- November 11, 2022

- Posted by: Shane Daly

- Category: Trading Article

An iron condor is a type of options trade that’s generally used when an investor believes that a stock will experience little volatility during the life of the contract. In this article, we’ll take a closer look at what iron condors are, how they work, and some of the pros and cons associated with trading them.

Key Points

Iron condors can be used to profit from stocks that are trading sideways, as well as those that are slightly trending up or down.

Involves selling two out-of-the-money call options and two out-of-the-money put options, and then buying two further out-of-the-money call options and two further out-of-the-money put options.

Maximum profit is the credit received when the trade is first entered, and the maximum loss is the difference between the strike prices of the options sold minus the credit received.

Iron condors are generally most successful when short-term options are used, and when the options expire 20-60 days from when the trade is entered.

Trades should be closed out when they have reached 50-75% of their maximum profit potential.

What Is An Iron condor?

An iron condor is created by selling one out-of-the-money put option and buying one out-of-the-money put option with a lower strike price while also selling one out-of-the-money call option and buying one out-of-the-money call option with a higher strike price.

The key here is that all four options must have the same expiration date. By selling the two options and buying the other two, the trader is protected from large moves in either direction. That’s because they will still collect a premium even if the stock price falls or rises within a certain range.

As mentioned, an iron condor is created by selling one out-of-the-money put option and buying one out-of-the-money put option with a lower strike price while also selling one out-of-the-money call option and buying one out-of-the-money call option with a higher strike price.

However, if the stock price falls outside of a range that we call the “profit window”, the investor will start to incur losses. This range is defined by the strike price of the call option that we are selling and the strike price of the put option that we are also selling. We need price to stay inside that range to make money.

However, if the stock price falls outside of a range that we call the “profit window”, the investor will start to incur losses. This range is defined by the strike price of the call option that we are selling and the strike price of the put option that we are also selling. We need price to stay inside that range to make money.

It’s important to manage your risk when trading iron condors and make sure that you set your trade up in such a way that you are comfortable with the potential losses.

One of the great things about iron condors is that they can be traded in any type of market—whether it’s rising, falling, or sideways. That’s because you’re not necessarily betting on which direction the market will move, but rather how much it will move.

Of course, like any other type of trade, there are risks involved with trading iron condors. The biggest risk is that you could lose money if the stock price moves outside of your predetermined range.

Another risk to consider is that implied volatility could decrease after you enter into your trade, which would reduce the amount of premium you collect.

What Are The Benefits Of Trading Iron Condors?

There are several benefits associated with trading iron condors with options.

First, this strategy can be used in both bullish and bearish markets as long as price stays within the profit window.

Second, it provides limited downside protection while still offering the potential for significant upside gains.

And third, it’s a relatively low-risk way to trade options since your maximum loss is limited to the difference between the strike prices of the two options that you sell minus the premium that you receive for selling those options.

What Are The Risks Associated With Trading Iron Condors?

As with any type of trading, there are risks involved in trading iron condors with options.

Risk #1: Time Decay

As we mentioned before, time decay is the biggest risk when trading iron condors with options. This is because the value of options tends to decrease as their expiration date approaches. To mitigate this risk, you can do one of two things:

– Sell options that are further out from expiration. This will give you more time for the stock price to move into your expected range.

– Sell options that are closer to being at-the-money. This means that they will have less time decay because they will have more intrinsic value.

Risk #2: Volatility Spikes

Volatility spikes refer to sudden increases in the amount of price movement for a security. These spikes can occur when there’s unexpected news about a company or sector. To mitigate this risk, you can do one of two things:

Set wider boundaries for your trade. This means that you will still make money even if there’s a small volatility spike outside of your expected range.

Use stop-loss orders. A stop-loss order is an order placed with a broker to sell a security when it reaches a certain price. This price is typically below the current market price for long positions or above the current market price for short positions. By using stop-loss orders, you can limit your losses if there’s a sudden spike in volatility.

Use Weekly Or Monthly Options?

The Iron Condor can be used with either short or longer-term options. What’s important is to ensure that the options you trade have good liquidity. Getting filled at good prices can have a huge impact on your P/L

For those new to Iron Condors, we suggest monthly options that expire 20-60 days from when you put the trade on. As you gain experience, move into weekly options with the understanding that these are less forgiving than longer term.

Our Iron Condor Strategy

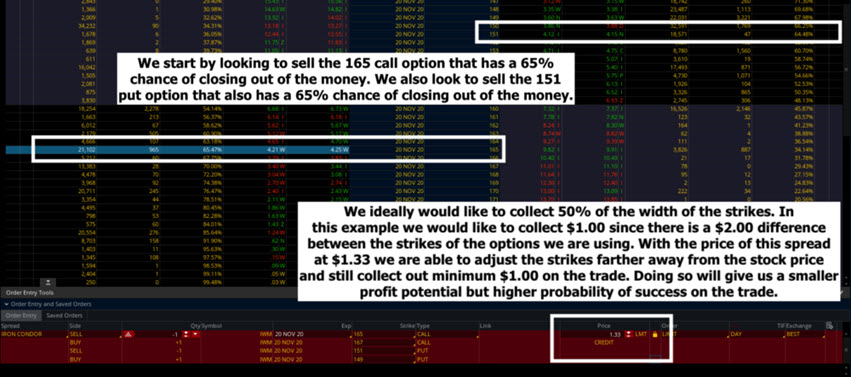

Whether we are using weekly or monthly contracts, we look to sell the call and put options that have a 65% chance of closing out of the money.

We will then look at buying the call and put options that are further out of the money. We look to put the trade on for 50% of the width of the strike prices.

What is Our Profit?

These are not home run trades and our max profit is what we collect when putting the trade on.

Let’s say we sell for $1.00, the most we can make is $1.00 ($100 for the contract) as long as the price stays inside our profit window.

Risk Defined

We talked about the overall risks of Iron Condors but let’s look at how we deal with risks for the trade.

As a risk-defined trade, we know that the most we can lose is the difference between the strike prices minus the credits we received when opening the trade.

Imagine we sell an Iron Condor that is $2.00 wide for $1.00. Our risk is $1.00 ($100 for the contract).

Wait. If we risk $1 and can only make $1, is that not a bad ratio?

No. These are safer trades than buying calls and puts, have a higher probability of success, and can make money in five different ways. We will even look to risk 3 to make 1 because, over time, our data backs these trades up.

Five Different Ways To Profit

If the stock goes up, down, or sideways, we will make money as long as the price stays inside our profit window (strike price of the call/put options we sold)

When selling an Iron Condor, we make money if the stock moves up, down, or sideways as long as the stock stays between the strike prices of the call and put options that we sold to open the trade.

Is time decay adding up? Decreasing volatility? No problem. We make money when that happens as well.

Hold To Expiration?

At Netpicks, we don’t hold to expiration although that is the only way we can book full profits. If we can keep 50-75% of the maximum profit we can make, we will close the trade.

If we made $1.00 when we opened the trade and we can buy it back for $.25 -$.50, that is acceptable to us.

Iron Condor Trade Walkthrough

This is an older trade but a great example for this article and involves the IWM (Russell 2000 ETF).

We believe that price will be fairly neutral over the next month and we use the Nov 20 monthlies that have 44 days left before they expire.

Here are the steps we took to open the Iron Condor:

165 out-of-the-money call option that has a 65% chance of closing out of the money and sell that option as part of the spread. We will also buy the 167 call at the same time to make sure we are in a risk-defined trade to the upside.

151 out of the money put option that has a 65% chance of closing out of the money and we sell that option as part of the spread. We will also buy the 149 put at the same time to make sure we are in a risk-defined trade on the downside.

Remember, when pricing out this Iron Condor we need to collect 50% of the width of the strikes. There is a $2 difference between the strike prices so we want to collect a $1.00 credit.

Looking at our first example, the Iron Condor is trading for $1.33. While this would give us a bigger profit potential, we would rather adjust the strike prices of the options farther away from the stock price. When we do this, it gives us a lower profit potential but a bigger profit window and a higher probability of success.

If the profit window is too tight, the price has a better chance of breaking out of that range. A wider window gives us more flexibility with price movements.

How do we do this? We move both the call options and the put options farther away from the current stock price.

Our new setup would be

Selling the 170/172 call spread (Sell the 170 call and buy the 172 call at the same time) and selling the 148/146 put spread (Sell the 148 put and buy the 146 put at the same time).

This accomplishes our Iron Condor strategy of collecting the $1.00 that we are looking for which is 50% of the width of the strikes.

Yes, we give up some profit potential on this adjustment but we get a bigger profit window on the trade.

IWM now has more room for the upside and downside and we can still make money on this risk-defined trade. By collecting 50% of the width of the strikes we are left with a 1:1 risk-to-reward ratio on the trade.

IWM now has more room for the upside and downside and we can still make money on this risk-defined trade. By collecting 50% of the width of the strikes we are left with a 1:1 risk-to-reward ratio on the trade.

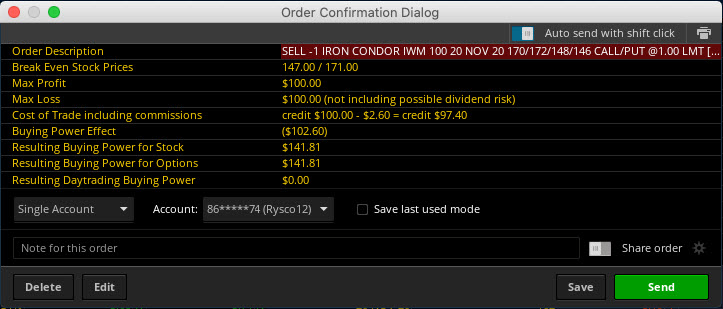

Trade Breakdown

Selling the spread to open the trade for $1.00 gives us a credit of $100 for each spread. That $100 is our maximum profit.

Our risk is calculated by the $2.00 difference between the strike prices minus the $1.00 we collected as just explained.

The most we can lose is $1.00 or $100 for the spread

Where Is Break-Even?

On the upside, $171.00 is our break-even price by taking the $170 call option strike we sold and adding the $1.00 we collected

If the price moves to the downside, $147 is our break-even price. This is the 148 strike of the put we sold and subtracting the $1.00 we collected when we opened the trade.

IWM can move higher, lower, or stay sideways and as long as the price stays between our break-even prices, we make money.

Just Getting Started With Options?

You can trade the markets and make money, but you don’t have to sit glued to your computer screen all day long.

Our One Day Options Trading Strategy gives you the freedom to trade today and exit tomorrow.

You’ll get immediate access to our high-performance markets so you can start trading right away.

Imagine making profits in just one day – it’s not only possible, it’s what we specialize in.

We want to help you achieve your financial goals, and our One Day Options Trading Strategy is the perfect way to do that.

Download our Two Favorite Markets Plus Our Unique One Day Options Trading Strategy now!