- July 24, 2023

- Posted by: Shane Daly

- Categories: Advanced Trading Strategies, Trading Article

A complex pullback is a price retracement in which the corrective pattern consists of multiple corrective waves against the market bias. It is a more intricate and multi-dimensional correction compared to simpler pullback formations.

Sometimes, what appears to be a straightforward pullback can turn into a complex correction with multiple countertrend legs. Complex pullbacks can be tricky because they can catch a trader off guard who’s expecting a one-legged pullback.

Sometimes, what appears to be a straightforward pullback can turn into a complex correction with multiple countertrend legs. Complex pullbacks can be tricky because they can catch a trader off guard who’s expecting a one-legged pullback.

What is a Complex Pullback?

A complex pullback involves two or more countertrend legs within a pullback structure. This means that instead of having a simple one wave pullback, price action becomes more consolidated and puts in another wave or more.

The two-legged pullback pattern can be traded effectively but it’s important to have a solid understanding of price action analysis and pullback strategies.

The two-legged pullback pattern can be traded effectively but it’s important to have a solid understanding of price action analysis and pullback strategies.

By studying market action and being aware of these variations in pullbacks, traders can develop a plan that takes into account the possibility of multiple countertrend legs within a correction.

What is a Single Leg Pullback?

The idea behind pullbacks is that price has made a with trend move, paused, and then the pause resolved into another with-trend wave. Understanding single leg pullbacks is important for traders looking to enter on a pullback with an obvious stop loss area and profit targets.

Single leg pullbacks occur when price moves against the market bias, creating a countertrend move before continuing in the direction of the trend. These types of pullbacks tend to occur in strong trending markets and offer a good trade entry location because they often only have one pullback leg before continuing in the direction of the trend.

Single leg pullbacks occur when price moves against the market bias, creating a countertrend move before continuing in the direction of the trend. These types of pullbacks tend to occur in strong trending markets and offer a good trade entry location because they often only have one pullback leg before continuing in the direction of the trend.

For a single leg pullback entry, traders can look to enter as price approaches a key level such as a previous swing high or low. The idea is to anticipate that price will continue its original trend after this brief counter move.

Not all pullbacks are created equal, so it’s essential that traders analyze their entry points carefully and manage risk accordingly. Understanding how single leg pullbacks work is just one piece of the puzzle when it comes to trading complex corrections successfully.

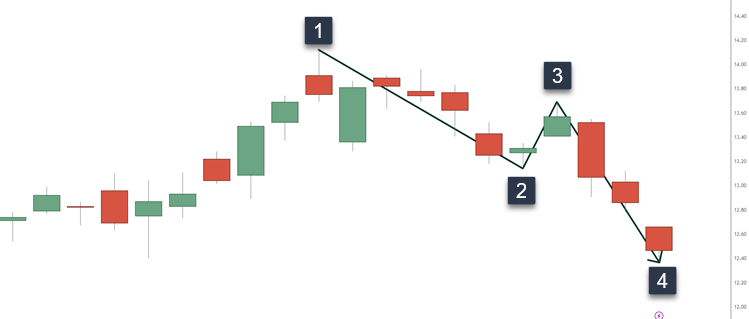

Two-Legged Pullbacks

These types of pullbacks can be challenging to trade because traders who enter the market as it turns into a trend leg and tighten their stops aggressively will likely be stopped out on the second pullback leg.

- Pullback terminates at a swing low

- Price rallies from the area – stop placed below swing at 1

- Second leg of the pullback takes out the stop

To handle these complex corrections successfully, you need to understand the nature of price movement in the market. Pullbacks tend to be proportional to the strength of a trend, so strong trends often require longer pullbacks with multiple legs.

Additionally, the law of alternation in Elliott Wave theory states that complex pullbacks alternate with simple ones. Therefore, if you encounter a simple pullback, expect its next correction to be more complex.

Ultimately, having a plan pullback trading plan for entering and managing trades during two-legged pullbacks is vital.

5 Key Points

Here are some key points to keep in mind when dealing with two-legged pullbacks:

- They can often signal weakening pullbacks within a trend (profit taking)

- Consider using smaller position size with simple corrections expecting a complex

- You may see strong with trend moves from the complex correction

- Traders should consider waiting for confirmation before entering a trade on the second leg of the pullback

- Successful navigation of complex corrections requires experience and an understanding of basic patterns

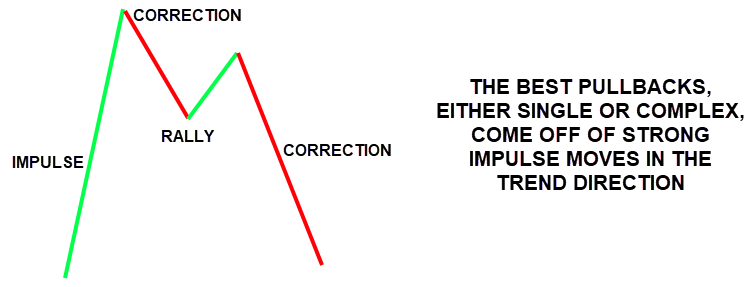

Benefits of Trading Two-Legged Pullbacks

Trading two-legged pullbacks can offer unique opportunities to capitalize on price movements and potentially increase profits.

- By identifying two or more countertrend legs within a pullback structure, traders can enter at the turn of the trend leg and tighten their stop aggressively

- There is greater potential for profit than simple pullback setups, as well as an increased ability to manage losing trades since the failure of a complex pullback could signal a trend change

Success with pullback setups requires:

- A disciplined approach that plans for the possibility of complex consolidations

- Understand of the law of alternation in Elliott Wave theory

- Consideration of the proportional length of pullbacks based on trend strength

- Looking for possible entry points including failure tests around previous swing lows.

With practice and experience, traders can refine their approach to these setups and apply basic patterns consistently to reveal a small but consistent edge in their trading.

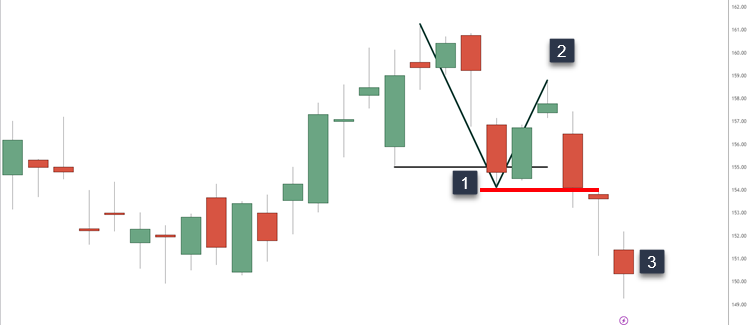

Simple Entry Rules for Two-Legged Pullbacks

These entry rules apply to both simple and complex corrections, but they’re especially important for managing the latter.

Here are four items to consider when developing your strategy:

- Wait for the first leg of the correction to end before taking any action (reversal)

- Look for signs of a potential second leg, such as a failure test around the previous swing low or a strong bullish/bearish candlestick pattern.

- Enter on the second leg only if it meets your criteria and confirm with other indicators.

- Set your stop loss below/above the low/high of the correction.

Trading pullbacks can be tricky, but following these simple entry rules can help you with trading higher probability pullback trades.

This is an example of a failure test entry. Price pierces the lower support line (clone of the top line) and then reclaims the zone. This trade entry technique can be used with horizontal support/resistance zones as well.

Frequently Asked Questions

What does a complex correction mean?

A complex correction is a price retracement that involves multiple pullback patterns within the larger market movement. It is a more elaborate and detailed form of correction compared to a simple or one-legged corrections.

What are the various types of correction waves?

The various types of correction waves include zigzags, flats, triangles, double and triple combinations, and irregular corrections.

What typically follows the completion of the 5th Elliott Wave?

After the completion of the 5th Elliott Wave, a corrective phase known as an ABC correction often follows, which aims to retrace a portion of the preceding impulsive wave.

What is the underlying principle of the Elliot wave theory?

The underlying principle of the Elliott Wave theory is that market prices follow a repetitive pattern of five upward waves (impulse) and three downward waves (correction) as a result of investor psychology and collective market sentiment.

Can you explain what a simple correction refers to?

A simple correction refers to a straightforward price retracement within a larger trend. It involves a single wave or pattern that retraces a portion of the previous price move before the trend resumes in its original direction.

Conclusion

Complex pullbacks require a deeper understanding of the market and trading patterns. While single leg pullbacks may seem more obvious, being able to identify two-legged pullbacks can provide traders with greater opportunities for profits.

Remember to follow the law of alternation in Elliott Wave analysis and consider the proportional relationship between pullback size and trend strength.

When entering a two-legged pullback trade, be sure to define your setup and stick to simple entry rules. Always maintain discipline when managing losing trades and keep in mind that complex consolidations can also occur within these types of corrections.

If you are using a pullback trading strategy to handle the markets, ensure you have a complete trading plan that lays out all the rules you will follow.