- February 27, 2023

- Posted by: Shane Daly

- Category: Trading Article

Everyone knows that the stock market can be volatile, but not everyone knows what happens to options when trading is halted. A “stock trading halt” is when the exchange stops trading of a particular security for some time. It could be for a few minutes, a few hours, or even days.

Options are contracts between two parties that give the holder the right to buy or sell an underlying security at a set price on or before a certain date. This does not end just because the market has been halted.

So what happens to options when the stock trading is halted? Let’s take a look.

Three Levels Of Circuit Breakers To Know

If the S&P 500 index experiences a 7% drop from its closing price between 9:30 am EST and 3:24 pm EST, level 1 circuit breaker halt will be initiated to pause trading on all US exchanges for 15 minutes.

During the normal trading hours of 9:30 am EST to 3:24 pm EST, a level 2 circuit breaker will suspend all stock market activity if the benchmark indexes drop 13% from the previous day’s closing price. This will also last 15 minutes. But after regular hours have concluded at 3:24 pm EST until 4 pm when trading ends, stocks are still free to trade as long as they remain below 7% or 13%, which happen to be Level 1 and Level 2 Circuit Breaker thresholds respectively.

Should the S&P 500 index experience a downturn of 20% or more from its prior closing price, all trading will be suspended until 4 pm EST with a Level 3 circuit breaker.

Circuit Break Example = Effect On Stock

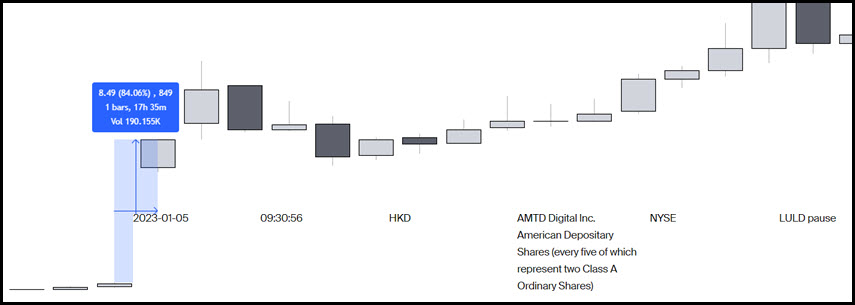

This stock was halted at 9:30:56 after putting in a 84% jump in price.

If you had bought puts puts for this stock, you could see how much trouble you’d be in. As the writer of this put, you’d be in profit.

Complete Suspension of Trades

When stock trading is halted, there will be no new trades made until it resumes. All open orders will remain in place until stock trading begins again and they can be filled. This means that you won’t be able to buy, sell, or exercise your options until stock trading resumes. If you have open positions in the affected stocks, you may need to wait until after the halt is lifted before making any adjustments to them.

Volatility and Price Quotes

During a halt in stock trading, volatility and price quotes can change dramatically since no trades are being made. This means that prices may go up or down when trading resumes depending on market sentiment. It can also create opportunities for traders who are willing to take risks during these times of uncertainty. It’s important to remember though that this volatility can work both ways so it’s best to approach these situations cautiously and do your research before making any major moves.

Also, the price of options uses the underlying instrument as the core of the pricing model. Without an up to date price quote for the stock, the pricing of options will not be accurate.

What Can I Do Until Trading Resumes?

First off, don’t panic! While it can feel like an eternity waiting for trading to resume (especially if there are open orders involved), try and make the most of this time by doing some research on the company or sector so you’re better prepared when trading resumes.

In fact, if holding long puts and the price of the underlying gaps down, you could be in for a nice payday! The same is true for call options. A large gap up when trading resumes could equal a large gain.

Additionally, if you have any pending trades that haven’t gone through yet due to the suspension period, use this opportunity to review those trades and see if they still make sense given current market conditions.

Finally, take a few moments just to relax and remind yourself why you got into trading in the first place—to make money!

Conclusion:

To recap, halts in stock trading can have serious implications for those who trade options contracts since there will be no new trades until the halt has been lifted and expiration dates may not be valid if they fall within the timeframe of the halt itself.

Additionally, volatility and price quotes could change drastically during these times so traders need to stay up-to-date with market news and adjust their strategies accordingly when necessary. Knowing how halts affect options can help ensure that traders make sound decisions even during times of uncertainty.

4 Comments

Comments are closed.

Great

Glad you enjoyed it Bob.

What happens to the puts owned on SIVB when the stock no longer exists? I don’t see that addressed in the article.

Was actually just reading this article that explains it very well:

https://www.forbes.com/sites/brandonkochkodin/2023/03/15/retail-traders-left-hanging-as-brokers-halt-transactions-on-silicon-valley-bank-just-as-bets-are-set-to-pay-off/?sh=612a9a003f55