertical spread. Sticking with GOOGL lets price out the 1125/1150 call spread. Instead of paying $75.40 or $7540 for the 1125 call we will also sell the 1150 call at the same time.

The full price of the 1125/1150 call spread is $17.90 or $1790 per spread.

However, as you can see on the trade page above the mid price is at $12.95. If we can get filled at the mid price we are able to save $495 per spread.

Placing orders at the mid price between the bid/ask prices looks like a winning situation.

Why wouldn’t we do this on every trade?

The challenge is getting filled at the mid price.

Be Open To Adjusting Your Order

I will always start my orders at the mid price. If it’s a buy order like we have talked about in the examples above and I can’t get filled at the mid price I will adjust the price higher. The higher I move my price the better chances I will have of getting filled on the trade.

If the order is a sell order and I can’t get filled at the mid price, then I can adjust the price of the order lower. The lower I move the price the better chance I have of getting filled on the trade.

Adjusting the prices of the orders like this seems like more work when compared to just using a market order. However, taking this extra step can lead to significant cost savings over a whole series of trades long term.

Be aware of how wide the markets are on the products you are trading. Working your orders at better prices can make an immediate impact on your results.