- September 25, 2023

- Posted by: Shane Daly

- Categories: Trading Article, Trading Indicators

Moving averages are a popular trading tool that can be combined with envelopes for better results. Envelopes help avoid false signals in choppy markets and can be used to filter out whipsaw trades. The main drawback is they may delay entry on winning trades and give back more profits on losing trades.

Moving average envelopes are widely used by technical analysts as a trading tool. Similar to moving averages, these envelopes are designed to smooth data and identify price trends. By adding a margin above and below the moving average line, envelopes help filter out false signals and provide clearer trading opportunities.

This article aims to provide a comprehensive overview of moving average envelopes, emphasizing their significance in market analysis and the prevention of false signals. We will also cover the drawbacks and challenges associated with the use of envelopes and introduces advanced techniques for trend identification.

It is important to note that investing in financial markets involves risks, and traders should carefully consider their risk tolerance and financial circumstances before utilizing moving average envelopes.

Moving Average Envelopes Overview

Moving average envelopes are a popular trading tool that can be used to identify price trends and help avoid false signals in choppy markets, making them favored by technical analysts.

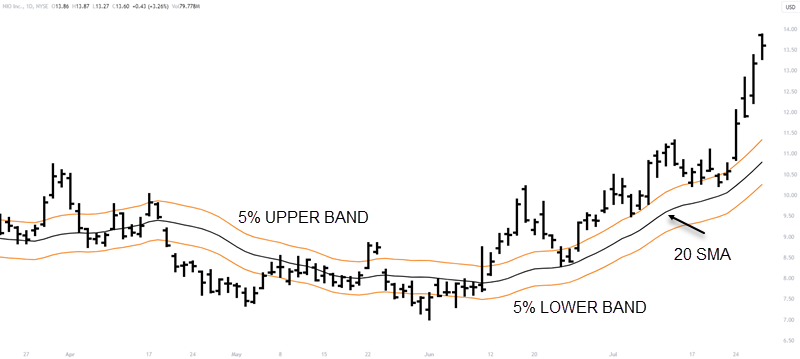

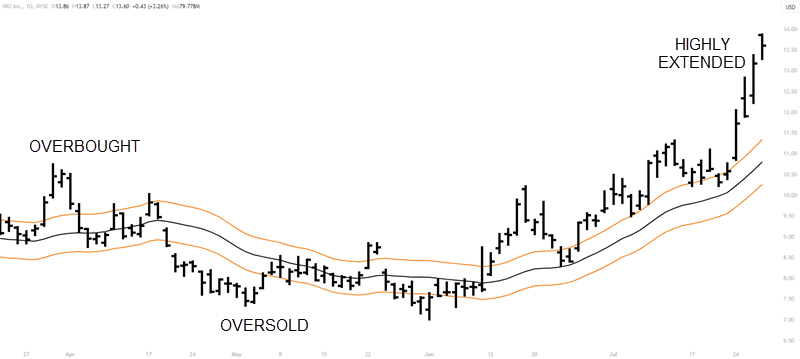

These envelopes are essentially lines plotted at a certain percentage above and below a moving average. They help traders visually identify potential buying and selling signals.

When price moves above the upper envelope, it may indicate an overbought condition and a potential sell signal. Conversely, when price moves below the lower envelope, it may indicate an oversold condition and a potential buy signal. You DO NOT just make a trade based on those conditions. You need a setup of some type.

By using moving average envelopes, traders can filter out noise and focus on significant price moves, enhancing their overall trading strategy.

These envelopes are powerful technical analysis tools that can provide valuable insights into market trends and price movements.

Understanding Market Analysis

An interesting statistic reveals that 70% of investors who incorporate market analysis into their trading strategies have reported higher returns on their investments compared to those who do not utilize this analytical approach.

Understanding market analysis is crucial for successful trading strategies.

Moving average envelopes provide a way to confirm trends and avoid false signals in choppy markets. By smoothing data and identifying price trends, moving average envelopes help traders make buy or sell decisions based on trend confirmation.

This analytical approach can improve trading strategies and increase the probability of successful trades.

Significance of Moving Averages

The significance of using moving averages lies in their ability to smooth data and identify price trends. When prices close above the moving average, it signals a buy opportunity, while falling below the moving average indicates a sell signal. Consider the presence of choppy price action when price is contained within the bands.

However, there are drawbacks to using envelopes, such as whipsaw trades and delayed entry on winning trades. Nevertheless, by experimenting with wider envelopes and other variations like Keltner bands and Bollinger Bands, traders can enhance their analysis and make more informed decisions.

However, there are drawbacks to using envelopes, such as whipsaw trades and delayed entry on winning trades. Nevertheless, by experimenting with wider envelopes and other variations like Keltner bands and Bollinger Bands, traders can enhance their analysis and make more informed decisions.

Drawbacks and Challenges

Despite their potential benefits in filtering out false signals and improving trading strategies, moving average envelopes also come with several drawbacks and challenges.

- Delayed entry on winning trades: Envelopes add a lag to entry signals, which means traders may miss out on potential profits if they wait for confirmation from the envelopes before entering a trade.

- Greater profit loss on losing trades: Envelopes can give back a larger portion of profits on losing trades due to their wider range. This can result in larger losses if the trade goes against the trader’s position.

- Whipsaw trades: Moving averages can generate whipsaw trades, where the price moves back and forth across the moving average, resulting in multiple false signals. Envelopes can help filter out some of these false signals, but they are not foolproof.

- Discipline required: Envelope indicator strategies require discipline to stick with the system and not deviate from the trading plan. This can be challenging for traders who may be tempted to make impulsive decisions based on short-term market fluctuations.

While moving average envelopes can be useful in improving trading strategies, traders should be aware of these drawbacks and challenges and carefully consider their suitability for their individual trading style and risk tolerance.

Enhancing Envelope Effectiveness

One approach is to consider additional technical analysis indicators that can provide insights into trend direction and generate more accurate trading signals. For example, traders can incorporate the RSI or MACD to confirm trend reversals and filter out false signals.

Combining moving average envelopes with other indicators, such as Keltner bands or Bollinger Bands, can offer more precise tools for identifying turning points in the market.

Experimenting with these strategies can help traders enhance the effectiveness of moving average envelopes and improve trading decisions. It is important, however, to consider individual risk tolerance and financial circumstances before using these tools, as investing involves risk.

Trend Identification Techniques

These techniques are particularly useful for traders who rely on moving average envelopes as a means of trend identification.

Envelope Slope

Envelope Slope

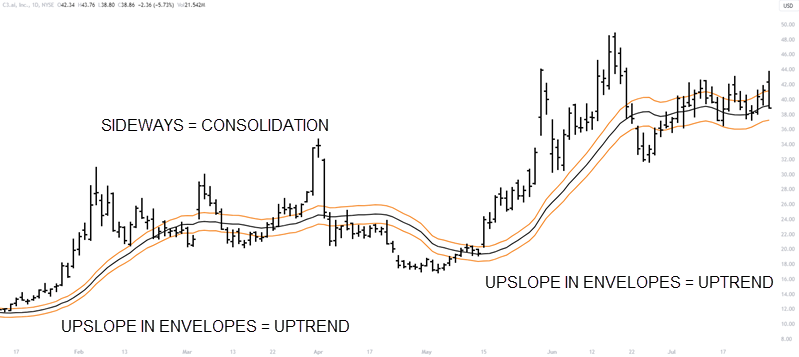

When the envelope is trending upwards, consider a bullish trend is in play. Sideways envelopes would be a consolidation while down sloping lines equals bearish trend.

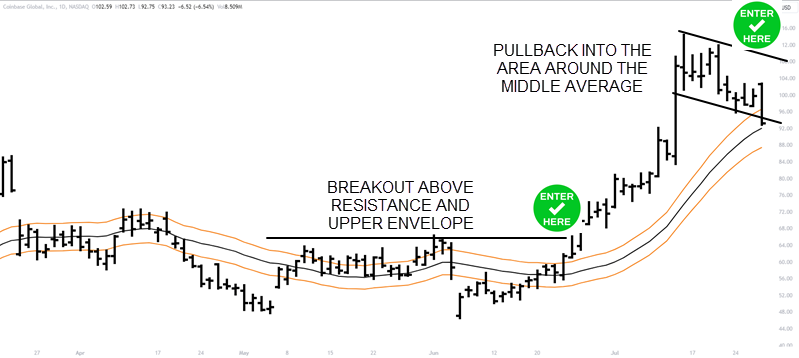

Upper Envelope Breakouts

Traders can also use the upper envelope as a trend identification tool. When prices break above the upper envelope, it suggests a potential uptrend. This breakout can serve as a signal for traders to enter a long position and take advantage of the upward price movement.

Periodic Analysis

Traders can analyze the periods in which the market exhibits consistent trends. By identifying these periods, traders can focus their efforts on trading during these times and avoid choppy markets with unclear trends. This approach allows traders to maximize their profitability by capitalizing on the most favorable market conditions.

Advanced Techniques

Moving average envelopes, as discussed in the previous subtopic on trend identification techniques, are a popular tool used by traders to identify trends in the market. However, they have certain drawbacks, such as whipsaw trades and delayed entry on winning trades.

In order to overcome these limitations and increase the profitability of trades, advanced techniques can be used.

One such technique is to incorporate trading discipline when using moving average envelopes. This involves adhering strictly to the trading system and not deviating from the predetermined rules. By maintaining discipline, traders can avoid impulsive decisions that may lead to losses.

Consider this example where price breaks above the upper envelope. A trader could wait until price returns to the middle line and look for a reversal or trade a breakout.

Additionally, advanced techniques include using narrower or wider envelopes to identify short-term trend reversals and countertrend trading. Keltner bands and Bollinger Bands® are examples of tools developed specifically for this purpose.

Additionally, advanced techniques include using narrower or wider envelopes to identify short-term trend reversals and countertrend trading. Keltner bands and Bollinger Bands® are examples of tools developed specifically for this purpose.

By incorporating these advanced techniques and maintaining trading discipline, traders can enhance the effectiveness of moving average envelopes and increase the likelihood of identifying profitable trades.

Trade Risks

Trade risks should be carefully evaluated and understood by traders in order to mitigate potential losses. When it comes to utilizing moving average envelopes as a trading indicator, there are certain risks that traders should be aware of.

These risks include false signals leading to whipsaw trades, delayed entry on winning trades, and potentially giving back more profits on losing trades (depending on trade management rules). Discipline is required to stick with the system and avoid impulsive decisions.

It is important to note that moving average envelopes are just one tool among many and should be used in conjunction with other indicators for better results. Traders should consider their risk tolerance and financial circumstances before incorporating moving average envelopes into their trading strategies.

| Risk | Description | How to address it |

|---|---|---|

| False signals | Moving average envelopes can generate false signals, leading to potentially unprofitable trades. | Combine moving average envelopes with other indicators to confirm signals and reduce false signals. |

| Delayed entry | Moving average envelopes may result in delayed entry on winning trades. | Use other indicators or techniques to confirm the trend and avoid missing out on profitable opportunities. |

| Giving back profits | Moving average envelopes can lead to giving back more profits on losing trades. | Implement proper risk management techniques, such as setting stop-loss orders, to limit potential losses. |

Final Takeaways

Incorporating moving average envelopes into a trading strategy can provide traders with additional tools to identify trends and potential turning points in the market, ultimately enhancing their overall trading performance. Moving average envelopes, when combined with moving averages, help traders filter out false signals and avoid whipsaw trades. They can also help identify trend changes and short-term trend reversals.

The use of Keltner bands and Bollinger Bands can provide more precise signals for traders. It is important to note that these tools are not foolproof and require discipline and risk management. Traders should consider their risk tolerance and financial circumstances before using moving average envelopes or any other trading tool.

Remember that trading involves risk, including the possible loss of your entire account.

Frequently Asked Questions

How can the moving average envelope be effectively utilized?

The moving average envelope is used to create bands around a moving average, aiding in identifying potential trend reversals or overbought/oversold conditions in the market.

What sets moving average and moving average envelope apart from each other?

Moving average calculates the average price over a specific period, while the moving average envelope plots bands around the moving average, indicating potential price boundaries.

In what ways do Bollinger bands differ from Moving Average Envelopes?

Bollinger bands use standard deviations to plot bands around a moving average, while Moving Average Envelopes use a fixed percentage.

Could you explain the strategy behind using the envelope indicator?

The envelope indicator strategy involves tracking price movements within the envelope bands, considering potential breakouts or trend shifts.

Is the envelope indicator considered reliable for trading decisions?

The envelope indicator’s effectiveness depends on market conditions and should be used in conjunction with other indicators for better decision-making.

What are the distinctions between the Keltner channel and the moving average envelope?

Keltner channel uses Average True Range for its bands, while the moving average envelope simply applies a fixed percentage around the moving average.

Conclusion

Moving average envelopes are a powerful trading tool that can help traders profit from trading the markets. By combining the smoothing effect of moving averages with the filtering capabilities of envelopes, traders can identify potential buy and sell signals.

Consider the risks involved in trading and to tailor the use of envelopes to individual risk tolerance and financial circumstances. Like any tool, moving average envelopes have their limitations and challenges, but when used in conjunction with other trend identification techniques, they can provide valuable insights into market trends and short-term reversals.

The decision to use moving average envelopes should be based on an understanding of market analysis and a careful assessment of one’s investment goals and risk appetite.