- October 14, 2022

- Posted by: Shane Daly

- Category: Trading Article

A Put option contract gives the holder the right, but not the obligation, to sell an underlying asset at a predetermined price (the strike price) by a certain date (the expiration date). As the buyer of a Put, you want the underlying stock to be under your strike price by expiration.

Example: As an option buyer, you pay a $2.00/share premium at a strike price of $50.00. By expiration, the stock price dropped to $45.00. This means you have the right to sell those shares at $50.00 (the put writer buys them) giving you a profit of $5.00 – Premium paid $2.00 = $3.00/share or $300 for 100 shares (1 options contract).

Most contracts are not exercised. You would sell your options contract back to the market at the going premium price which, considering the contract is ITM, could be a nice gain.

But someone has to sell the Put option and you can be the Put Writer and do so for income.

We are going to cover everything you need to know about selling naked puts, including what they are, why someone would want to sell one, how they work, and what the risks and rewards are.

What Is A Naked Put Option?

A naked put (opposite of naked calls) is when you sell a put option without owning the underlying asset, usually shares of stock. The buyer of the put option hopes the stock price will go down far enough to at least cover the premium and they can sell the shares at the higher strike price when the stock price is actually lower.

As the seller, you are taking a bullish position on the underlying instrument.

When you sell a naked put, you collect a premium from the buyer of the option. If the stock price remains above the strike price at expiration, then you keep the premium and no further action is taken. If the stock price falls below the strike price at expiration, then you are “put” the stock at the strike price and you must purchase it at that price if the contract is exercised.

When you sell a naked put, you collect a premium from the buyer of the option. If the stock price remains above the strike price at expiration, then you keep the premium and no further action is taken. If the stock price falls below the strike price at expiration, then you are “put” the stock at the strike price and you must purchase it at that price if the contract is exercised.

The seller of the put option is hoping the stock price stays relatively stable or goes up, so the Put buyer does not exercise their right to sell the stock.

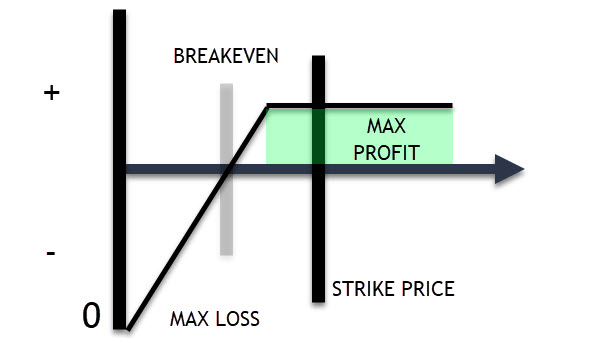

The worst-case scenario the Put seller can accept is break even. This price is calculated by taking the strike price minus the premium received. Any lower and the put seller will be at a loss.

The maximum profit a Put seller makes is the premium received.

ABC Stock Example

Let’s imagine that ABC stock is trading at $50.00 and you are looking to sell $55 puts with a premium of $5.00. The premium you would receive as a naked Put writer would be $500.00.

You bank the premium and best case scenario, you keep the entire premium as profit.

But, things don’t always go as planned in trading.

Outcome 1

During the life of the contract, the stock price is well above the $55 strike price to $83.00 due to some very positive news. The buyer of the put option, who has the right to sell those shares at the strike price, probably won’t sell them at $55 when they can sell at $83.00. The contract expires and you keep the full premium.

Outcome 2

The stock price drops to $45.00 and now the put seller is obligated to buy the stock from the put buyer if the contract is exercised.

The put seller has to pay the strike price x 100 for each contract that was sold. In our example, $55.00 x 100 = $5500 which goes to the put buyer.

The put seller now owns the shares and quickly decides to sell those shares for the current price of $45.00/share. Imagine an imperfect fill and the seller receives $44.00/share.

What is the financial position of the Put seller?

$5500.00 (strike price x 100) – $4400.00 (market value) = $1100.00

Remember the premium received? That will offset the loss: $1100.00 – $500.00 (received premium) = Loss of $600.00

Outcome 3

The market is not really moving and the stock doesn’t move far from $50.00. The put buyer probably won’t exercise the option and it will expire worthless.

Risks Associated With Selling A Naked Put

The biggest risk associated with selling naked puts is that of the downside potential of the stock. If the stock price falls sharply, this could lead to substantial losses especially if that stock becomes essentially worthless.

Only experienced options traders should write naked puts because of the danger involved. The margin requirements for this strategy are often rather stringent because losses are likely.

What Is Required For Naked Put Sellers?

Using Tastyworks as an example, here are the margin requirements for selling naked puts.

The margin requirement for an uncovered put is the greatest of the following calculations times the number of contracts times the multiplier (usually 100).

20% of the underlying price minus the out-of-money amount plus the option premium.

10% of the strike price plus the option premium.

$2.50.

The premium received from the sale of the short put may be applied to meet the initial margin requirement. However, if you sell a put in a cash account, the put must be cash-secured.

EXAMPLE OF SELLING A NAKED PUT IN A MARGIN ACCOUNT

Sell to open 1 MAR 45 Put at .50 with the underlying stock at $47.50:

[((.2 x 47.50) – 2.5) + 0.50] x 1 x 100 = $750

[(.1 x 45) + 0.50] x 1 x 100 = $500

$2.50 x 1 x 100 = $250

The requirement for this position would be $750.

The $50 generated from the sale can be applied to the margin requirement, resulting in a buying power requirement of $700.

Quick FAQ

Q: What is writing a naked put?

A: Writing a naked put is when a trader writes (sells) a put without owning the underlying asset. The aim is to profit from an increase in the price of the underlying asset and keep the premium that was received. It is a bullish options strategy.

Q: What is the maximum profit for this strategy?

A: The maximum profit is the premium received.

Q: What is the maximum loss for this strategy?

A: The maximum loss is theoretically “unlimited” if the underlying asset price falls to zero. (Assigned shares at $50.00 strike but stock has fallen to $0.00)

Q: What is the level of risk for this strategy?

A: The level of risk for this strategy is large because the investor does not own the underlying asset and may therefore be assigned shares at a price higher than the current market value, incurring a loss. (Assigned shares at $50 strike price when market value is only $45.00)

Q: What are the margin requirements for this strategy?

A: The margin requirements for this strategy are usually quite high, as losses can be substantial.

You don’t need to have tens of thousands of dollars to start trading options.

With One Day Options Trading Strategy, you can make money whether the stock market goes up, down, or even sideways.

Check out our free Options guide called 8 Minute Options Cookbook to learn more