- December 19, 2022

- Posted by: Shane Daly

- Category: Trading Article

When it comes to options trading, there are a variety of strategies that can be employed to make a profit. Two such strategies are straddle and strangle. Both of these strategies involve the purchase of calls and puts, but there is a key difference between the two.

With a straddle, the investor uses ATM (at-the-money) options with the same strike price.

With a strangle, the investor uses options that are OTM (out-of-the-money) at different strikes.

So, which is the better strategy?

Let’s take a closer look.

What Are The Advantage of Trading Long Straddles?

A long straddle is an options strategy that involves buying both a call and a put on the same underlying asset with the same expiration date and strike price. The trade is established for a net debit (or cost), and it profits if the underlying stock price rises above the upper break-even point or falls below the lower break-even point.

The profit potential is unlimited on the upside and if the stock price falls, downside gains can be huge as $0.00 is possible for the stock. It does not matter which way the stock moves but we do need it to make a big move in one of those directions. This is great if you are expecting a large move fairly soon but are unsure of the direction.

Our loss is capped to what it cost us to put the long straddle on plus the cost of commissions for the trade.

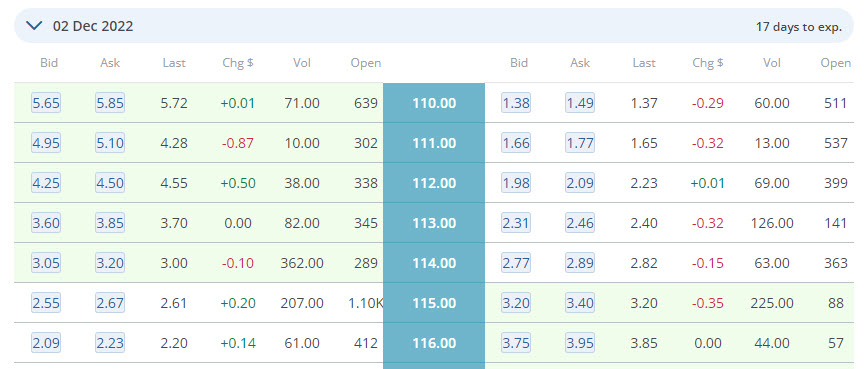

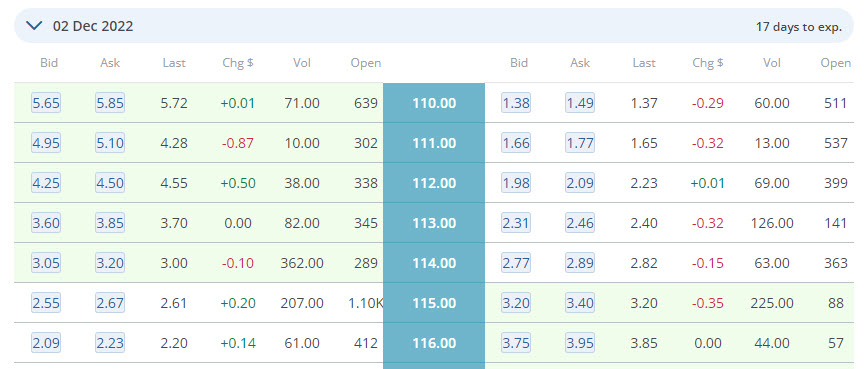

Using XOM as an example which is trading at $114.13 we look to buy a call and put at the $114.00 strike price. We will use the bid price for both buys:

Using XOM as an example which is trading at $114.13 we look to buy a call and put at the $114.00 strike price. We will use the bid price for both buys:

Call @ $3.05 + Put @ 2.77 = $5.82 to put the trade on ($582.00/options contract). That is the most we can lose on this trade.

To make any money on this trade, we need the price of XOM to move past the breakeven price.

To the upside, our breakeven price is strike price + cost of the trade = $119.82. On the downside, we need the price of XOM to break through $108.18.

Trade Outcomes

If the price stays around the strike price of $114.00 through to expiration, both options expire worthless and become a losing trade.

If the price is above the strike at expiration, the put option expires worthless and if the price is below, the call expires worthless.

Most trades do not exercise their options and will sell the long straddle before expiration. It is important to have guidelines on when to take a profit. Some will use a percentage of their risk or close the trade if a certain price point is hit.

Trading Long Strangles

With a strangle, our goal is the same – profit from a big move in either direction. The difference between a strangle and a straddle, is the strike prices we will use to set the trade up.

A straddle will use the same strike while a strangle will use a strike price both above and below the current stock price. This means the strangle is set up out of the money and is cheaper than the ATM straddles.

Using XOM which is trading around $114.00 again as an example, we will look to buy a 2 strikes out of the money call option at a strike of 116.00. To keep it even, we will look to buy the $112.00 put options.

To set this trade up: Call @ $2.09 + Put @ $1.98 = $4.07 ($407.00). This is much cheaper than the straddle but the price has to move a greater distance for us to make any money.

To the upside, the price will have to break strike + cost of trade or $116.00 + 4.07 = $120.07.

On the downside, we need to see a price bust through strike – the cost of trade or $112.00 – 4.07 = $107.93.

Like the straddle, our loss is limited to the amount it cost to put the trade on, $4.07 ($407.00/options contract).

Trade Outcomes

If the price stays within the range of the strangle strike prices or at a strike price, the trade will expire worthless if you hold to expiration.

If the price is above the call strike price, the put will expire worthless and the flipside is also true. As mentioned, Options traders rarely exercise their options and are generally closed to sell back to the market.

Strangle or Straddle. Which is Better?

Better is always relative but the main advantage of a strangle is being cheaper to put on. Since you are using OTM options, the price you need to pay to buy the calls and puts is not as expensive as ATM options. Since they are cheaper, some traders can take a bigger position to profit from the moves.

That said since the strike prices are further away from the current stock price, you need a bigger move to make money on these trades. Furthermore, the longer it takes for a big move to get to at least break even, the time decay eats into your position. You need the price to move sooner and further using strangles.

Long straddles are closer to breakeven prices so the move does not have to happen as fast or as large as strangles do. While time decay is an issue, the closer strike prices make it a little more forgiving. The main drawback is the cost and the maximum risk. These are much higher than the strangles.

FAQ – Long Straddle and Long Strangle

Q: What is the difference between a straddle and a strangle?

A: A straddle is an options strategy that involves simultaneously buying a call and a put on the same underlying asset with the same strike price and expiration date. A strangle is an options strategy that involves simultaneously buying a call and a put on the same underlying asset with different strike prices but the same expiration date.

Q: What is the advantage of a strangle over a straddle?

A: The main advantage of a strangle is being cheaper to put on.

Q: What is the disadvantage of a straddle over a strangle?

A: The main drawback of a straddle is the cost which is higher than a strangle. Since your maximum risk is the cost of the trade, the straddle has a larger risk profile than the strangle

Q: What do you need the price to do for a strangle to be successful?

A: You need the price to move sooner and further using strangles since the breakeven price is further away.