- June 6, 2017

- Posted by: Mark S

- Category: Trading Article

Do you know what gets ignored when people write about trading? Living through a trading drawdown.

Traders understand that their account will ebb and flow (just like the price on the chart) but when their trading account starts to look like a bear market due to an extended drawdown period, things change.

What Is A Drawdown In Trading?

In simple terms, a drawdown is when your trading account starts to retrace after a period of losing trades.

In more direct terms, a drawdown in trading is a peak to trough decline measured over a certain period of time. This means that your trading drawdown can happen during a single day of trading or over the course of weeks or months.

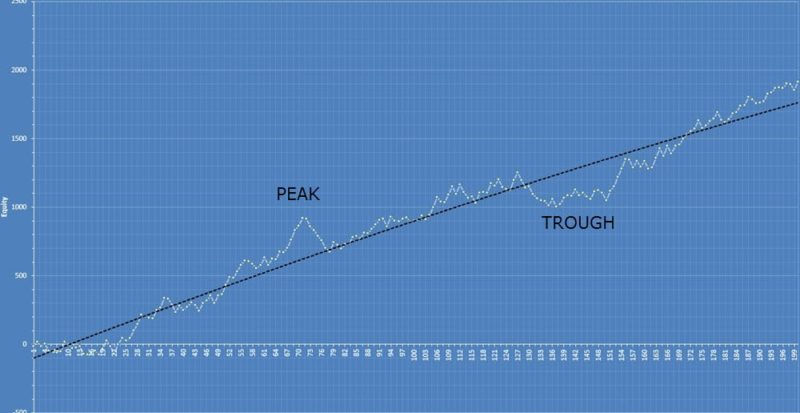

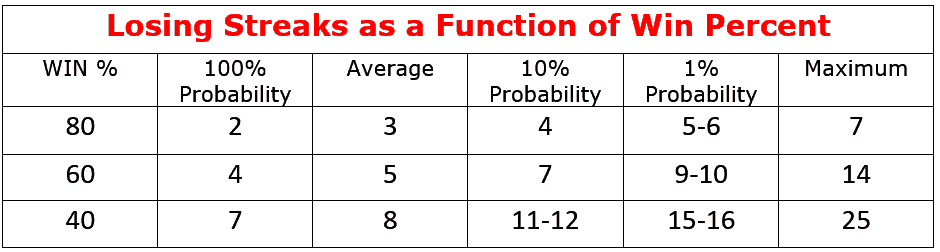

While we would all love an equity curve that continues to make all time highs, that is not the case. Here is an example of what a more realistic equity curve looks like:

When I talk about drawdowns, I am referring to the ones that will plague you your entire trading career.

On the flip side of that is the MAX drawdown you can expect from your trading system.

Maximum drawdown is what you determined the greatest peak to trough differential is that can occur before making a new peak. This is information you should have calculated when you did your strategy back testing.

In doing a proper back test of your trading strategy, you will learn the optimal risk per trade you should be using to sustain your trading account during the pullback in your equity curve.

You Will Live In Drawdown

Just like a price chart does not simply go straight up, you will be spending a lot of time in trading account drawdown. If you think it is a rare event, just look at the chart above. About 70% of that chart is below peak!

Do you think you could live through that?

Look around trade number 127. After that peak, your trading account was in drawdown for 30 trades before reaching a new high. By that time, many traders would abandon their trading strategy and look for something “better”.

That equity curve chart highlights the importance of money management. If you do not control your risk and position size taking into account drawdown reality, you will get wiped out when they come.

Still think you won’t suffer drawdown that can affect your decision making process?

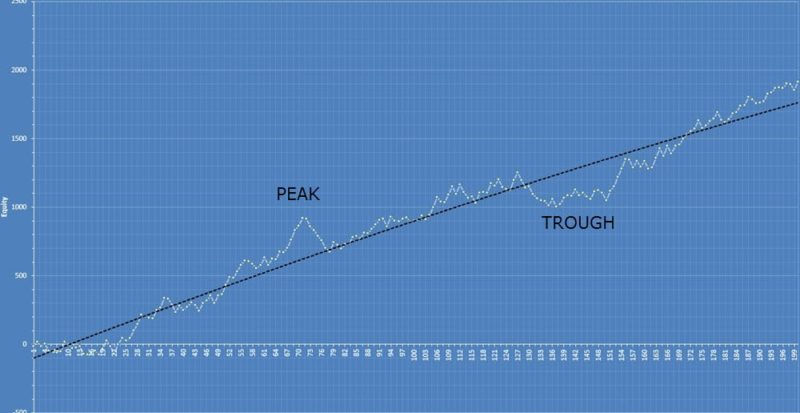

When I first saw these numbers, it hit home that risk is vital to not only limit the extent of a drawdown but also to keeping my trading account in respectable shape.

So How Do You Live Through That?

You have taken losing trades in the past and have no doubt seen down ticks in your trading account. A short lived drawdown is manageable as you keep working your trading plan.

But there will the those that test your resolve as you take loss after loss and the equity curve peak is a distant memory.

The question is what can you do to live through this potentially painful reality of trading?

Know The Drawdown Numbers of Every System You Trade

Your ability to handle drawdowns is dependent completely upon how mentally prepared you are for them. This means it’s crucial you know your system’s past Max Drawdown as well as you know your own birthday.

You should expect to visit a drawdown of equivalent size once a year then, an even bigger one sometime in the future – we’ll talk about this later.

If you’re trading, and consider yourself a trader, you need to be very aware of what will happen to your account during that drawdown. If you do, you will be mentally prepared and have the intestinal fortitude to stick with the program through these tough times.

If you’re not prepared mentally for the drawdown, you will make emotionally driven decisions at the worst possible time in the worst possible place. These emotional decisions lead to that trait all bad traders share – getting out at the lows.

How many of us have done that?

One of the main benefits of trading with an algorithm is to eliminate those counterproductive emotional decisions. Please don’t offset that advantage by acting emotionally when in DD.

Measure Your Drawdown

Don’t we all look at the drawdown stats from the evaluator sheets and say, ya I can live with that?

Then we see those drawdowns in OUR account we react like deer in the headlights and say, “What is happening? I didn’t expect this.”

It’s completely unreasonable to expect a trading system to make money each and every day of each and every month. Things simply don’t go UP, nor DOWN, forever. They peak and valley, go through up cycles and down cycles.

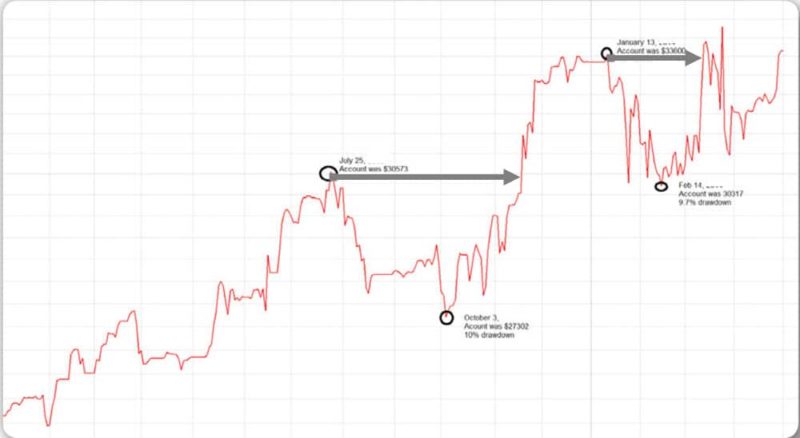

Here’s another equity curve example. This system has a MAX Drawdown of 21%.

If you started trading this system with $25,000 on January 30, by July 25, your account grew to $30,573. It was a pretty good steady growth with a few drawdowns thrown in.

Anyone trading this would be sitting back on July 25th feeling pretty darn good because the portfolio grew 22% in just a few short months.

How prepared do you think you were for the next few months?

A new equity high was not seen until November 18th. As well, on October 3rd the account had fallen 10%. Do you think you would’ve bailed around October 4th?

Good chance!

By January 13th the account was back up to $33,600 and you are now kicking yourself. But, hold on, another drawdown is just about to start. However, this one was on 9.7% and a new equity high was seen by March.

MAX drawdown was 21% and the drawdowns experienced so far have been 10% and 9.7% both completely in the realm of possibility.

You’ve looked at the equity curve of the system and know this kind of up and down is very typical. So measure each of your drawdowns and use the MAX drawdown to see if the one you’re currently in, is in the realm of possibilities.

But most importantly, don’t be dejected by a drawdown, especially if it is well within the historical parameters you’ve evaluated. I believe this simple exercise will get you used to what a drawdown is and will help you to live through them, since most of your time will be spent in them.

Assume The Worst Drawdown Hasn’t Happened Yet

The only way you will never encounter a drawdown is by never trading. So if you want to trade you need to accept drawdowns but more than that you also need to expect a new max DD will always take place in the future.

If you approach your trading accepting DD and have an expectation of a new MAX DD somewhere in the future, you’ll never be a nervous wreck who can’t think straight when it happens.

You will take it in stride, step back, and asses the system rationally.

Accept There Is No Free Lunch

Understand that the larger the returns, the larger the risk. The larger the returns, the more volatility in your equity curve. You can easily get no risk by investing in US saving bonds, but will you be happy with gains of just 2% per year.

Probably not, and for that reason traders are on the lookout for larger returns.

But how many are prepared for the higher risk and volatility that accompanies that higher return?

Our natural tendency is to stop that which is causing us pain (losses), and so a human’s natural inclination is to quit a system when it’s in a drawdown because it “just doesn’t feel right.” You have to overcome this basic human instinct by making it all about the statistics and being prepared.

Set a realistic line in the sand, a line based on your tolerance for losses and the stats of your trading system. If you do this BEFORE you start trading and make a pact with yourself to not flinch until that line is crossed, your daily mental battle of whether you should stick with the program or dump it, has been won.

You’ll have what very few traders have, intestinal fortitude.

Part of the problem with trading with any trading strategy is that it’s too easy to quit. All you do is stop trading.

An investment in real estate or a hedge fund for example, often takes more time to liquidate, giving traders time to let the emotion run its course and evaluate from a place of rationality.

It is important to note the corollary to things don’t go UP forever: things don’t go DOWN forever either. Trading systems are very cyclical, they make money, then they lose money, then they make money etc. It pays to stick with a system in its downturn, because their cyclical nature means they will come out of it.

Quit Once Strategy Has Fallen Below Circuit Breaker

We;ve covered a lot of information:

- You know your drawdown numbers

- you measure your drawdowns

- you’ve accepted drawdowns, and

- you expect to have another large drawdown in the future.

But there is one more very important question to answer.

What if the drawdown I’m in is more than a drawdown and the system is just not working in this market environment?

You need to have a mechanism to help you answer this question.

You need to have a mechanism to know when to move to cash. You need to have a line in the sand.

One simple way to measure your drawdown is using a moving average on the equity curve that tells you to stop once its violated. Without this line, you could go crazy wondering whether the current drawdown equates to a “broken system.”