- January 23, 2023

- Posted by: CoachShane

- Category: Trading Article

Trading covered strangles is a popular strategy among options traders looking to profit from stock price movements while mitigating potential risks.

In this blog post, we’ll explore the basics of a covered strangle trade, how it differs from a covered call, and how to select the right stocks for a covered strangle trade.

We’ll also discuss the role of volatility in a covered strangle trade and the potential risks and rewards of this strategy.

By the end of this post, you’ll have a better understanding of the covered strangle options strategy and how to successfully implement it in your own trading.

Five Quick Hits

A covered strangle gives the trader more flexibility to adjust their position to maximize profits or minimize losses.

The maximum risk a trader has is the potential loss of the entire premium received for the options.

The maximum profit for a covered strangle is the difference between the strike prices of the call and put options minus the premium received for the options.

Breakeven = stock price minus total premiums received

A covered strangle can potentially earn higher returns than a covered call strategy if used correctly.

Definition of Covered Strangle

A covered strangle is an options trading strategy that involves simultaneously shorting a call option and a put option on the same underlying security with different strike prices.

The strategy is called “covered” because the trader owns the underlying security, thus offsetting the potential loss from the options positions. The goal of a covered strangle is to profit from the movement of the underlying security’s price within a specific range.

The strategy is called “covered” because the trader owns the underlying security, thus offsetting the potential loss from the options positions. The goal of a covered strangle is to profit from the movement of the underlying security’s price within a specific range.

Covered Strangle Example

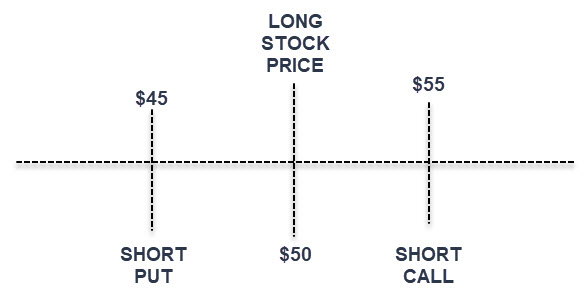

An example of a covered strangle in options would be a trader who buys 100 shares of XYZ Corporation at $50 per share and simultaneously shorts a call option with a strike price of $55 and sells a put option with a strike price of $45.

If XYZ Corporation’s stock price remains within the range of $45 to $55, the trader can profit from the time value of the options and potentially earn higher returns than a covered call strategy. If the stock’s price moves outside of this range, the trader can adjust their position to minimize potential losses.

Benefits of Covered Strangle

The benefits of a covered strangle options strategy include:

The ability to profit from both upward and downward movements in the underlying security’s price.

The potential to earn higher returns than a covered call strategy.

The ability to mitigate potential losses by owning the underlying security.

The potential to profit from a stock that is expected to remain within a specific price range.

The flexibility to adjust the covered strangle position to maximize profits or minimize losses.

What Does A Trader Want To Happen

A trader using the covered strangle options strategy wants the stock’s price to remain within the range of the strike prices of the call and put options.

If the stock’s price moves outside of this range, the trader can adjust their position to minimize potential losses. The trader may also want the stock’s price to move in either direction, as this allows them to profit from both upward and downward movements in the stock’s price, which is not possible with a covered call strategy.

If the stock’s price moves outside of this range, the trader can adjust their position to minimize potential losses. The trader may also want the stock’s price to move in either direction, as this allows them to profit from both upward and downward movements in the stock’s price, which is not possible with a covered call strategy.

Difference Between Covered Strangle and Covered Call

A covered strangle is different from a covered call in several ways.

First, a covered strangle involves selling both a call option and a put option, while a covered call only involves buying a call option.

Second, a covered strangle allows the trader to profit from both upward and downward movements in the underlying security’s price, while a covered call only allows the trader to profit from upward movements.

Third, a covered strangle can potentially earn higher returns than a covered call if the underlying security’s price remains within a specific range, while a covered call only earns a fixed return if the stock’s price goes up.

Finally, a covered strangle gives the trader more flexibility to adjust their position to maximize profits or minimize losses, while a covered call is a fixed contract that cannot be adjusted.

How Do You Profit From A Covered Strangle

A trader can profit from using a covered strangle options strategy by buying shares of the underlying security and then selling a call option (bearish) and a put option (bullish) on those shares with different strike prices.

If the stock’s price remains within the range of the strike prices, the trader can profit from the time value of the options.

If the stock’s price goes outside of this range, the trader can adjust their position to minimize potential losses.

The trader can also profit from both upward and downward movements in the stock’s price, which is not possible with a covered call strategy.

What Is The Maximum Risk

Using the example above:

Trader bought 100 shares of XYZ stock for $50.00/share or $5,000

Sold a 55 call for $3.50 and received the premium of $350.00

Sold a 45 put for $2.25 and received the premium of $225.00

Maximum risk is 5000 – 350 – 225 = $4425.00

However, we also are long a put which means if the share price drops below the strike of $45, you could be on the hook for the shares. $45.00/share x 100 = $4500.

Total potential loss: $4500 + $4425 = $8925.00

Maximum Profit

Profit potential of this trade is limited to the total premiums received plus upper strike price minus stock price.

In the example above, the maximum profit is 10.75, because the total premiums received are $5.75 and the upper strike price minus stock price equals 5.00 (55 – 50).

This is the maximum amount of profit that the trader can earn if the stock’s price remains within the range of the strike prices and does not move outside of this range. If the stock’s price moves outside of this range, the trader may incur a loss on the options positions.

Where Are The Breakeven Prices

The breakeven prices of a covered strangle are calculated by taking the Stock Purchase Price – Premium Received for Strangle

For example, if a trader sells a call option with a strike price of $50 for a premium of $2 and a put option with a strike price of $45 for a premium of $1, the breakeven prices would be calculated as follows: Share price – $3.00.

In Summary

A covered strangle is a strategy for traders who are looking for riskier, yet potentially more profitable opportunities than a covered call.

With this strategy, the trader has the potential to earn higher returns if they correctly select their stocks and strike prices, while at the same time having the flexibility to adjust their position to minimize losses should the stock’s price move outside of their expected range.

The maximum risk the trader has is the potential loss of the entire premium paid for the options, but with careful research and monitoring, a trader can maximize their profits and minimize their losses. Understanding how this strategy works is key to making better trading decisions in order to achieve long-term success.

Get the inside scoop on two of the most exciting markets today.

Our one day options trading strategy gives you the opportunity to make a quick profit without having to sit glued to your computer screen all day long.

Trade today, exit tomorrow. It’s that simple.

These markets are hot and getting hotter by the minute. Make sure you don’t miss out on this incredible opportunity. Download our guide now and get started immediately.