- November 7, 2022

- Posted by: Shane Daly

- Category: Trading Article

A lot of people want to trade options because of the flexibility and potential profits options trading offers. But one question always comes up: how much trading capital do you need to start trading options?

The answer, unfortunately, is not as simple as a single number. It depends on a few factors, which we will explore in this blog post. So if you’re wondering how much money you need to start trading options, read on!

What Is An Options Contract?

An option contract is an agreement between two parties to buy or sell an asset at a certain price on or before a certain date. Options offer traders a lot of flexibility, as they can be used to speculate on the future direction of an underlying asset or to hedge against losses in the underlying asset.

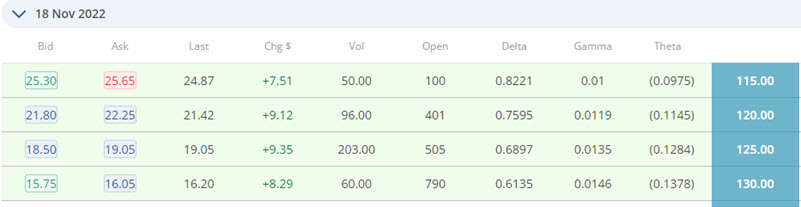

Trading options is a lot less capital-intensive than trading the actual shares. As an example, as I am writing this, the share price of Moderna (MRNA) is trading at $134.80. If I were bullish on MRNA and wanted to buy shares, I would need 134.80 x 100 = $13,480.00 to control 100 shares.

Using a simple in-the-money call option, I could control those same 100 shares (each contract is 100 shares of underlying) for $1590.00 (Mid price of bid/ask @ 130 strike price)

How Do You Determine Your Account Size?

There are a few things you need to take into account when determining the size of your account: your risk tolerance, your trading strategy, and the premiums for the options you want to trade.

Your risk tolerance is how much capital you’re willing to lose in a single trade. Your trading strategy will dictate how many contracts you need to buy or sell to make a profit (or loss).

And finally, funding requirements are set by brokers who determine how much money you need to put down to trade an option contract at their firm.

What Account Type Should You Use To Trade Options?

The type of account you use will also impact how much money you need to start trading options. If you’re using a cash account, then you’ll need 100% of the purchase price of the contract in your account to enter the trade.

However, if you’re using a margin account, then you’ll only need a portion of the purchase price—the amount will depend on your broker’s margin requirements. For example, if the margin requirement for an option contract is 10%, that means with a $10,000 margin account, you can buy up to $100,000 worth of contracts.

Margin Account

During our options training, we teach traders that the margin account is our preferred account to use. You will appreciate the flexibility these accounts offer because they allow you to trade our favorite strategy: vertical spreads.

Margin accounts get a bad rap mainly due to the lack of respect traders give them. Using too much leverage has wiped up many accounts of many traders over the years. The good news is that we don’t use the margin that is available to us. We need the margin account because we like to set up options trades using strategies that allow us 5 ways to profit.

All of the trades we teach are risk defined. This means we know exactly how much we can lose on the trade. No surprises and this allows us to control risk when using the margin account.

The PDT – Pattern Day Trading Rules – still applies to option trades. Any account under $25000 can only set up 3-day trading in a 5 day period. This rule will prevent a new trade if you go past the 3 you are allowed.

Cash Account

If you want to take a more day trading/active trading approach to options, then the cash account may suit you better. Virtually all traders can get involved with a cash account because the funding requirements are super low.

There are limitations: can only trade long calls/puts and vertical spreads are not permitted.

The good news is you are not subject to the PDT rule and can trade as often as you like.

How Do You Manage Risk Once The Options Trade Is Open?

Once your trade is open, there are a few things you can do to manage risk. First, you can set stop-loss orders with your broker, which will automatically close out your position if it reaches a certain price.

Second, you can use hedging strategies like buying puts or selling calls to offset some of your risks when holding shares for retirement or dividend investing.

Third, remember that options expire — so if the underlying asset isn’t moving in the direction you want it to go before expiration, don’t be afraid to close out your position and take your losses (or small gains).

Whatever your account size, try to stay within 2 – 5% of the risk of each trade. The entire portfolio risk will not exceed 50% of the trading account. You are more than welcome to be more aggressive or conservative but for us at Netpicks, that is our comfort zone.

I can’t repeat enough that our favorite strategy is a vertical spread. If the price goes up, down, or sideways, we can end the trade in profit.

What Is Our Recommendation For Account Size?

Our options trading approach is always about keeping our risk small and taking a larger number of small trades. We get to spread risk around into different sectors (and even instrument types) and we have found, over time, we see more consistency with results.

We believe that an account size between $3500 – $5000 is the minimum required to have a better handle on risk. The lower amount of trading capital, the larger impact a losing trade will have on your account and even prevent further trades.

We mentioned a 2 – 5% risk on your account per trade. With the minimum account size mentioned, you’d be risking $175 – $250 on each trade. A loss won’t have such an impact that you are unable to continue to trade.

What Are Common Mistakes Made By Novice Traders

Trading options can be a great way to make money, but it’s not without its risks. If you’re new to options trading (or even experienced), there are a few mistakes you might be making that could cost you.

Not Knowing the Difference Between Calls and Puts

One of the most basic things you need to know when trading options is the difference between calls and puts. Knowing which type of option to trade is crucial; if you don’t, you could end up making a mistake that costs you money. While it seems counter-intuitive to “buy a put” when looking to sell an instrument, these are the types of phrases you will need to grasp.

Not Doing Your Homework

Before you start trading options, you must do your homework. This means reading up on the basics of options trading, learning about the different types of options contracts, and familiarizing yourself with the risks involved. Not doing your homework is a surefire way to lose money trading options.

Getting Emotional

When it comes to trading, it’s important to remain calm and objective. Getting emotional about your trades—whether it’s excitement over a potential win or frustration over a loss, will only cloud your judgment and lead to bad decision-making. If you find yourself getting too emotionally invested in your trades, take a step back and reassess your strategy. The key to success is having a trading strategy/plan and following it consistently.

Failing to Manage Risk

Risk management is one of the most important aspects of trading options (or any other type of trading). When trading options, you need to be aware of the potential for loss as well as the potential for gain. Failing to properly manage risk can lead to big losses, so it’s important to always keep risk in mind when entering into any trade. Again, 2 – 5% is our sweet spot for trading.

Holding Onto Losers for Too Long

It’s hard to admit when we’ve made a mistake, but sometimes the best thing we can do is cut our losses and move on. Holding onto losers for too long is one of the biggest mistakes novice options traders make; instead of admitting defeat and moving on, they hold onto losing positions in hopes of recouping their losses. This almost always ends up costing them even more money in the long run.

If you find yourself in a losing position, don’t be afraid to admit it’s not working out, and move on to better opportunities.

Top 5 Points To Remember

A losing trade should have no more than a 2 – 5% impact on your account.

Common mistakes made by novice traders include not knowing the basics of options, not doing their homework, getting emotional, failing to manage risk, and holding onto losers for too long.

You need to do your research, have a trading and risk management strategy in place before you start trading options.

If you find yourself in a losing position, don’t be afraid to admit it and move on.

There is no one-size-fits-all answer when it comes to how much money you need to start trading options successfully. As a minimum, we suggest an account size between $3500 – $5000.

Conclusion

There is no one-size-fits-all answer when it comes to determining how much money you need to start trading options successfully. It depends on factors like your risk tolerance, trading strategy, and overall trading goals.

However, as long as you do your research and keep risk management top of mind at all times, there’s no reason why you can’t be a successful options trader.

Want To Make More Money In The Stock Market?

One way to do that is by investing in dividend stocks. Dividend stocks are companies that pay out a portion of their profits to shareholders, typically as cash payments or shares of stock.

Our list of 101 top dividend stocks can help you get started. We’ve put together a comprehensive list of some of the best dividend-paying companies that we watch, so you can find the right one for your portfolio.

Download our free report today and start investing in dividend stocks!