- April 4, 2020

- Posted by: CoachMike

- Categories: Options Trading, Swing Trading, Trading Article

I have heard all of these statements repeated during my nearly 20 years of trading options and markets in general:

- “Let your winners run, cut your losses quickly.”

- “Keep your losses small”

- “You have to use stop orders”

Traders get so concerned with getting the stop orders in place to limit the losses that they don’t always do so in the right way. In fact, in many cases in an attempt to limit the losses traders can actually cause more damage.

I’m not saying you shouldn’t try and limit the damage on a losing trade.

However, there is a right and wrong way of doing so.

We will take a look at an example of how using a stop order incorrectly can take you out of a trade too early and then also walk through 2 ways that I use in my own personal options trading to protect against large losses.

Why Stop Orders Are A “No Go” With Options For Us

We will use Tesla (Symbol: TSLA) as our example.

- We currently have a bearish position on TSLA with a debit put spread.

- We are long the 480/470 put spread using the April 24 weekly options.

- We opened the trade for $4.78 or $478 per spread.

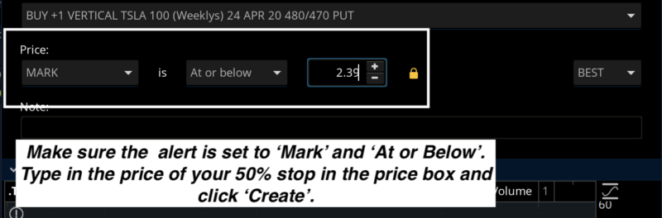

When using long options, we like to use a 50% stop in order to take a partial loss on a trade that goes against us. In the case of the TSLA spread, that would put the stop order in at $2.39.

You could place an actual stop order in place at $2.39 to take the trade off for a 50% loss.

Here is the problem with that approach.

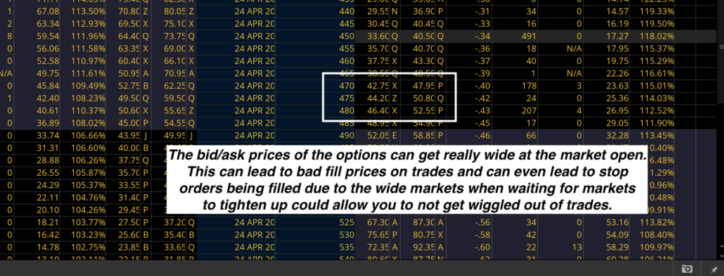

With markets so volatile at the moment the bid/ask prices of the options can get really wide, especially during the first 30 and last 30 minutes of the trading session. This can lead to option orders getting filled at bad prices.

If you look at the prices of the TSLA options below at the open you can see how wide the bid/ask spreads can be. You can see $5-$6 wide bid/ask spreads. These bid/ask prices will typically tighten up as you get later into the session.

However, the wide markets at the open can cause stop orders to be filled and your trades taken off. When in reality, markets could tighten up 10 min later and lead to the position being right back into a small profit.

This is why we don’t like to place actual stop orders on options trades.

How To Properly Protect An Options Trade

Instead to using actual working stop orders on a trade, we like to take 2 different approaches to manage our options trades:

- Using Price Alerts

- Position Size

To be transparent, you should know we like to use mental stops.

I mentioned earlier we like to use 50% stops on our options trades. However, instead of placing an actual stop order I like to place alerts on my positions. In the Thinkorswim platform, which I use for my charting, I can place an alert to notify me when the TSLA put spread is trading for $2.39 or below.

This way when I get the alert I can go in and manually place my order. This allows me to work my order to make sure I get a good fill price.

Taking this approach allows me to still respect my 50% stop, while making sure I get a good price instead of running the risk of getting taken out due to wide markets at the open/close of the trading day.

You can also have these alerts sent to an email address or mobile device as a text message. This way I’m able to manage a trade at any point during the day anywhere I have cell phone or internet service.

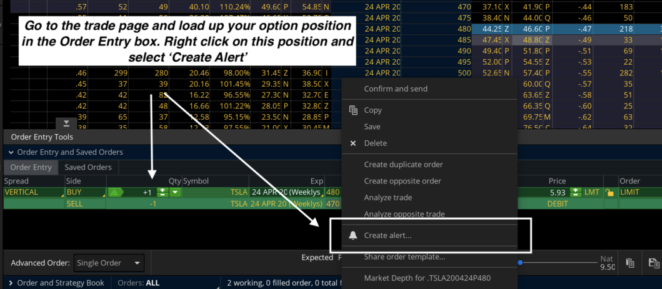

To place an alert on an options position in Thinkorswim, you can follow these steps:

- Go to the trade page and load up your position in the Order Entry box at the bottom.

- Right click on the position and select ‘Create Alert’.

3. In the box that pops up you can change the price box to ‘Mark’ and then set it to alert you if the price is ‘At or below’. Finally in the price box make sure you put in the 50% stop price that you want to use.

4. Click ‘Create’.

Position Size

The second option that is absolutely crucial to keep in mind when trading options is position size. I like to manage my trades at order entry. What this means is I use position sizing that allows me to take a full loss and not wipe out an account. We don’t want to take the full losses but I also want to be prepared if a big market move happens against me.

Trading small size allows me to take a larger number of positions while still keeping my desired risk levels. I’m never in a position where the outcome of one trade will impact whether I can take another trade.

Don’t Look for Home Run Trades

Don’t fall into the trap of taking one or two big trades hoping for a home run trade that could change the ballgame for you. Keep your position sizes small and spread your capital into many different areas. The small size on your options trades will allow you to get the diversification that you need and will also allow you to avoid taking the large losses on one or two big trades.

Using price alerts and proper positions sizing are much better ways of protecting against big losses over using actual stop orders. You can still protect your account size but do so without getting burned by bad fill prices due to wide markets.