- December 6, 2014

- Posted by: Shane Daly

- Category: Trading Article

This week, a trader asked me a question about a particular trading session. The question pretty much centered on whether the trader had made enough money that day and whether they had missed any opportunities. My immediate thought was that this was an issue with daily profit targets.

The trouble with daily profit targets

Having a loose daily profit target is great in that it gives you something to shoot for. But the trouble is, the markets are the markets and they’ll do whatever they want to. One day they’ll move in a very favorable manner for your strategy and other days it’ll be tough to make any money at all.

Daily profit targets can get you into the habit of being in a “I must trade every single session and make $x” mind set. This can make you press too hard when trading isn’t great and get you to step off the gas when you reach your profit target even though the markets are actually trading really well.

Missed trading opportunities

The other point the trader made was that perhaps there were a couple of trades that should have been taken. There are two points to consider in this regard. The first is that you aren’t likely to be able to catch every single trade that occurs. Clearly if you are missing a significant number then it becomes a problem, but missing the odd trade here and there is just not something that you’re going to be able to avoid.

The second point is that you might not take trades where market conditions are such that the trades that do occur are borderline. If you step back from the market when there is good reason to do so, then there will always be trades you don’t take that still turn out to be winners.

Recognize days of opportunity and days of chop

So how do you tell when you should press the gas pedal and when you should probably step back from poor market conditions?

To begin with and this almost goes without saying, you should know exactly what your trades look like, where they tend to occur and what conditions give them the best chance of success. If your strategy does particularly well when a market trends but performs poorly in ranging conditions, you need to consider this a factor in how you trade.

Once you know what favorable the market conditions look like, you need to anticipate possible conditions before the trading session begins. So if you’re looking for a trend or even just a move, you need to consider where the market is in relation to recent sessions (i.e. is it going to open within recent activity or is likely to be trading at new prices) and whether there’s anything such as news that’s driving the market (or if upcoming economic data is likely to hold movement back before the release).

Know When You’ve Got Away From a Poor Trading Session

The email went on to say that “taking trades blindly today would have led to several losses”. This is the nature of trading – have the sense to assess market conditions in deciding whether or not to take a trade, but also the confidence to take trades when they meet your criteria.

Unfortunately, there are days where there’s likely to be a less than optimal trading environment – but fortunately, it’s not too much of a stretch to anticipate this sort of thing. The particular day in question was the Wednesday before very important BoE (UK interest rate decision), ECB (European rate decision) on Thursday and NFP (US jobs data) on Friday.

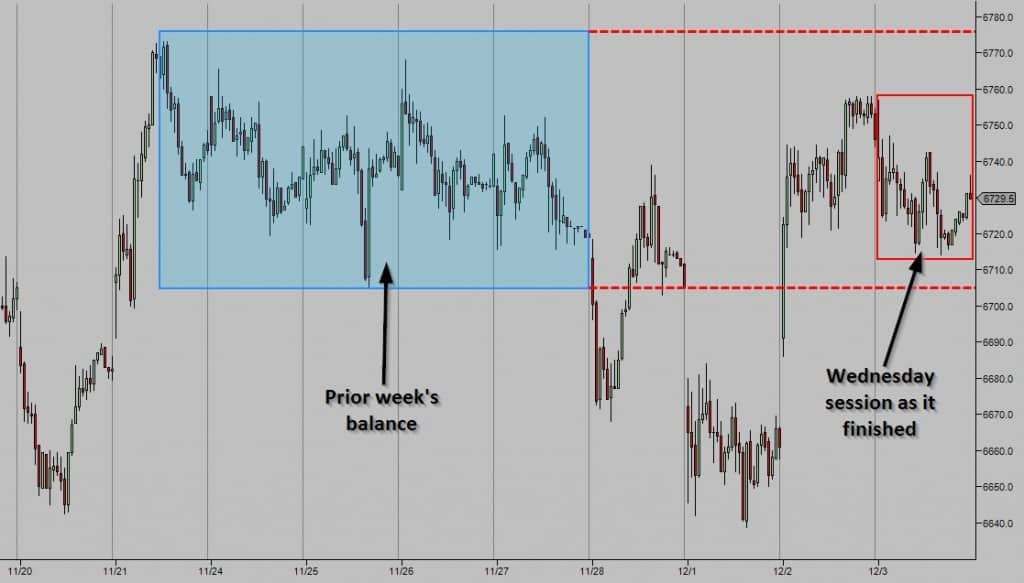

The key idea to note here was that the action had been sideways leading up to the Wednesday before the first of the set of key data. In fact, it had dipped lower and re-entered a strong sideways balance from the prior week. So it’s unlikely that the big guns would want to heavily commit prior to the releases and therefore the upcoming session would probably not be very directional – especially if the market couldn’t escape this balance.

Daily profit targets

Having a daily profit target to have something to shoot for and know what your relative performance has been is a good thing. However, it’s crucial to your trading success that you avoid the “I must trade every single session and make $x” mind set. No one trading session is exactly the same and conditions can vary considerably. So spend a little time each day before the session starts, on assessing what the conditions are likely to be.