- April 26, 2024

- Posted by: Shane Daly

- Categories: Day Trading, Trading Article

Understanding bullish and bearish sentiment in day trading is important for your success. In bullish markets, buy on dips, use momentum trading, and focus on positive-moving stocks.

For bearish markets, consider short selling, identify downward trends, and manage risks as you would in any trade. Watch sentiment shifts closely, adapt strategies when needed, and align with prevailing market mood.

Recognizing fear and greed is essential. By understanding these sentiments, you set the stage for profitable trading outcomes or lower dollar losses.

Main Points

- When prices drop, buy and look for stocks with good momentum in strong markets.

- Short sell and spot downward trends in weak markets.

- Change your strategies based on how people feel (sentiment) for success.

- Use tools to analyze numbers well in good and bad markets.

- Manage risks carefully to deal with uncertain markets.

Understanding Market Sentiment

Market sentiment shows the mood of investors and the overall financial market, showing whether they’re more optimistic (bullish) or pessimistic (bearish).

Market sentiment refers to the overall attitude and emotional state of market participants, such as investors, traders, and analysts, towards a particular security, market, or financial instrument. It is the collective psychology and mood of the market, reflecting whether participants are optimistic (bullish) or pessimistic (bearish) about future price movements.

Fear and greed are strong emotions that really impact market sentiment, leading to panic selling when there’s fear and too much buying when there’s greed. As a trader, you need to be able to recognize the peaks of fear and greed to spot potential market turning points.

Avoid making trading decisions only based on these emotions; instead, look at the whole picture of market sentiment. By understanding market sentiment, you can understand market psychology, predict trends, and make smart trading decisions using sentiment indicators.

Adjust your trading strategies with the current market sentiment to improve your chances of success when day trading.

Sentiment Indicators for Day Traders

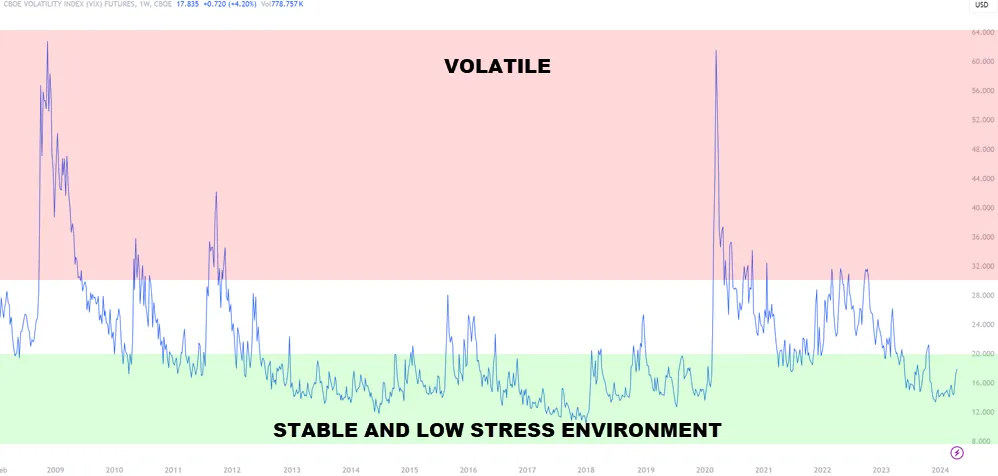

Sentiment indicators are important for day trading because they give insights into market mood and possible price changes. These indicators, like the VIX and high/low ratio, help traders understand how investors feel.

The Bullish Percentage Index (BPI) helps traders know when to buy based on a positive market outlook. Watching the put/call ratio can show how options traders are feeling, which helps predict where the market might go.

By looking at moving averages of stocks, traders can see trends and predict changes in sentiment for good trades. The Commitment of Traders (COT) report lets traders see how big players in futures and options markets are feeling.

Using these sentiment indicators well can help day traders predict market movements and make smart decisions based on current market sentiment.

Day Trading Strategies for Bullish Markets

To make the most of good market conditions in day trading, focus on strategies like buying on dips and using momentum trading techniques. In bullish markets, where prices are going up, buying when prices drop temporarily can be a good idea. This means buying stocks when their prices go down a bit during an overall upward trend, so you can get in at a better price.

Also, momentum trading in bullish markets means going along with the upward trend by buying stocks that are doing well and showing positive momentum. This strategy aims to take advantage of the market’s direction and momentum, which could lead to quick profits.

Using tools like moving averages and the relative strength index (RSI) for technical analysis can help you with your day trading in bullish markets by giving you insights into price trends and potential entry and exit points.

Day Trading Strategies for Bearish Markets

In bearish markets, using strategies like short selling can be helpful for day traders wanting to profit from falling stock prices. Here are some important strategies for day trading in bearish markets:

- Short Selling: Use short selling to benefit from declining stock prices by borrowing shares and selling them at a high price, then buying them back at a lower price.

- Focus on Downward Trends: Identify short-term downward trends and increased volatility for potential trading opportunities in bearish markets.

- Technical Analysis Tools: Utilize technical analysis tools like moving averages and Relative Strength Index (RSI) to spot bearish signals and make trading decisions in your trading plan.

- Disciplined Risk Management: Practice disciplined risk management methods to navigate the increased uncertainty and fear that often come with a bearish sentiment, ensuring effective management of volatile market conditions.

Adapting to Sentiment Shifts

Adapting to sentiment shifts in day trading involves watching market sentiment, volume changes, and price movements.

When bullish sentiment is present, it shows a positive outlook on the market, prompting traders to buy securities in anticipation of price increases. On the other hand, bearish sentiment indicates a negative view, leading traders to sell securities expecting price declines.

Recognizing peaks of fear and greed is important for adjusting trading strategies accordingly. Day traders must stay quick in responding to shifts in market sentiment to take advantage of opportunities effectively.

By aligning their trading activities with the prevailing sentiment, traders can better manage risks and improve their chances of success in day trading.

Risk Management in Bullish and Bearish Markets

When trading in different market conditions, it’s important to adjust your risk management strategies to protect your profits and minimize potential losses effectively.

Here are some key steps to handle bullish and bearish markets:

- Implement Stop-Loss Orders: In bullish markets, set stop-loss orders to protect your profits and limit losses as market sentiment can change rapidly.

- Utilize Trailing Stops: Consider using trailing stops when trading in bullish markets to lock in gains as the market goes up. This helps secure profits while allowing for potential further increases.

- Diversify Your Portfolio: In bearish markets, diversify your investments across various asset classes to spread risk and reduce the impact of market downturns. Diversification can help decrease losses during tough market conditions.

- Stay Mindful of Market Sentiment: Keep an eye on market sentiment to adjust your risk management strategies. Understanding the current sentiment is important for making informed decisions and adapting your approach to take advantage of opportunities while minimizing potential losses.

Summary

In day trading, you need to learn to master the balance between bullish and bearish sentiment. By understanding and recognizing market sentiment, using relevant indicators, and adjusting your strategies, you can handle both bullish and bearish markets effectively.

FAQ

How can I identify bullish and bearish market sentiment?

You can identify bullish and bearish market sentiment using indicators like the Fear and Greed Index, Put/Call Ratio, Volatility Index (VIX), and sentiment surveys. These tools help gauge the overall mood and expectations of market participants.

What are some effective day trading strategies for bullish markets?

In bullish markets, consider buying breakouts, using momentum indicators like RSI and MACD, and looking for stocks with strong positive momentum. Buy on dips during temporary price pullbacks within an overall upward trend to enter at more favorable prices.

How should I adapt my day trading strategies for bearish markets?

In bearish markets, consider short selling to profit from falling prices. Use oscillators like Stochastic and CCI to identify oversold conditions. Focus on stocks with strong downward trends and increased volatility. Adjust your risk management by setting tighter stop-losses and reducing position sizes.

How can I spot potential shifts in market sentiment?

To spot potential shifts in market sentiment, use technical analysis tools like trendlines, support and resistance levels, and moving averages. Monitor news and economic data for events that could impact sentiment. Be alert for divergences between price action and sentiment indicators, which may signal a potential sentiment shift.

What are the key risk management considerations for day trading in different sentiment environments?

In both bullish and bearish markets, use stop-losses to limit potential losses. Adjust your position sizes and leverage based on the prevailing sentiment and volatility. Maintain emotional control and discipline, avoiding impulsive decisions based on fear or greed. Regularly reassess your risk tolerance and adapt your strategies accordingly.