- November 26, 2024

- Posted by: Shane Daly

- Categories: Trading Article, Trading Indicators

If you’re looking to improve your technical analysis skills, you’ll find RSI divergence to be one of the most powerful tools to use. This indicator goes beyond basic price action by revealing hidden momentum shifts that aren’t immediately obvious on your charts. While many traders rely only on price patterns, you’re missing some signals if you haven’t mastered the art of spotting divergences between price movement and RSI readings.

TLDR

- RSI Divergence occurs when price movement contradicts momentum indicators, signaling potential market reversals in trend direction.

- Bullish Divergence forms when price makes lower lows while RSI shows higher lows, indicating possible upward reversal.

- Bearish Divergence appears when price creates higher highs while RSI shows lower highs, suggesting potential downward reversal.

- Traders commonly use the 14-day RSI period setting and combine signals with support/resistance levels for reliable trading decisions.

- Confirmation through volume trends, candlestick patterns, and additional technical indicators enhances RSI divergence trading accuracy.

Understanding RSI Divergence Basics

When price movements and momentum indicators tell different stories, RSI divergence becomes a powerful tool for spotting potential market reversals. You’ll find this technical analysis concept particularly useful when the Relative Strength Index doesn’t match what prices are doing on your charts.

There are two main types of RSI divergence you need to know about. When you spot the price making lower lows while the momentum indicator shows higher lows, that’s a bullish divergence. It’s telling you that despite falling prices, buying pressure might be building up. Overbought and oversold conditions can help confirm these divergence signals.

On the flip side, bearish divergence happens when prices reach higher highs, but the RSI makes lower highs, suggesting the upward trend might be running out of steam.

These divergences serve as valuable entry signals and exit signals for your trades. They’re especially helpful because they show you when a trend might be weakening before the price action confirms it.

Using the 14-day period as your default RSI calculation timeframe can provide reliable divergence signals across various asset classes.

Types of RSI Divergence Signals

RSI divergence signals encompasses several distinct types that you’ll encounter in technical analysis.

As a technical indicator, RSI divergence helps you identify potential trend reversals and continuations in the market by comparing price action with RSI movements.

When you’re analyzing bullish divergence, you’ll notice the price making lower lows while the RSI shows higher lows. This signal often indicates that selling pressure is weakening and a potential uptrend may emerge.

Conversely, bearish divergence occurs when you see the price reaching higher highs while the RSI forms lower highs, suggesting the market might be overbought and due for a reversal.

You’ll also want to watch for hidden divergences in your trading strategy.

Hidden bullish divergence, marked by higher price lows and lower RSI lows, typically confirms an ongoing uptrend.

Hidden bearish divergence shows lower price highs with higher RSI highs, suggesting continued downward momentum.

These signals are particularly useful when combined with other technical indicators to confirm potential oversold or overbought conditions.

Day traders often prefer shorter RSI periods for more frequent and responsive divergence signals in volatile markets.

The most effective analysis combines RSI signals with support and resistance levels to identify high-probability trading opportunities.

Identifying Bullish RSI Divergence

Spotting bullish RSI divergence requires watching both price action and indicator movements on your chart. When you’re analyzing a downtrend, look for situations where the price makes lower lows while the RSI indicator forms higher lows.

This pattern signals decreasing selling pressure and a potential reversal in trend. Similar to MACD Divergence, this strategy works particularly well in trending crypto markets.

| Step | What to Look For | Why It Matters |

|---|---|---|

| 1 | Connect price lows | Creates visual trendline |

| 2 | Connect RSI lows | Shows momentum pattern |

| 3 | Compare trendlines | Confirms divergence |

| 4 | Check for Falling Wedges | Adds confirmation |

To identify a reliable bullish divergence, you’ll want to focus on markets that have been in a clear downtrend. When you spot the price making lower lows while your RSI shows higher lows, you’re likely witnessing a potential buying opportunity. This pattern often suggests that sellers are losing momentum and buyers might be ready to take control.

You can strengthen your analysis by looking for additional confirmations, such as Falling Wedges or other supporting price action patterns, before considering long positions.

Similar to the Stochastic Momentum Index, this divergence strategy works best when combined with support and resistance levels to enhance trading decisions.

Spotting Bearish RSI Divergence

Successfully identifying bearish RSI divergence requires looking for specific chart patterns where price action contradicts momentum indicators. You’ll see this pattern when prices reach higher highs, but the RSI shows lower highs, signaling weakened momentum in the market. This disconnect often precedes a potential downturn in price.

To spot these patterns, you’ll need to watch the RSI as it moves above 70 into overbought territory. When you see the RSI starting to decline while prices continue upward, you’re likely seeing a bearish divergence forming. It’s essential to chart both the price action and RSI simultaneously to catch these warning signs early.

Like the Average True Range indicator, RSI helps traders gauge market volatility and potential reversals.

Don’t rely just on bearish divergence, though. You’ll want to look for confirmation indicators to support your analysis. Watch for supporting signals like declining volume trends during price increases or bearish candlestick patterns.

These additional indicators help validate the reversal signal and increase your confidence in potential selling opportunities. By combining multiple technical factors, you’ll make more informed trading decisions based on stronger evidence of upcoming price reversals.

Similar to how the 50-day moving average helps filter out market noise, RSI divergence provides clarity on potential trend reversals.

RSI Divergence Trading Strategies

Mastering RSI divergence trading requires a comprehensive strategy that combines pattern recognition with precise execution. When you’re looking for trading signals, pay attention to both bullish divergence and bearish divergence patterns in relation to price movements.

These patterns become especially powerful when they occur near key support and resistance levels.

To increase your trading accuracy (and success), don’t rely only on RSI divergence. Use confirmation signals from other technical indicators to validate your trades. For example, you might wait for candlestick patterns or moving average crossovers before entering a position.

Failure swing strategies can also improve your trading by focusing on specific RSI movements around the overbought and oversold levels.

Market context is needed for successful trades. You’ll want to assess the overall trend and market conditions before acting on any divergence signals.

Remember to use proper risk management by setting stop-loss orders at points that make sense. For bullish trades, place stops below recent lows, and for bearish trades, set them above recent highs.

Always evaluate your risk-to-reward ratio to ensure each trade aligns with your overall trading strategy.

Entry and Exit Points

Effective RSI divergence trading depends on identifying precise entry and exit points in the instrument. When you spot a bullish divergence, where price shows lower lows but the RSI forms higher lows, you’ve found a potential entry signal for an upward move (considering a long trade).

Your exit points are the opposite (considering a long trade) when you notice bearish divergence, where the price reaches higher highs while the RSI shows lower highs. You’ll also want to watch for failure swings, which can signal it’s time to exit when the RSI drops below a previous swing low.

Consider using a 2B reversal pattern when confirming your divergence signals for more reliable trade setups.

To strengthen your trading decisions, look for confirmation signals like moving average crossovers or increased trading volume.

Don’t forget about risk management – it’s important to your success. Before entering any trade, determine your risk-reward ratio and set stop-loss orders at key support and resistance levels.

Consider using put options as a hedging tool to protect against potential downside movements when RSI signals become less clear.

Momentum Confirmation Techniques

While RSI divergence provides some decent trading signals, combining it with momentum confirmation techniques improves your ability to spot reliable trade setups.

| Aspect | Details |

|---|---|

| RSI Divergence | Occurs when price and RSI move in opposite directions, indicating potential trend reversals. |

| Types of Divergence | Bullish Divergence: Price makes lower lows, RSI makes higher lows. Indicates potential uptrend. Bearish Divergence: Price makes higher highs, RSI makes lower highs. Indicates potential downtrend. |

| Confirmation Techniques | – Momentum Indicators: Use moving averages or MACD to confirm divergence signals. – Candlestick Patterns: Look for pinbars or engulfing patterns for additional confirmation. |

| RSI Levels | Pay attention to RSI crossing the 70 and 30 thresholds for confirming bullish or bearish momentum. |

| Trading Volume | Significant volume spikes during divergences can indicate strong market interest and validate trend reversals. |

| Support and Resistance Levels | Examine these levels to understand the bigger picture and refine trade entries and exits. |

You should also consider the bigger picture by examining support and resistance levels in your analysis.

When you combine these momentum confirmation techniques with RSI divergence signals, you’ll develop a more comprehensive approach to trading. This multi-layered strategy helps reduce false signals and increases your chances of identifying profitable trading opportunities.

Risk Management With Divergence Trading

Successful divergence trading demands a strong risk management strategy to protect your capital and maximize potential returns. When you’re trading with divergence trades, it’s essential to set stop-loss orders just beyond recent swing points to limit your potential losses if the trend reversal doesn’t work out as you expected.

As mentioned, combine your divergence signals with other technical indicators to validate your trade setups and make trades that are better supported with information.

Here are three elements of effective risk management in divergence trading:

- Position sizing: Never risk more than 1-2% of your capital on a single divergence trade.

- Risk-reward ratio: Maintain at least a 1:2 or 1:3 ratio to ensure your potential profits justify the risks.

- Stop-loss placement: Adjust your stops based on current market conditions, using tighter stops in volatile markets.

Regularly review and adjust your risk management approach as market conditions change.

Smart traders know that success isn’t just about spotting divergence signals – it’s about protecting your capital while maximizing your chances of profitable trades through disciplined risk management practices.

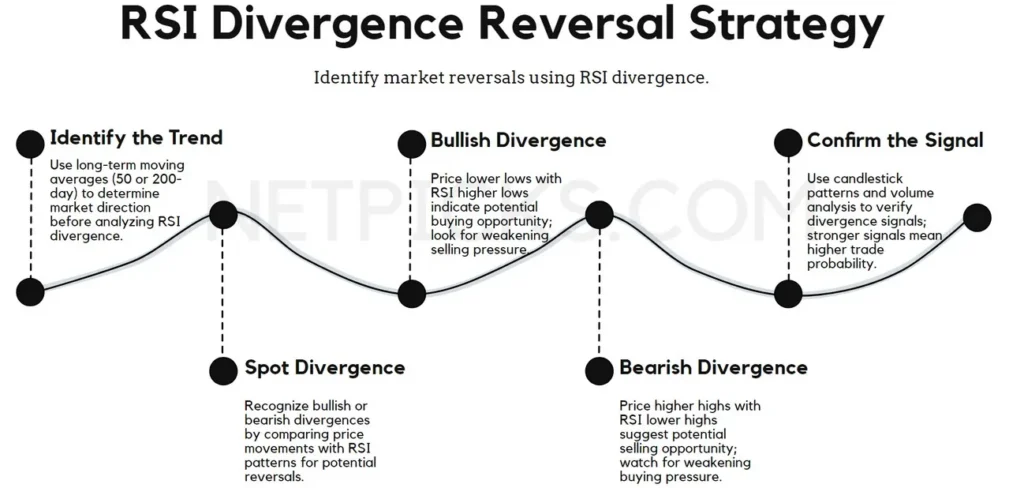

Objective: To identify potential market reversals using RSI divergence and execute trades with a clear entry and exit plan.

Step-by-Step Strategy:

- Identify the Trend:

- Determine the current market trend using a longer-term moving average (e.g., 50-day or 200-day). This helps in understanding the overall market direction.

- Spot Divergence:

- Bullish Divergence: Look for instances where the price makes lower lows, but the RSI makes higher lows. This indicates weakening selling pressure and a potential upward reversal.

- Bearish Divergence: Identify situations where the price makes higher highs, but the RSI makes lower highs, suggesting weakening buying pressure and a potential downward reversal.

- Confirm the Signal:

- Use additional indicators such as candlestick patterns (e.g., bullish engulfing for bullish divergence, bearish engulfing for bearish divergence) or support/resistance levels to confirm the divergence signal.

- Check for volume confirmation; increasing volume on a bullish divergence or decreasing volume on a bearish divergence can strengthen the signal.

- Entry Point:

- For a bullish divergence, enter a long position when the price breaks above a recent resistance level or when a confirming bullish candlestick pattern forms.

- For a bearish divergence, enter a short position when the price breaks below a recent support level or when a confirming bearish candlestick pattern appears.

- Set Stop-Loss:

- Place a stop-loss order below the recent swing low for a bullish trade or above the recent swing high for a bearish trade to manage risk.

- Determine Exit Point:

- Use a risk-reward ratio of at least 1:1 to set your target profit level.

- Alternatively, exit the trade when the RSI reaches the opposite extreme (e.g., above 70 for a long position or below 30 for a short position) or when a reversal candlestick pattern appears.

- Risk Management:

- Limit your risk to 1-2% of your trading capital per trade.

- Regularly review and adjust your strategy based on market conditions and performance.

Your Questions Answered

What Is the RSI Divergence?

RSI divergence is when price movements don’t match RSI signals, indicating potential trend reversals.

When analyzing timeframes, you’ll spot bullish indicators in oversold levels and bearish patterns in overbought levels.

Your divergence strategy should focus on market conditions while managing risk.

Maintain solid trading psychology, as these signals can help you identify key turning points in price action.

What Is the Best RSI Period for Divergence?

You’ll find that the best RSI period depends on your trading strategy. For short term trends, a 7-14 period setting works well, while long term analysis benefits from 14-21 periods.

Consider market conditions and volatility impact when choosing your settings. Test different RSI settings with historical performance data to find what suits your style.

Remember to use confirmation signals, as indicator limitations can affect divergence types’ accuracy.

How Accurate Is RSI Divergence?

RSI divergence’s accuracy typically ranges from 60-75% when you’re using proper trading strategy effectiveness and risk management practices.

You’ll find it’s most reliable when you combine multiple indicators and analyze different timeframes.

Market conditions impact its success rate – it works better in trending markets than sideways ones.

To boost accuracy, you should always confirm signals with chart pattern recognition and consider volatility implications before trading.

What Is a Good RSI for a Stock?

When you’re analyzing RSI levels, look for readings below 30, which typically indicate oversold conditions and potential buying opportunities.

Conversely, RSI readings above 70 suggest overbought conditions where you might want to consider selling.

For reliable RSI trading patterns, you’ll want to combine these indicators with other technical analysis tools.

RSI trends around 50 are neutral, while some traders adjust their RSI confirmation levels to 20 and 80 for more volatile stocks.