- June 4, 2019

- Posted by: Shane Daly

- Category: Trading Article

The Turtle Soup trading strategy is based on the breakout trading system of the Turtles.

The difference is that we want the breakout to fail when using the Turtle Soup strategy and Turtle Soup Plus One.

The story of the Turtle Traders is a popular one and shows that people who have no prior financial training, can be taught to trade.

It also shows that given the same system, traders will get different results.

Part of the trading system the Turtles used was buying new 20 day and 50 day highs. The system also included selling the new lows as well.

The trading system worked when a significant event took place that would help drive the price in the direction of the breakout.

Often times, the price moved against the breakout and that is where Turtle Soup begins to shine.

Turtle Soup Strategy – No Disrespect

Linda Raschke, where I got this strategy from, means no disrespect for the Turtle Traders who used this successfully in the long run. It was a term coined by some of her friends and the name stuck.

Just like any style of trading, breakouts can fail. They eventually breakout in trends but with Turtle Soup, we want to jump into the times that the breakout does not work. This is where the opportunity to enter a trader exists.

Some times, the price reversal from the break is short lived while other times can lead to an enormous run in price. There will be times you will lose and times you will not get a trigger into the trade.

Your job, is to execute your trade when the system sets up without worry about what will happen next. That is where we manage the trade.

Using The Donchian Channel

The Donchian channel is a technical indicator that takes the high and low for N number of periods. For our purposes, we will set N=20 to account for the last 20 days.

The channel makes a stair stepping pattern as each new 20 day low or high is made. The green arrows show you the progression of highs and lows which that the blue lines show. Remember, every new high or low in a look back of twenty days, is marked by the lines.

We can use the Donchian channel to quickly spot for Turtle Soup trading opportunities.

Trading The Turtle Soup Strategy

The trade entry is one part of the strategy but the most important aspect of any strategy is your risk management.

Ensure you risk an appropriate percentage of your account that can withstand a string of losing trades.

Ensure you place your protective stop that will be outline in the trading rules.

Buy Setups

- The market makes a new 20 day low and the lower that price shoots below the former low, adds to the trade setup.

- The last 20 day low must be at least four days in the past (using daily charts). This means you can’t compare the low of today to the low of yesterday if that was the prior 20 day low

- Your entry will be place 5-10 ticks above the prior 20 day low. Forex traders may want to use the same in pips. The entry is only good for one day.

- Your stop loss, if entry occurs, goes 1-2 ticks below the low of today

Sell Setups

- The market makes a new 20 day high. The higher the high, the better

- The last 20 day high must be at least 4 days in the past

- Entry is placed 5-10 ticks below the prior 20 day high

- Stop loss will be set 1-2 ticks above the high of today

Re-entry Rules and Profit Taking

- If you are stopped out the same day or the next day of the trade, you can place a stop order, buy or sell, at the same price as your previous entry

- Profit taking is dynamic as we don’t know how far price will travel before reversing. Trailing stops are a good approach as is scaling partial out at 1R

The rules are simple and with the use of the Donchian Channel, the setups are easy to spot

Trading Examples

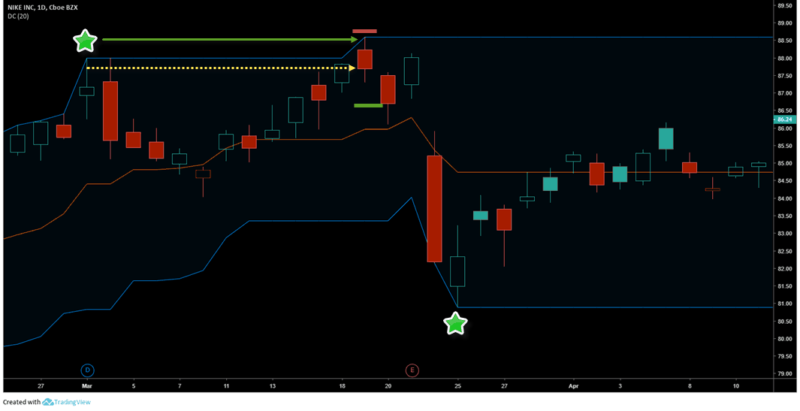

This is a chart of Nike and you can see how powerful this setup can be when looking at fading a new 20 day high in the face of earnings.

The first green star is the prior 20 day high and the green arrow shows where that high was broken.

The dotted yellow line is the trade entry price with happens to be the closing price of the new high. You’d have to have rules in place when the new high closes down on the day.

The solid green line is 1R scale out and after a one day retrace, the market gaps down on earnings. You would take these large moves as a gift and exit the trade.

The second green star shows a long that we would skip. The new low and the old low are separated by one day.

Forex Daily Chart

I would like to see the new highs show a breakout that was clearly rejected at resistance as opposed to marginal new highs.

Green star shows previous 20 day high and the green line shows the new high.

You already know where the entry would go as well as the stop loss.

The red momentum candlestick is one that would have me exiting all the position after a 143 pip drop in price.

Corn

This setup and trigger in corn shows that the large momentum moves that form a new low, do not mean that price will continue in that direction immediatley. Counting on the failure of price to continue is the Turtle Soup opportunity.

The green star is the former 20 day low and the momentum candle makes a new low. Buy stop 5-10 ticks off the low of the previous 20 day low leads to a small gain upside.

Can you spot the last 20 day low where the blue line steps down? Would that have been a trade you could have been in to take advantage of the current gap up in Corn prices?

This strategy is not just meant for daily charts and can be used on intra-day time frames as well.

Turtle Soup Intra-Day

If you are a day trader, there are a few ways you can trade Turtle Soup on lower time frames.

- You can monitor the daily 20 low or high and trade and mange on the lower time frame

- You can use the last 20 periods of your preferred trading time frame

This is the same chart of corn using the last 20 day low we saw on the daily chart. This chart, is the one hour chart.

The bottom white line is the last 20 day low which was made by the daily momentum red candle.

The yellow line is the entry price.

At the green star, price breaks the low of the last 20 day low. We would set at buy stop order at 357 and you can see price takes us long on the next candle.

The orange line is the highest price traveled after the entry which was a 4% gain in price. Using an intra-day chart would have a trader more active in the management part of the trade.

Turtle Soup Plus One

Most of the examples I gave actually use the Turtle Soup plus One strategy which means:

- Price makes a new 20 day low or high

- We place our order to be triggered on the next day and not the day of the break

With the Turtle Soup original method:

- Price makes the new 20 day high or low

- Once alerted to that event, you immediately place your stop order at the appropriate price which could trigger you intra-day

- This is not the approach you would use if you your prefer end of day trading strategies

The last example given in Corn is a detailed version of the original method. You do not have to use the lower time frame chart but many traders like to see price in greater detail.

With both methods, the stop order is good for that day only.

Conclusion

The Turtle Soup strategy takes advantage of breakout failures of 20 day high or lows using a stop order to enter the market.

You can enter the trade on the day of the break by setting your order to enter upon a new 20 day high or low being made

Traders who prefer end of day charts would note the new high and place an order to go long or short on the next day.

The stop orders are good for that day only.

Stop loss is set 1 tick above or below the recent candlestick.

This is a simple approach that is quick to scan for and traders may want to determine what type of new high or lows they want to see. Marginal breakouts may be ignored and a trader may want to see the new high or low close above (below) the previous high/low price.