- May 8, 2021

- Posted by: CoachMike

- Categories: Options Trading, Stock Trading, Swing Trading, Trading Article

The COVID-19 pandemic has drastically changed the markets that are front and center for both active traders and investors. Markets that were never on the radar for many traders are now all the rage.

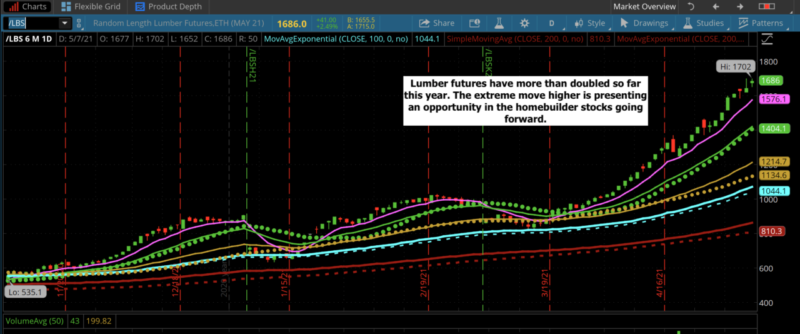

If you would have asked me 12 months ago whether I tracked the price of Lumber futures I would probably have laughed at the thought. However, the historic moves that we have seen in some of the lesser known markets makes it hard to ignore the opportunities that are there for active traders.

Quiet Markets Become Loud

With the trillions of dollars of stimulus money being thrown at the markets over the last year, we have seen markets that have historically been quiet spring to life. One of those areas is in the commodity space.

All commodities have been on historic moves higher in recent months, which have made them more attractive as both trading and investment vehicles.

Lumber futures (Symbol: /LBS) have more than doubled just since the first of the year.

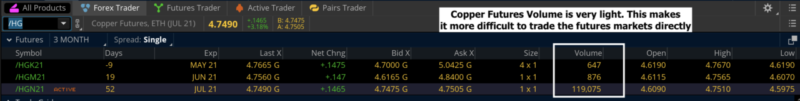

Copper futures (Symbol: /HG) are up over 30% since the first of the year. While the commodity futures aren’t the most liquid products for traders to trade directly, there are ways we can take advantage of these moves higher.

How To Profit Without Trading Futures

Futures aren’t for everyone as they can be riskier products to trade.

The commodity futures don’t have the best liquidity either, which can make them more difficult to get in and out of at good pricing.

- The active Copper futures contract had 119,000 contracts trade on Friday.

- The active Lumber futures contract only had a few hundred contracts trade on Friday.

Those volume numbers make them tricky to actively trade.

Those volume numbers make them tricky to actively trade.

However, there are other ways we can get exposure to these extreme commodity moves. One way to get exposure indirectly to the movement in Copper and Lumber prices is through the homebuilder stocks.

There are a few reasons I have added these products to my watch list.

Added To The Watchlist

First, with the rise in commodities like Copper and Lumber, we will see an impact on the homebuilders going forward. The starting prices of new home builds has risen $30,000-$60,000 in some areas solely due to the increases in material costs.

That is a huge spike that so far hasn’t impacted the price of the homebuilding stocks. However, we are reaching extreme levels that will be hard to ignore going forward.

The homebuilders have also benefited from interest rates being at historic lows and the massive amount of stimulus money being thrown at the markets. The low interest rates have caused big supply issues in the real estate market. There are way too many buyers chasing a limited supply of available homes.

Buyers are offering well over asking price on homes in some cases sight unseen. This has made building a new home more attractive as it is cheaper to build new than to buy a used home in many cases.

The low rates and huge stimulus have helped offset the rise in material costs, as home buyers haven’t even blinked at the rising costs. However, as markets get more stretched and home prices continue to skyrocket higher, we will get to a point where the higher costs begin to price buyers out of the market.

Top 5 Homebuilding Markets

We don’t expect the homebuilding stocks to become mainstays on our watch list of products to trade, but in the near term while these markets are so active we do want to have exposure to the sector.

We have identified 5 markets that we feel are good candidates to track in the months to come.

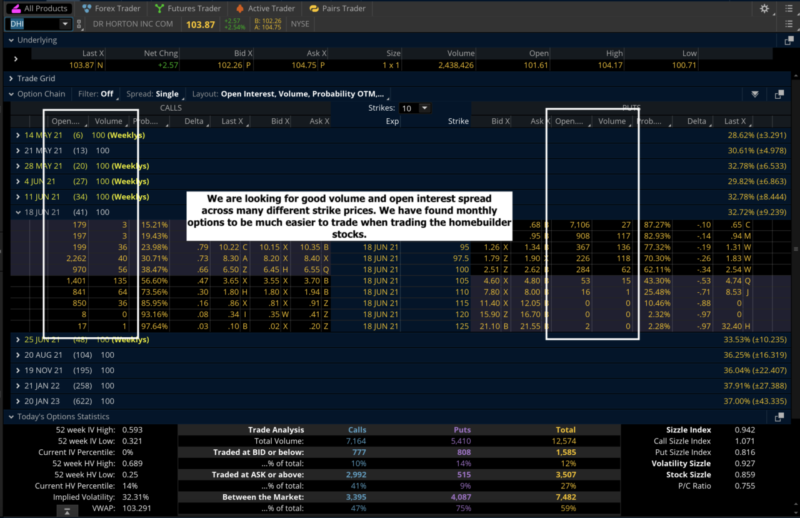

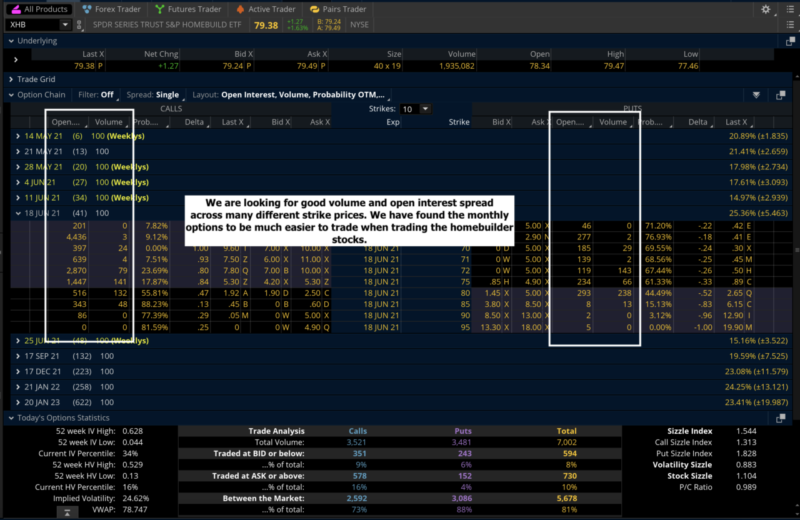

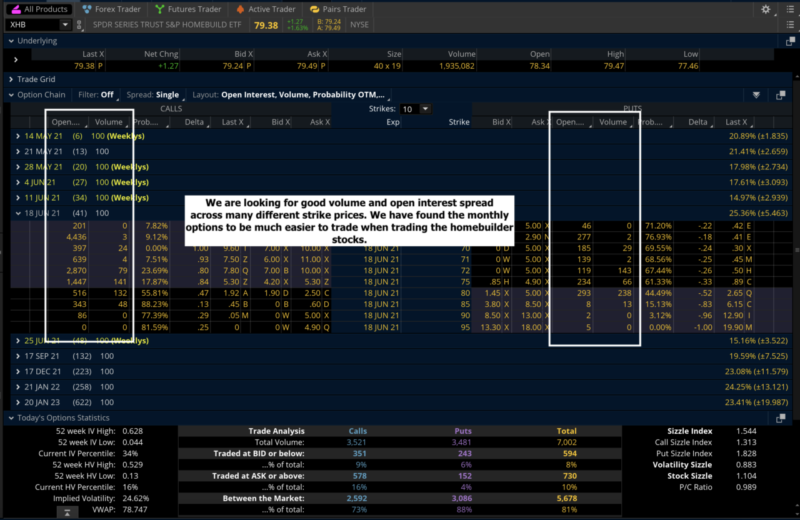

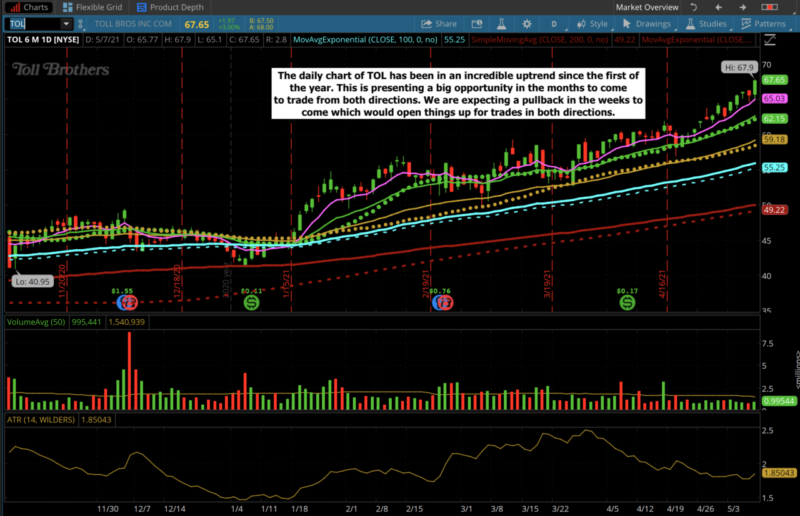

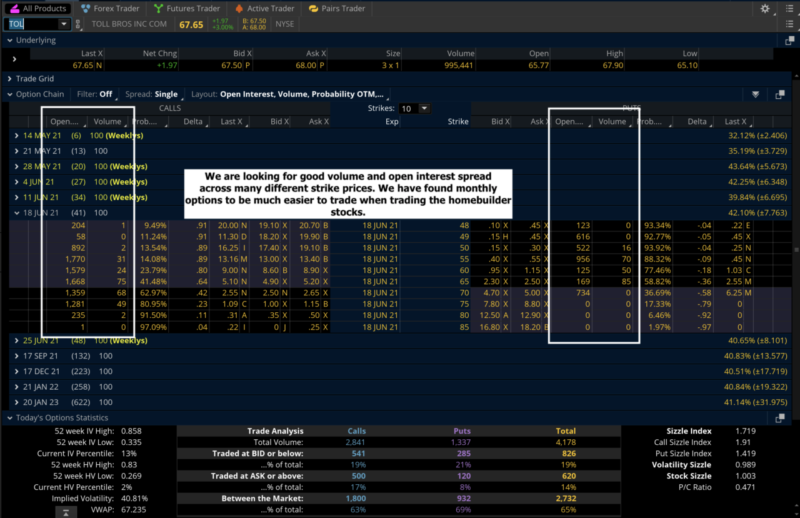

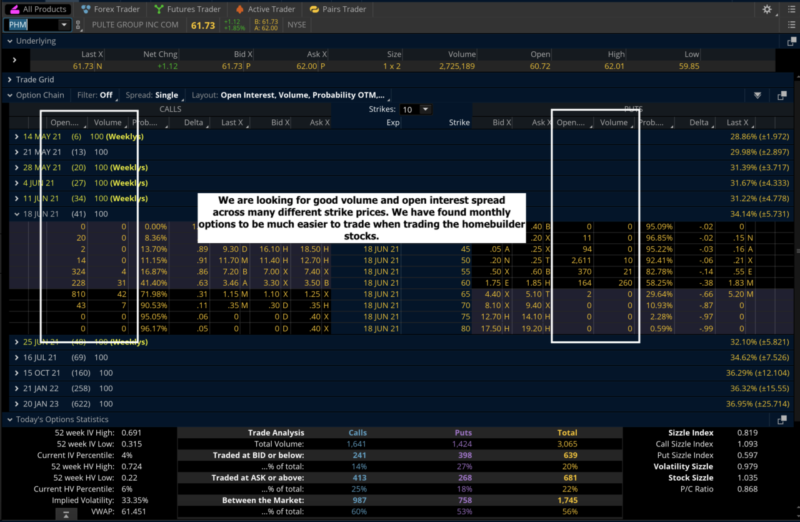

We took a look at the markets that have had the most consistent stock movement along with good liquidity in the options markets. When we talk about liquidity, we are looking for good volume and open interest numbers spread across many different strike prices.

Our Top 5 List includes 1 ETF and 4 individual homebuilding stocks.

- S&P Homebuilders ETF (Symbol: XHB)

- Toll Brothers (Symbol: TOL)

- Pulte Group (Symbol: PHM)

- Beazer Homes (Symbol: BZH)

- DR Horton (Symbol: DHI)

You don’t need to trade all 5 of these at the same time as they are very highly correlated products. We recommend looking to trade 2 or 3 of them. We are currently in trades on XHB and PHM which gives us good exposure to the sector without taking on too much risk.

S&P Homebuilders ETF – XHB

Toll Brothers – TOL

Pulte Group – PHM

Beazer Homes

DR Horton

What Options Strategies To Trade

Looking at XHB, PHM, TOL, and DHI, you will see the stocks have weekly and monthly options available while BZH does not. However, we recommend sticking with the monthly options as the weekly cycles don’t have a ton of action in them. The volume and open interest is not great and will make it more difficult to get in and out of trades quickly and at good prices.

The two options strategies that are most attractive to us to use on these 5 markets is trading simple long calls and long puts as well as selling credit spreads. The stocks have been in amazing up trends the last number of months so long calls and short put spreads have been great trades to consider.

Going forward, with these markets so overbought at current levels, we will start looking for pullbacks to take advantage of.

We will be looking to sell out of the money call spreads and buying long puts once price does confirm that it is ready to head lower.

When buying long calls and puts we will be looking at the monthly options with 20-60 days left to expiration. We will also look to buy the option that is 1-2 strikes in or out of the money. We want to make sure we are trading the strike price in this range that has the highest open interest number.

When selling credit spreads we will also go to the options with 20-60 days left to expiration and sell a spread where we can collect 30-40% of the width of the strikes.

For example, if we were to look at selling the 80/85 call spread on XHB, then we would want to make sure we can collect between $1.50 and $2.00 when opening the trade.

Conclusion

Markets will cycle over time which means new markets or new areas of the markets will become attractive trading candidates. Being open to trading markets that we may have never considered before is a necessary part of trading in 2021.

Just a few months ago lumber and copper prices were not even a blip on my radar.

However, for the time being they are presenting an opportunity to diversify into markets that can provide good trading conditions.

Trading the homebuilders gives me a way to participate not only from the lumber and copper prices skyrocketing higher, but also from the extreme real estate market conditions that we are seeing due to low interest rates and massive stimulus money in the system.

Do we plan on trading these stocks long term?

No, we don’t but that will depend on market conditions.

We believe they will good markets to trade for the next 6 months at least. Add them to your watch list going forward and let’s see if we can capitalize off these extreme directional moves going forward.