- October 22, 2023

- Posted by: Shane Daly

- Categories: Options Trading, Trading Article

Navigating the world of options trading can be challenging, but you can make it easier. Covered calls are a dependable tool that are available to a certain type of options trader. They’re widely regarded as the simplest strategy for trading beginners, offering stability and income.

These particular options contracts are widely regarded for their reputation as one of the most straightforward options strategy, making them an excellent choice for individuals who are new to the world of trading. What sets covered calls apart is their unique ability to provide not only stability but also a potential stream of income, making them an appealing choice for both novice and experienced investors alike.

Let’s delve into the “hows and whys” of covered calls, and why they’re your best bet for a smooth beginner experience in options trading. You’ll come to understand why they’re often considered the optimal choice for those seeking a blend of security and profit potential in the realm of options trading.

Understanding the Concept of Covered Calls in Options Trading

In order to succeed in options trading, one strategy to consider is the concept of covered calls. This strategy involves selling a call option on securities you already own. The call premium importance are important as it provides income and partially shields you from price drops.

On the downside, if the stock price climbs above the call’s strike price, you’re obligated to sell your securities if the buyer of the call exercises their option. That’s where ‘in the money calls’ come in. An “in the money” (ITM) call option is an options contract where the current market price of the underlying asset is higher than the strike price of the call option.

In simpler terms, it means the call option has intrinsic value. They’re higher risk, but they offer higher premiums. The key is balancing the risk with the potential reward.

Selling Puts, Long Call, Long Put, and Vertical Spread

You often need to explore other key options trading strategies such as selling puts, long call, long put, and vertical spread, but remember, it’s crucial to understand each one thoroughly before diving in.

| Options Strategy | Key Points |

|---|---|

| Selling puts | Betting the stock will rise or stay flat Watch out for substantial risk if the stock drops |

| Long call | Potentially unlimited profits if the stock soars You’ll need to understand intrinsic value to calculate potential profits |

| Long put | Profits increase as stock decreases Lower risk than selling puts, but still requires careful management |

| Vertical spread | Limits both potential profit and loss A balanced approach for those seeking moderate risk |

These strategies each have unique risk management characteristics in options trading. Keep these details in mind when deciding on your options trading approach.

How to Implement Covered Calls

Armed with the knowledge of various strategies, we’re now moving on to how to implement covered calls, one of the easiest options trading strategies for beginners.

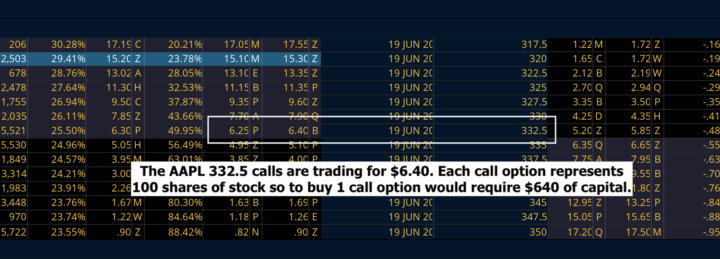

The most important fact is that you own at least 100 shares of a stock. Then, sell a call option on that stock. You’re essentially offering someone the right to buy that stock at a certain price within a specific time period. This strategy helps you earn income from the premium received from the sale.

However, there’s a risk if the stock’s price skyrockets, as you’re obligated to sell your shares at the strike price. Though it’s a relatively simple strategy, it’s crucial to carefully consider the potential outcomes before proceeding.

Benefits and Potential Drawbacks of Each Options Trading Strategy

Let’s look into the pros and cons of each options trading strategy, so you’re able to make a decision that suits your situation.

| Options Strategy | Pros | Cons |

|---|---|---|

| Covered Calls | – Easy to implement – Provides regular income |

– Limited profit potential – Substantial downside risk |

| Cash-Secured Puts | – Potential to buy stock at a discount – Premium income |

– Risk of substantial losses if the stock price falls |

| Long Calls | – Unlimited profit potential – Limited risk |

– Requires accurate prediction of market direction – Vulnerable to time decay |

Understanding these strategies’ strengths and weaknesses helps you navigate the market’s unpredictable nature. Remember, no strategy is perfect; it’s about finding what works best for you.

Frequently Asked Questions

What Are the Tax Implications of Trading Covered Calls?

When you trade covered calls, you’ll face tax implications. Your profits are subject to capital gains tax (depending on your country and tax shelters available), but you can use tax deduction strategies to offset some of your taxable income. Always consult a tax professional.

Can I Use Covered Calls as a Part of My Retirement Investment Strategy?

Yes, you can use covered calls in your retirement strategy. It’s about selecting the right underlying stocks and managing the duration of your calls. They can provide a steady income stream and lower risk but you need to speak to a professional to see if this is right for your situation.

Are There Any Specific Software or Tools That Can Help Me in Trading Covered Calls ?

Absolutely, there’re specific tools to aid you. When selecting software for covered calls, consider automated tools. They streamline options trading, making it efficient, and provide valuable data-driven insights.

How Does the Volatility of the Market Affect the Profitability of the Covered Calls Strategy?

Volatility impacts your profitability in covered calls. Higher volatility increases option premiums, boosting your profits. Yet, it’s risky as it means the stock price is fluctuating more dramatically and if the call buyer is deep in the money, they may exercise their right to buy the stock at the strike price.

Conclusion

Covered calls, often considered one of the simplest options trading strategies, offer both stability and income, making them an attractive choice, especially for beginners.

Understanding the concept of covered calls involves selling call options on stocks you already own, which can provide regular income and mitigate potential losses to some extent. However, it’s crucial to be aware of the risks, particularly when the stock price significantly rises.

In addition to covered calls, there are various other options trading strategies to explore, each with its own risk management characteristics. It’s essential to thoroughly understand these strategies before diving into options trading.

Unlock the Secrets to Options Trading Success!

Discover the 6 game-changing secrets that have powered success for over 24 years. Dive into our exact trading blueprint, learn how to capitalize on volatile markets, and find out how to achieve returns of up to 120% on top-performing stocks like Amazon, Netflix, and Bank of America.