- May 4, 2021

- Posted by: CoachMike

- Categories: Options Outlook, Options Trading, Stock Trading, Swing Trading, Trading Article

The tech stocks have proven to lead the overall market on the upside and the downside over the last 12 months. We are again seeing that this week with many of the overbought tech stocks selling off.

Interestingly, the selling has come after many of these stocks released good earnings numbers.

We have been talking about this buy the rumor and sell the news event that has taken place of late. The tech stocks rallied so much leading into earnings, that all the good news was priced in ahead of earnings.

As a result, we have seen a much needed round of profit taking over the last 3 trading days.

TWTR Chart Levels

One of the stocks that has caught our eye during the selling over the last few days is Twitter (Symbol: TWTR).

We know the tech sector does not like to stay down for long.

Looking back over the last few years, almost all dips have been bought up quickly. This has us looking for a potential bounce higher in TWTR over the next 1-3 weeks.

TWTR is one stock that got roughed up after it’s most recent earnings numbers that were out last week with price selling off from around $65.00 pre-earnings to down around $54.50 at the close today.

Recent selloff looking for a bounce.

With the recent selloff, we are seeing the potential for an oversold bounce over the next few weeks. If we look at the last 3 months, we have seen price selloff from a high back in late February at $80.75 to a low yesterday of $52.50.

With close to a $30 move lower, the stock is sitting at oversold levels. We also have found support right on top of the 200 EMA on the Daily chart at $54.40.

With the key support level at $54.40 holding over the last 2 trading days, we are looking for a potential bounce higher over the next 1-3 weeks.

We aren’t expecting an explosive move back up to the highs, but a tradable bounce higher is expected.

Using the 130 minute chart.

From the Daily chart, we like to move to the 130 minute chart as that is the time frame we use for our entry and exit points.

On that 130 minute chart we can see that our Pulse Indicator has plotted Green.

When this happens, it indicates that price is between a 2 and 3 standard deviation channel move on the downside. In other words, price is oversold in the near term. Less than 2% of all occurrences fall outside of this range on the downside.

There is a high probability that we will see a period of consolidation or even a bounce higher over the next 1-3 weeks. We will be looking for a bullish trade that would benefit from a bounce higher off these key support levels that we are seeing come into play this week.

TWTR Options Trade

With our outlook leaning bullish on TWTR over the next few weeks, what is the best way to trade this opinion with options?

We could buy a long call option which would make us money as long as TWTR traded higher.

The problem with this strategy is it is too aggressive for our taste. It would only give us one way of making money. We would need the stock to trade higher and it would have to do so quickly.

A better strategy to use would be to sell an out of the money put spread.

Selling a put credit spread is a way to put on a bullish trade in a much more conservative way. Credit spreads give us 5 ways of making money on the trade instead of only have one way with a long call.

Knowing that the stock has been weak of late, we know it’s possible that we are early on the trade and the stock could chop sideways first before moving higher. Selling a put spread allows us to make money from a sideways move while the stock is building energy for a bounce higher.

Short Put Spread Details

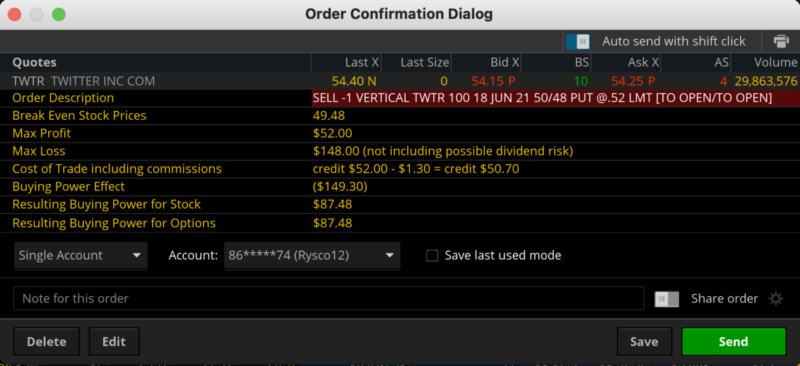

To structure our trade we are going to use the June 18 monthly options with 45 days left to expiration. We decided to sell the 18Jun21 – 50/48 put spread for our position. This had us selling the 50 put which is close to $4.50 out of the money while also buying the 48 put at the same time. This will leave us with a fully risk defined trade.

We were able to open this position for $.52 or $52 per spread. This gives us $52 of profit potential per spread while leaving us with $148 of risk on the trade per spread. The $148 is also the amount of capital required per spread to open the trade.

How We Make Money On The Trade

We make money 5 different ways on this TWTR trade.

We make money from the stock moving up, down, or sideways as long as price stays above $50.00/share. We also make money from time decay adding up every day and from volatility decreasing.

5 Ways Of Making Money On The Trade

- TWTR stock moves higher as long as price stays above $49.48

- TWTR stock moves lower as long as price stays above $49.48

- TWTR stock moves sideways as long as price stays above $49.48

- Time decay adding up with each passing day

- Volatility decreasing while in the trade

This trade will be very forgiving for us since we don’t need a directional move in order to make money.

We will profit quickest if the stock does make a move higher.

If it instead just moves sideways we can still be profitable but we will be required to hold the trade longer to let the time decay add up in our favor.

The only move that hurts us is a big move lower which we aren’t expecting since the stock is already oversold.

Trade Management

We recommend keeping the risk between 2-5% of your account per trade. This way if the trade loses, it won’t leave us with a large drawdown on our account.

Once in the trade, we will look to close it out when we can keep between 50-75% of the max profit on the trade. With the max profit on the trade the $.52 credit that we received for opening the trade, we will be looking to close the trade for between $.13-$.26 anytime over the next 45 days.

We don’t like to hold these trades all the way to expiration. We would rather take the partial profit before the options expire and not have the high stress that can come into play the closer you get to options expiration.

Conclusion

The overall market has seen some much needed selling this week. While it feels like we could be in for more selling going forward, we also have to respect the fact that all dips have been bought up quickly in recent months. Using a diversified approach, we are looking for a mix of bullish and bearish positions.

We still have on bearish exposure in part of our portfolio which gives us the potential to profit from a bigger wave lower. However, there are a few stocks like TWTR that are hitting key support levels after big moves lower. Using the put credit spread outlined above, is a way to put on a low risk trade that would benefit from a bounce higher off the oversold levels that we are seeing.

As always keep the risk small and stay as diversified as possible. If you do the results will continue to work in your favor over time.

2 Comments

Comments are closed.

Great input – Thanks!

Questions:

I am already in to TWTR

Should I act on this post now or wait until further notice?

RDC

We still like TWTR to the upside in the next 1-3 weeks so we are still ok taking trades with a bullish outlook in the near term.