- January 17, 2015

- Posted by: Shane Daly

- Category: Trading Article

A key aspect of any auction is whether a market is currently balanced or imbalanced.

Is it moving sideways and testing recent prices over and over again or is it trending directionally and exploring new prices?

Whatever a market is doing, if it’s identified swiftly a change in its behavior from one type of phase to another can provide a potential opportunity for a trader to make some money.

Profiting from market balance breakouts is one side of this equation.

Time Frames

Think of the old trading adage “the trend is your friend”. The implication of this is that if you trade in the direction of the trend you are likely to make money. However, a stumbling block that traders often face is that they don’t address what a trend should look like. This means time frame and market structure.

The time frame you are looking for particular structure in is crucial in the sense that you are ideally looking to profit from the intensity of activity of participants trading in a higher time frame than yourself.

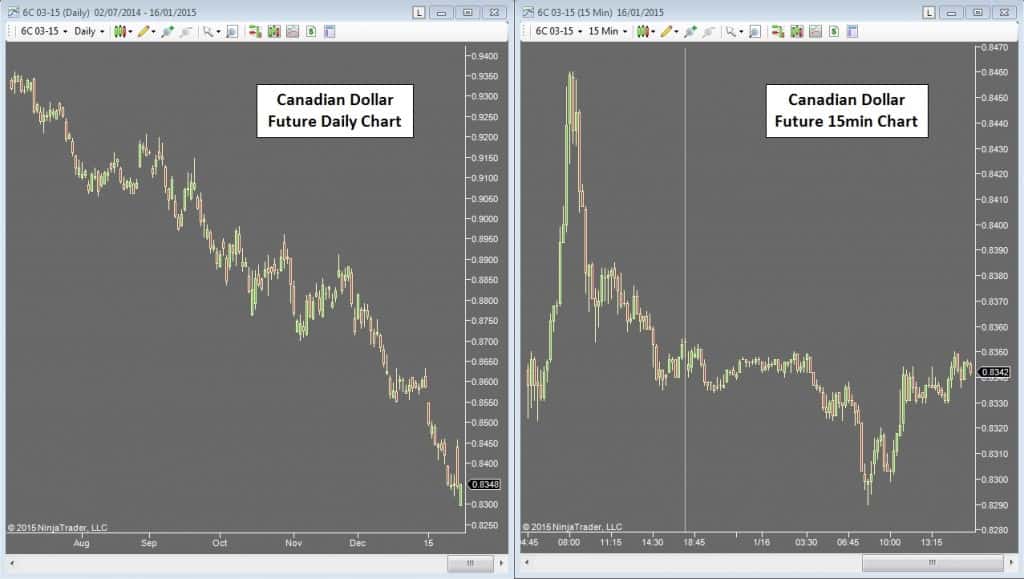

In effect, you are trying to ride the directional wave of bigger players by looking to time your entries on a higher time frame, but still taking the actual setups on your own time frame. So for example, you might look for a pullback in a trend on a daily chart as a condition to permit you to take a trade in that direction when a setup occurs on a 15 min chart.

Balance structures

The other aspect that traders often forget or struggle with is market structure. In terms of a trend, you can clearly see that in the last example of Canadian Dollar Futures, it’s pretty obvious that there’s a strong downtrend. But it’s not always so simple and this is where traders go looking for opportunities – unfortunately, this usually means they find structure and patterns that aren’t particularly strong and therefore are low probability.

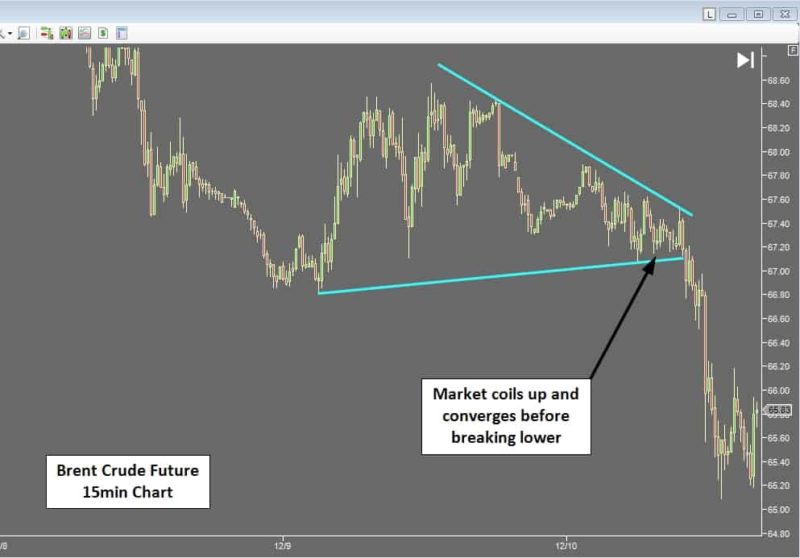

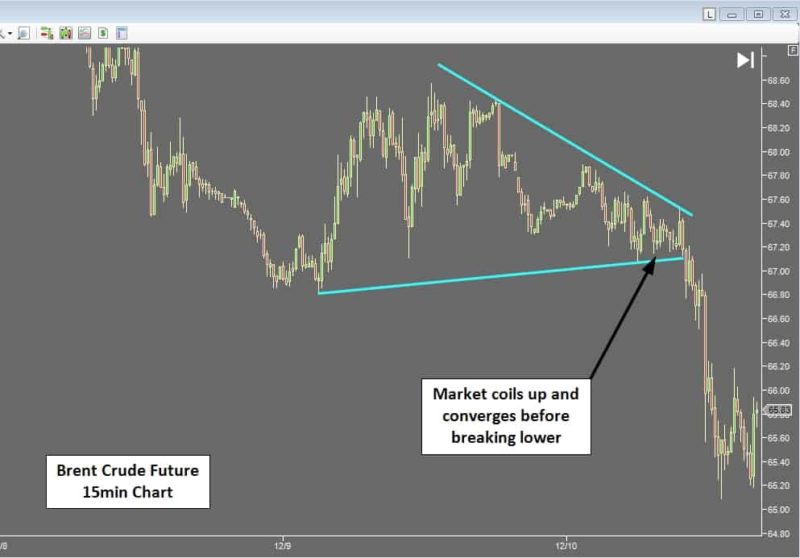

The best balanced market structures are those that converge on price and time. What I mean here by converging on price is that the balance tends to get tighter and tighter as the market continues in the range and forms something akin to a triangle.

Admittedly, the way a market balances can vary quite a bit and won’t always be as easy to see as this example (although it can be easier too). So to figure out whether a balance is good or not, it’s also useful to identify any big market moving events that are due (converging on time) and track volume participation at the extremes.

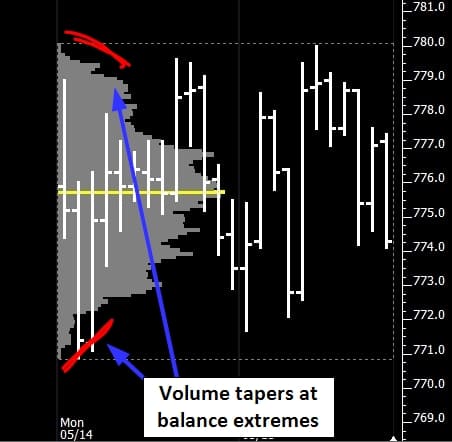

Markets tend to stay relatively balanced when there is highly anticipated news due out as bigger players stay somewhat on the sidelines, preferring to wait to commit their trading capital until after the news is out of the way. If a market is genuinely balanced, the volumes trading near extremes are likely to drop – this however is best seen in the form of a volume profile rather than adding a simple volume per bar indicator.

Breaks vs. extensions

A market balance can do one of two things when it breaches a current extreme price level – it can generate additional activity in that direction or it can fail to follow through and reverse into previous prices.

Whether a market breaks or not tends to be a function of whether the things that make it a balance in the first place remain constant. Has the news that the market has been waiting for just been released? Has the balance had enough time to develop and build up energy that needs to be released in the form of a directional move? Has volume significantly increased at the extremes?

An additional feature of some types of break is that strong directional volume (volume delta) starts to appear from the center of the balance area and continues strongly as an extreme is taken out.

Profiting from Market Balance Breakouts

Once you have an idea of what a decent market balance should look like, it’s really down to you to figure out how best to apply your current strategy in order to profit from the opportunities that present themselves.

A breakout can lead to a nice directional move that is at least going to be highly likely to be profitable on your particular time frame. A failed breakout or an extension of the balance range could provide a great chance to take a trade with a view to the market taking back a significant portion of the range. If you don’t already do this, I urge you to start to try to identify market balances and see just how successful your strategy can be when combined with a market balance breakout.