- November 7, 2023

- Posted by: Shane Daly

- Categories: Options Trading, Trading Article

At Netpicks, we learned that credit spreads can be a trader’s best friend in options trading. They’re not just about managing risk — they’re a tool to optimize profit potential (although limited to premium received) and the same time have a higher chance of success.

But they do need you to have some knowledge to take advantage of them. You’ve got to understand volatility, market conditions, and the right strategies.

Key Takeaways

- Credit spreads allow for income from premiums, limited risk, and higher chances of success

- Correlation between risk/profit potential in credit spreads is important for finding the right balance in individual trading strategies.

- Pricing models and volatility, such as the Black Scholes Model and implied volatility, impact the options pricing and profitability in credit spreads.

- Market conditions, investment strategies, and risk management play a significant role in optimizing profit potential in credit spread trading.

Understanding the Role of Credit Spreads in Options Trading

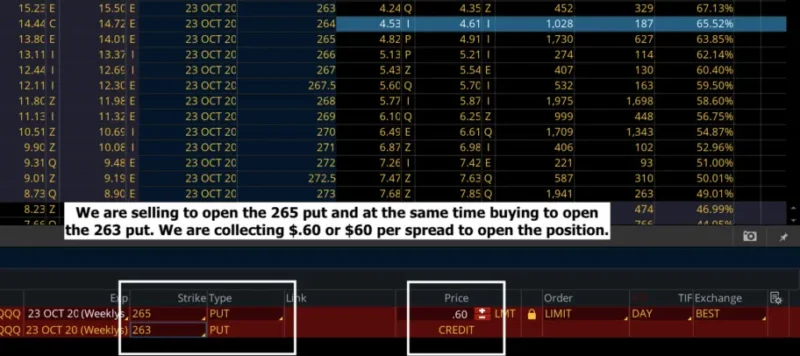

Credit spreads play a significant role in creating spread diversity, allowing traders to hedge risk while still banking profits. They function by simultaneously buying and selling options on the same underlying asset but with different strike prices or expiration dates. By doing so, you’re essentially creating a safety net that limits potential losses (but also limits gains to the premium received).

In terms of options liquidity, credit spreads can help increase it. This is because you’re engaging in multiple transactions, which can boost the market’s overall trading volume.

Remember, a liquid market is a trader’s friend (for any market) as it allows for quick buying and selling.

Correlation Between Risk and Profit Potential in Credit Spreads

Credit spreads, by their nature, are designed for risk diversification and profit maximization (limited).

Let’s consider this table:

| Risk Level | Credit Spread | Profit Potential |

| Low | Narrow spread | Low |

| Moderate | Moderate spread | Moderate |

| High | Wide spread | High |

| Very High | Very wide spread | Very high |

| Unknown | Variable spread | Variable |

What’s clear is that when the credit spread is wide, the risk level and profit potential are high. A narrow spread signifies lower risk and lower profit potential. The key is to find a balance that aligns with your trading strategy and risk tolerance. Remember, credit spreads must be tailored to your individual needs.

Pricing Models, Volatility, and Impact on Options Trading

The most commonly used option pricing model is the Black Scholes Model. It helps calculate the theoretical price of an option based on certain variables. However, one of its limitations is the assumption of constant volatility, which is rarely the case in real markets.

This is where the concept of Implied Volatility comes into play. It’s a metric that reflects the market’s expectation of future volatility. The impact of Implied Volatility can massively change an option’s price, thereby affecting profitability.

Influence of Market Conditions and Strategies on Credit Spreads

Every single market condition and investment strategy has an influence on credit spreads, which is an essential aspect to consider in options trading.

- Economic indicators such as GDP, unemployment rates, and inflation can influence the market, affecting the width of credit spreads.

- Interest rates also play a vital role. Higher rates often widen spreads, as the risk of default increases.

- Investment strategies like hedging can help manage risk, potentially narrowing the spread.

- Market volatility can cause fluctuation in spreads, hence calls for strategic adjustments.

Understanding these elements allows traders to anticipate changes in credit spreads and optimize their profit potential.

Importance of Risk Management and Pitfalls

Risk management is important with credit spread trading, and it’s equally important to be aware of the potential pitfalls that can erode profits. Implementing risk mitigation techniques can save a trader from heavy losses.

One common mistake is not having a plan to manage the trade if it goes against you. You must know your worst-case exit but also adjust as the market moves in your direction.

Many traders underestimate the risk of assignment, where the option buyer exercises their right to the underlying asset. This can lead to unexpected losses, especially if the trader isn’t prepared to take on the asset. Proper risk management and understanding of the common mistakes in credit spread trading can significantly optimize one’s profit potential.

Frequently Asked Questions

What Are the Basics of Options Trading and How Does It Work?

In options trading, I utilize Options Pricing Fundamentals to buy or sell contracts. It’s about predicting market movements and applying Risk Management Techniques to maximize profits and minimize losses. It’s complex but profitable.

How Can I Get Started in Options Trading?

To get started in options trading, ensure you know enough to start with simple calls and puts. It’s a learning process and one that our blog and options programs can help you with.

What Are Some Other Strategies in Options Other than Using Credit Spreads?

Some other strategies include a straddle strategy for its benefits in volatile markets. The Iron Condor approach also offers high-profit potential with defined risk in more stable market conditions.

How Does One’s Tax Situation Affect Their Profits From Options Trading?

In options trading, tax situation has a direct impact on net profits. The tax implications, like capital gains tax, can eat into your returns, so always factor them into your trading strategy. A good accountant can help you with this.

Conclusion

Credit spreads play a vital role in options trading, helping to optimize profit potential and at the same time, limiting risk. They’re influenced by several factors, including pricing models, market volatility, and investment strategies. It’s crucial to understand the risk-profit correlation and use effective risk management to avoid pitfalls. With the right knowledge and strategy, credit spreads can indeed be a powerful tool in your trading arsenal and a source of income.

Unlock the Power of Options Volatility!

Discover the secrets of profiting in any market condition.

Whether stocks are soaring or tumbling, our exclusive strategy has got you covered.