- September 3, 2020

- Posted by: Shane Daly

- Categories: Trading Article, Trading Indicators

Bollinger Bands are a popular technical indicator that was introduced to the trading world by John Bollinger in 1983.

The visual nature of the Bollinger Bands, as with all price channels like the Keltner channel, makes it easy for a trader to see if price has extended far from the average security price. This tells a trader if the instrument is priced too high or too low from an average price and a reversal (pullback in price) could be setting up.

- John Bollinger was clear that the bands were not a trading system by themselves giving out buy and sell trading signals.

- It is not as simple as buying or selling when price tags the bands

- Can give the trader valuable information to assist them in trading decisions.

Learning how to trade with the Bollinger Bands is straightforward but the actual buy and sell signals traders are looking for, have to come from an add-on approach.

What Are Bollinger Bands

Bollinger Bands are a volatility channel technical analysis tool that plots a middle line between an upper and lower line that plot X standard deviations from an average price (middle line).

They consist of 1 middle line and 2 outer bands.

- The upper Bollinger band is set 2 standard deviations away from the center line. A touch of the high is considered a high price an possibly overbought

- The center line, the middle band, is a simple moving average with default setting of 20 days, and is understood to represent the intermediate trend of the instrument

- Bottom line of the band is also set 2 standard deviations (default) from the centre line. A low price is considered when interacting in this zone and is considered oversold

The upper and lower bands will also contract and expand depending on the volatility of prices.

- Narrow bands indicate a security that is experiencing low volatility and probably a weak trend

- Wide or widening bands will show that volatility increases is occurring and a strong trend is forming

Note that the touches of the upper band is not a sell signal and a lower band touch is not a buy signal. The information is only telling that the market condition is price either high or low in relation to an average price. It is not predicting a price reversal but shows the current market condition.

How To Use The Bollinger Band Indicator

There are several ways you can use the bands as part of a trading strategy including pattern recognition of triangles and other patterns plus other indicators.

Here are a few strategies you can consider adding to your current routine.

Bollinger Band Squeeze – Price Compression

Markets trend and markets will form a trading range and from these price ranges, we can get big moves as price begins to breakout from the compression and volatility increases.

The “squeeze”, not the Bollinger Band Keltner Channel squeeze, indicates that volatility is not present in the market. We are looking for signs that volatility may be on the horizon.

We can see the the Bollinger Bands compressed together in this chart of Bitcoin. Trading the Bollinger Band squeeze can be as simple as:

- Look for the BB squeeze to occur that shows low volatility

- Mark off the support and resistance levels of the forming range

- Using price action and structure to look for the probability of a break in a particular direction and your entry point.

On this chart, we see that price before the breakout is settling in the bottom third of the range. The fact that price is unable to trade higher than it did on the left side of the range, tilts the edge to the downside.

Trading High Or Low Bollinger Band Tags

The 20 period simple moving average shows the intermediate trend and a strategy that can be used to trade these tags, are counter trend trades. Specifically, we would look for signs that indicate a mean reversion trade is a high probability trade.

To do so, we can use the double top or bottom formations and are called M or W patterns. I would add to these structures actual price action instead of blindly shorting or buying on the pattern alone. Using an example of Wheat futures, we can see at 1 and 2 price has put in a double top pattern. You could trade these blindly and get many false signals or we can add a simple failure test to aid us in a better entry.

Using an example of Wheat futures, we can see at 1 and 2 price has put in a double top pattern. You could trade these blindly and get many false signals or we can add a simple failure test to aid us in a better entry.

You can see at #2 that the candlestick has poked above the BB as well as the high at #1. We can see how price rejected at #1 which indicates sellers in the market.

Where do most traders put their stop loss on shorts? Right above resistance.

Price pokes above the resistance, clears out stop and your entry can be at the close or use a sell stop below the candle that cleared the highs.

You can reverse this pattern into the “W” pattern and reverse the trading steps.

Walking The Bollinger Bands – Price Stays High or Low

An example of strength or weakness that traders should take note of is when price hugs the upper or lower band in an existing trend.

You have very little in the way of pullbacks to enter the trend and if you are lucky to be in a walking the band trend, be on alert for sudden shocks of a trend reversal and an increase in trading activity.

This is the stock of Home Depot and price was hugging the upper band giving little in the way of pullbacks to enter the move. This is a strong uptrend.

We do have the beginning of a squeeze (can you spot it) but then volatility picks up. A few good lessons on this chart where there was a 23% increase in the price of the stock:

- Closes outside or at the upper band do not always translate into a mean reversion trade. John Bollinger classified closes outside the BB as continuation moves.

- Does increased volatility as shown via the widening of the bands indicate a possible collapse in the price? Can you see how the bands can show an ABCD price move?

- When price is showing extreme strength, the collapse in price can be explosive. Price collapsed about 15% in 7 days.

It is vital to ensure you show discipline in taking the profits but protecting yourself from sudden downside price shocks that can take away a huge chunk of your gains in a matter of days.

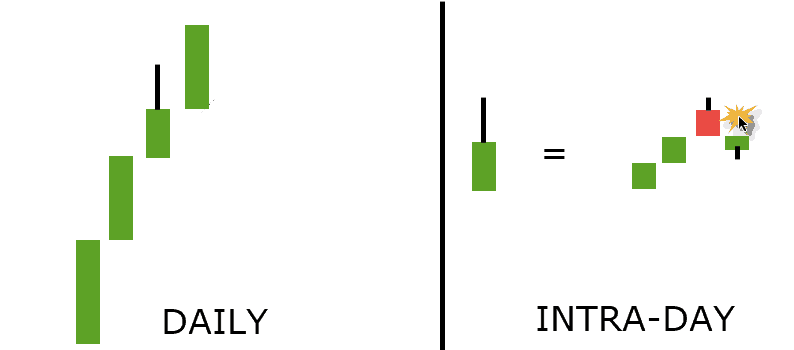

If facing a chart with virtually no pullback on your trading time frame, you could use a lower time frame to find an entry.

This example assumes that price is riding the upper Bollinger Band and the second last day closes off the high of the day.

This example assumes that price is riding the upper Bollinger Band and the second last day closes off the high of the day.

Dropping to an intra-day time frame may show a pattern such as the one shown on the right. You could simply buy stop the noted location with your stop under the low of the day. Remember, when these trends fail, it can be violent.

Bollinger Bands Trading Strategy – MACD + Band Combination

We can design a trading strategy that can be used for very short term trading, day trading or swing trading using the Bollinger Bands as explained.

I want to include a measure of momentum and for that, I am going to used the MACD (moving average convergence divergence). The settings of the MACD will be tweaked to make the 3/10 oscillator made famous by Linda Raschke.

Bollinger bands will use the default parameters of a 20 period look back setting and +/- 2 standard deviations for our band width.

Our long rules (reverse for a short position):

- We need price to interact with upper band and the momentum indicator to put in a new high

- Price must pull back to around the moving average as a support level. Pullback trading has an actual edge in the market

- Enter off a candlestick closing price, break of highs, or a hook in the fast line of the MACD

- Stops can be around the swing low or use the average true range indicator. Profit target at the top line or 1 times your risk.

- Consider using a trailing stop

- We can enter a squeeze on a breakout pullback move or using price structure as seen in the squeeze section above

This is a 5 minute chart of Gold futures (you could scalp these setups as well) and covers many of things that have been discussed.

- Bollinger Bands were in squeeze mode and price broke out to the upside. Our MACD made a new high and price has interacted with the upper Bollinger Band. Price pulls back close to the moving average and gives us a decent reversal candle for a breakout/pullback trade entry

- Price penetrated the upper band but our momentum indicator has put in lower highs. We are not allowed to trade any pullback to the moving average zone due to the MACD. We note the high.

- Price touches the upper band and the MACD puts in a new high. Pullback to the moving average for a long trade

- MACD makes a lower high so no pullback trade would be allowed. Price breaks the high, forms a long shadow and sets us up for a mean reversion trade.

Sum It Up

Bollinger Bands are a great indicator to help you set rules in regards to the trades you will take.

- The squeeze will allow you to quickly find instruments that are in consolidation and may be ready for a breakout trade.

- Pullbacks are a tried and tested trading method and the bands will help you determine which impulse legs may be ripe for another move after the corrective phase.

- Don’t trade the Bollinger Bands by itself. Adding in the MACD, price action, and support and resistance as described is a positive addition to a powerful trading indicator.

As with all trading strategies, you must have a trading plan that includes exact risk parameters as well as take profit levels, an entry signal, and stop loss levels.

Hope you enjoyed this article and picked up some great information to help in your trading. To help you trade patterns such as pullbacks like a pro, check out my free guide on “Price Pattern Trading” that you can instantly download.