- August 17, 2015

- Posted by: Shane Daly

- Categories: Forex Trading, Trading Article

Unlike the traders of yesteryear, today’s market participants have a huge selection of Forex trading tools at their disposal including trading tools online. As a matter of fact, the selection can be overwhelming at times so it’s important to dial it down to simple categories and decide what fits your needs.

The only way you’ll know what trading tools you need is to know what kind of Forex trader you are.

Swing traders may require different tools than traders who scalp or day trade the currency market. Let’s drill into four categories of trading tools that you may want to investigate as part of your Forex trading business.

Forex Trading Tool #1

The most obvious place to start is with the charting software you’ll need to chart the various currency pairs you may be trading. Your choices range from the charting packages offered by your broker, to the famous (and free) Metatrader package, and all the way to paid charts such as Sierra, Ninja Trader, and Tradestation.  Metatrader is very popular with the retail Forex trading crowd and EXTREMELY popular with those that sell Expert Advisors that trade for you. Think of “cheap algorithm trading” and you will know what I mean. (something I suggest you stay away from).

Metatrader is very popular with the retail Forex trading crowd and EXTREMELY popular with those that sell Expert Advisors that trade for you. Think of “cheap algorithm trading” and you will know what I mean. (something I suggest you stay away from).

Everyone will have different needs and different budgets.

You must test drive each platform you are interested in and see how it responds. One big thing for me is watching computer load and I can say that so far, I’ve found Sierra charting takes very low resources on my computer to run. While the charts are important, you also want to keep in mind who is supplying your data.

For retail Forex, your broker is generally the market maker and will supply you with the quotes and data and that may cause you concern. I’ve seen spikes in the broker data that did not appear when using an outside data source. Each charting package for Forex trading will come with many technical indicators and some will come with built in scanners as well as the ability to trade from the chart.

Again, everyone will have different needs so make sure you read the list of what’s available for the charts you are interested in.

Here are some of the highlights of Sierra charting:

- Sierra Chart is extremely fast with a definite focus on high performance in all areas of the program.

- You can create your own custom studies, indicators and trading systems using the Sierra Chart Advanced Custom Study Interface and Language or the built-in Excel compatible Spreadsheets.

- Sierra Chart is simple to get started with and simple to use. Download it and see for yourself. It is well organized with all functionality easily found. Yet it has the features and flexibility for advanced users.

Forex Trading Tool #2

Forex is currency trading and currencies are impacted greatly by the actions of the countries related to the currencies you are trading. Due to the impact news can have on currencies, the second trading tool is economic news reporting.

A calendar listing the days news events is something every Forex traders should be looking at for every trading session. This is very important for traders who day trade or scalp the currencies. Swing traders, depending on their style, aren’t really concerned with the volatility that can come with an individual news release.

One of the most important releases you should be aware of is called: FOMC: The Federal Open Market Committee The FOMC meets eight times per year to set key interest rates, such as the discount rate, and to decide whether to increase or decrease the money supply, which the Fed does by buying and selling government securities. – Investopedia

Another release you should be aware of is: NFP: Non-Farm payroll In general, increases in employment means both that businesses are hiring which means they are growing and that those newly employed people have money to spend on goods and services, further fueling growth. The opposite of this is true for decreases in employment. – Investopedia

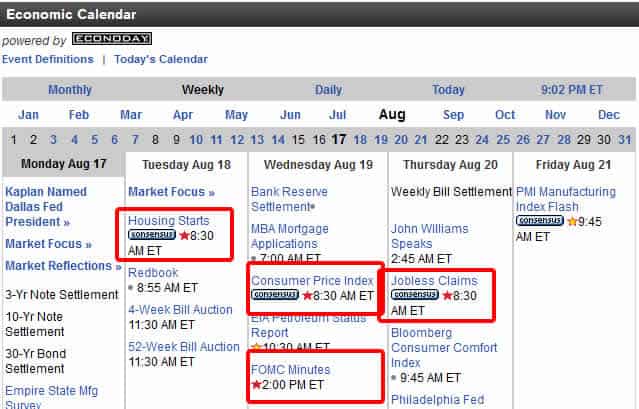

You can see on this segment below how the releases are listed on the Bloomberg calendar. I’ve boxed in the important releases and you can see they have a red star beside them. This indicates that these releases have the potential to move the market. Be very aware of these releases and a general rule at Netpicks is not to be taking a trade five minutes before the news.

Forex Trading Tool #3

Technical analysis is described as: a security analysis methodology for forecasting the direction of prices through the study of past market data, primarily price and volume – Wikipedia Traders utilize technical indicator tools to assess the opportunities that fall under their trade plan for taking a trade in Forex.

There are drawbacks that come with using trading indicators but most of them come with how traders use them. Indicators are not the “holy grail” nor do they have an “uncanny ability” to predict the next market move.

They are a tool that can have a place in a well thought out and tested trading plan. Traders will find they have favorite indicators they like to use which is important because you are able to expertly apply them due to the amount of time you use them. You must become an expert at whatever trading tool you use and any market including Forex, is not exempt.

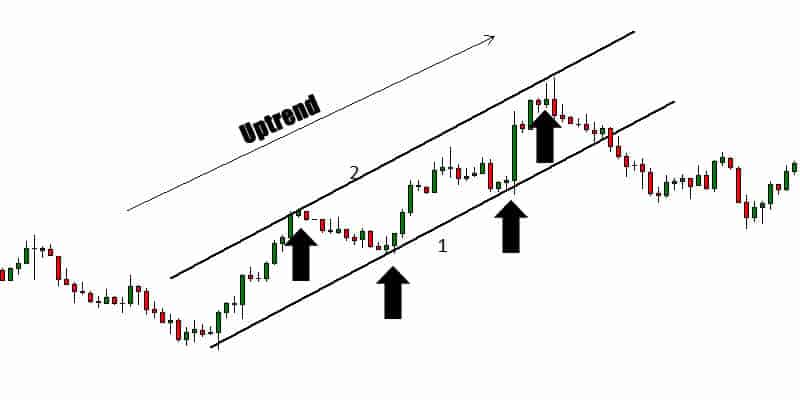

Let’s look at one very popular indicator known as Trend Lines. One of the oldest indicators around and are used to not only to determine trend, but also strength of trend and can even be used for entry into a trade.

Number one is the bottom trend line, number two is a copy of number one applied to the top and forming a channel. You can see how price is bouncing off both sides of the channel.  Drawing trend lines is straightforward. You simply connect two or more higher swing lows in an uptrend and lower swing highs in a downtrend as you can see in the chart above. I find trend lines to be powerful and can set up some very good channel trades where you short the top and buy at the bottom. Of course you need a trade plan for this but start experimenting with trend lines if you are new to them.

Drawing trend lines is straightforward. You simply connect two or more higher swing lows in an uptrend and lower swing highs in a downtrend as you can see in the chart above. I find trend lines to be powerful and can set up some very good channel trades where you short the top and buy at the bottom. Of course you need a trade plan for this but start experimenting with trend lines if you are new to them.

Forex Trading Tool #4

One thing that gets missed when talking about trading tools is the “paperwork” behind the scenes. You must have a way to journal in your trading business. You must know if you are slowly bleeding your account dry or if you are trading in a manner that will see you slowly compounding your account.

- Log important Trade Statistics like Profit Factor, Expectancy, Expectation

- Compare stats of Longs vs. Shorts; am session vs pm session

- Track set up types where you can track statistical information for 5 different setups to see which performs best

- Recommended risk per trade based on your trade account size & market/time interval you trade

Forex Trading Tools Are The Start

Using and understanding these categories of trading tools is the easy part. The hard part comes not only when you try to design a trading system or plan but also trying to stick to what you’ve tested shows an edge. One of the best ways to stay on track is being part of a bigger group of traders who care about your success.

Trading is tough…period.

Any edge you can gain, including surrounding yourself with those fighting the same issues, is well worth having in your corner. Forex trading tools are not just what you use to help you enter and exit trades.