- July 28, 2021

- Posted by: CoachMike

- Categories: Options Trading, Trading Article

Back on Monday we took a look at how to handle earnings on TSLA that were set to come out after the close. Being in the midst of a busy earnings cycle, it is important to have a plan of attack for how to handle these volatile reports.

Most options traders will focus on trying to correctly pick market direction.

Buying long calls or long puts in front of an earnings release is a popular approach by many retail traders who are looking for the large overnight returns.

But is that the best approach?

In our blog post on Monday, we broke down 3 different potential options trades that could be taken going into the TSLA earnings release.

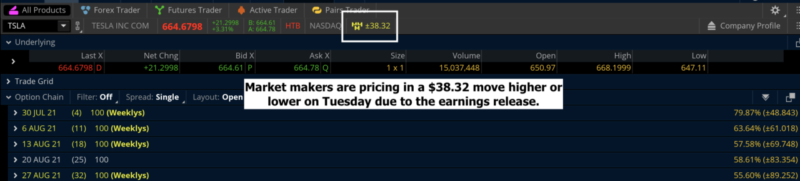

Let’s take a look at how each of them would have performed to see if there is a clear winner for best trade. Going into the earnings release, market makers were pricing in a $38 move higher or lower.

The stock ended up closing down just under $19 on the day. So the move ended up being smaller than expected on the downside.

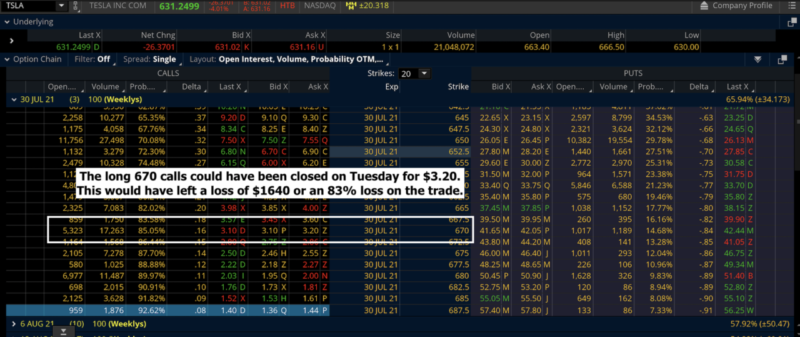

Trade Option #1:

- Buy the July 30 – 670 call option

- Bullish Trade

- Cost: $19.60 or $1960 per contract

- Max Risk: $1960

- Max Profit: Unlimited

Trade Option #1 from Monday was looking at buying the 670 calls in the July 30 options which expire at the end of the week. With this being an aggressive bullish trade, the stock closing down $19 would have hurt this position. As of mid day on Tuesday, these 670 calls were trading for $3.20. This would have resulted in a loss of $1640 or an 83% loss overnight.  We talked about how trading long calls and long puts into earnings can be dangerous. If you get on the wrong side of a directional move it can lead to large losses overnight. Trade Option #1 from Monday would have fallen into that camp.

We talked about how trading long calls and long puts into earnings can be dangerous. If you get on the wrong side of a directional move it can lead to large losses overnight. Trade Option #1 from Monday would have fallen into that camp.

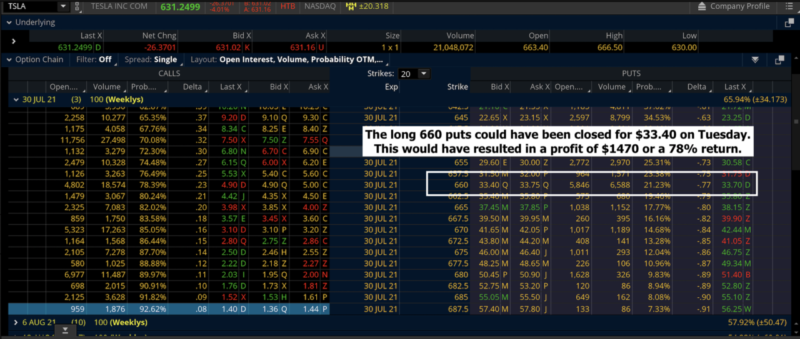

Trade Option #2:

- Buy the July 30 660 put option

- Bearish Trade

- Cost: $18.70 or $1870 per contract

- Max Risk: $1870

- Max Profit: Unlimited

Trade Option #2 on the other hand, would have benefited nicely from the selloff in the stock on Tuesday. The 660 puts which could have been purchased for $18.70 on Monday could have been closed for $33.40 mid day on Tuesday. This would have resulted in a $1470 profit of 78% return. This would have been a really nice trade overnight.  The problem with Trade Option #2 was the aggressiveness required to take the trade. As you can see from the outcomes of both the trades above, they were high risk/high reward trades. That is not necessarily a bad thing as long as you use small risk knowing that it is a 50/50 shot of making money.

The problem with Trade Option #2 was the aggressiveness required to take the trade. As you can see from the outcomes of both the trades above, they were high risk/high reward trades. That is not necessarily a bad thing as long as you use small risk knowing that it is a 50/50 shot of making money.

Trade Option #3:

- Sell the July 30 687.5/690 call spread. We are selling the 687.5 call and buying the 690 call at the same time.

- Neutral to bearish trade

- Trade Price: $.82 or $82 per spread

- Max Profit: $82 per spread

- Max Risk: $168 per spread

Trade Option #3 was my trade of choice as it allowed us to use smaller risk and take a trade that had a higher probability of success. We looked at selling the 687.5/690 call spread for $.82 or $82 per spread. This trade allowed us to take a bearish outlook but it only tied up $168 of capital at a minimum vs the over $1800 required to buy the long options.  The spread also stacked multiple factors in our favor. We ideally wanted the stock to move lower but we were also able to make money from the time decay adding up and from volatility decreasing.

The spread also stacked multiple factors in our favor. We ideally wanted the stock to move lower but we were also able to make money from the time decay adding up and from volatility decreasing.

The volatility did indeed decrease after earnings once the uncertainty was out of the way. As a result, the spread was able to be closed mid day for $.16 which would have given us $66 of profit per spread or a 39% return overnight.

While the % return was lower than the long put option, the spread gave us a much better chance of success on the trade. It was a better use of our capital and better allowed us to control the risk around earnings.

Which trade was best?

There was no right or wrong answer on Monday as to which trade was best. It all depended on how aggressive you wanted to be.

The long call or long put trades would have provided the biggest profit potential but also came with the most risk. They both only had one way of making money. The stock needed to make a big quick directional move in order for the trades to work.

The spread on the other hand tied up the least amount of capital and gave us 5 ways of making money on the trade. It did also come with the lowest profit potential. The spread ended up producing a 39% return on capital while the long put would have produced a 78% return.

Just looking at those % returns it seems the long puts would have been the best trade to take.

Keep in mind we have the benefit of hindsight as we know what the stock ended up doing on Tuesday.

In the moment on Monday before the earnings came out, we had to decide how much risk we wanted to take. I was most comfortable with the spread as it tied up the least amount of capital and gave the highest probability of success.

The key to trading options around earnings is to control the risk. Don’t select the best trade based off what potential profit it can produce. Instead, focus on how much risk you feel comfortable taking.

If you look at the numbers long term, the spreads will provide the most consistency over time. That is why they are our preferred trade when trading during earnings season.