- March 20, 2020

- Posted by: CoachMike

- Categories: Options Trading, Trading Article

It’s easy to turn on financial media these and get scared away from the markets due this high volatility that have been seeing the last 3 weeks.

As options traders, we have the opportunity to use the volatility to our advantage as it can provide an opportunity to use higher probability trades.

We have written a few recent blog posts on how to use the high volatility to our advantage by using different types of options trades. To better show the power in using volatility to your advantage let’s compare the outcomes of placing a bullish trade using a long call and a short put spread.

While both are bullish trades as you will see below one does have an advantage over the other when volatility is high.

Why Is Volatility Important For Trading Options

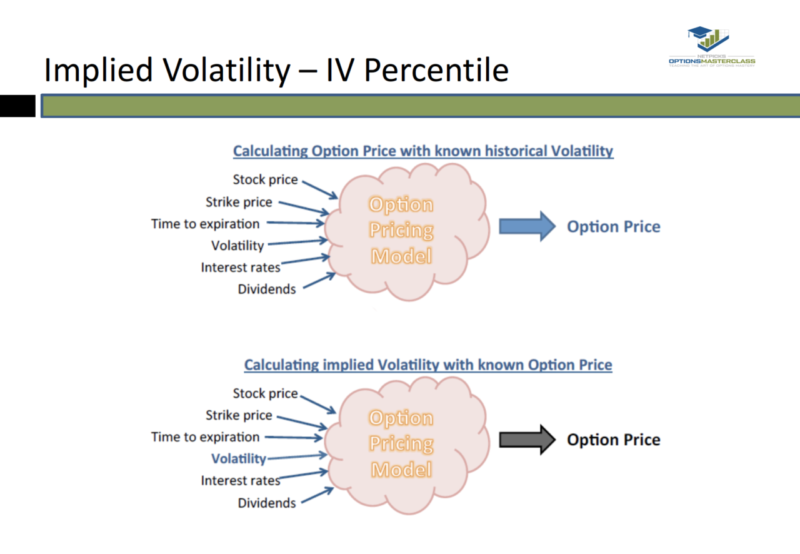

Before we get to the example below let’s discuss why volatility is so important to options traders. There are actually 6 different inputs that go into the pricing model of an option. It’s not enough to just track the price of the stock.

The input that can have the biggest impact on the performance of an options trade is the movement in implied volatility.

Implied Volatility

When the implied volatility is low the options are cheap. In this case you are looking for volatility to expand. If it does that volatility expansion will allow you to make more money faster.

When the implied volatility is high the options become very expensive. In this case, you are looking for volatility to contract.

As it moves lower it will cause the options to get cheaper. Using the right options strategy will allow you to make money from this contraction.

Trade Example: JP Morgan (Symbol: JPM)

Let’s put this to the test and take a look at a trade on JP Morgan (Symbol: JPM). Looking at the chart below let’s say you want to take a bullish outlook over the next few weeks.

Two options strategies that can be used here would be buying a long call option or selling a put spread. While both are bullish strategies lets see if one can take better advantage of the high volatility.

Trade #1 – Buying A Long Call

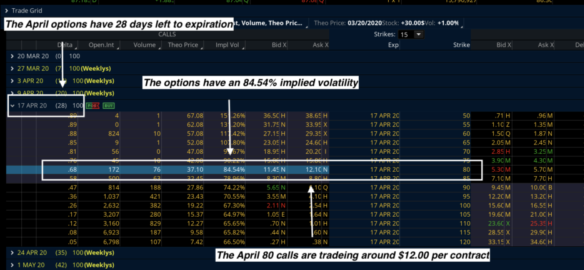

When buying call options we like to go out to the options that have 20-40 days left to expiration. We also like to buy the option that is 1-2 strikes in the money.

Doing so will give the stock time to move in our favor and also give us a higher quality position rather than buying a cheap out of the money option.

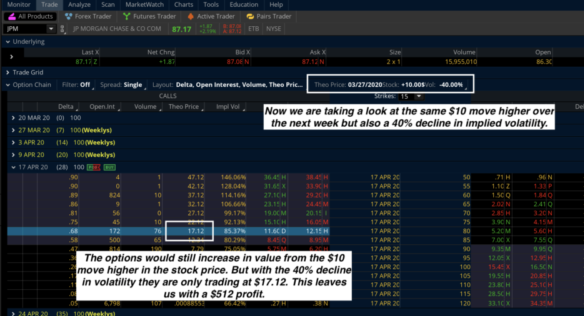

For our example, we are going to buy the April monthly 80 calls which are trading for around $12.00 or $1200 per contract.

- $1200 of capital required per contract

- Unlimited profit potential as long as the stock moves higher

- Max risk is $1200 per contract

- These options have 28 days left to expiration.

- The implied volatility of these options is at 98.57% which is extremely high for JPM.

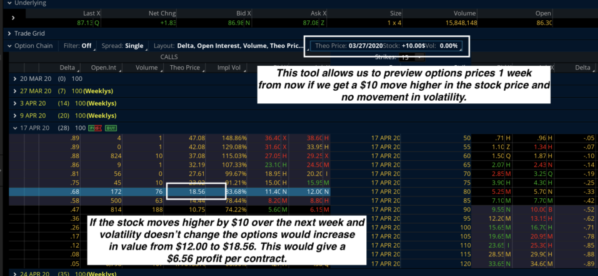

Over the next few weeks let’s run a hypothetical scenario.

Let’s say the stock moves higher by $10 one week from today and we don’t account for any change in volatility. The 80 calls in that case would be trading fro $18.56 which would give us $6.56 gain or a $656 profit per contract.

That’s a really nice return but we only make money if JPM moves higher and it does so quickly.

Here is where it get’s interesting.

We know as markets move higher volatility will move lower. In our example above, let’s take a look at the same $10 move higher taking place but now assume volatility drops during that move by 40% which would bring it closer to a normal range for the stock.

In this case, the options would be trading for $17.12. That would bring our profit down to $5.12 per contract or $512 profit per contract. A nice return, but $144 less due to the volatility dropping during the move higher in the price of the stock.

Instead of trying to buy options in this environment when the volatility is high and run the risk of losing some profit potential if volatility decreases during the trade, let’s take a look instead at selling a put spread to open the trade.

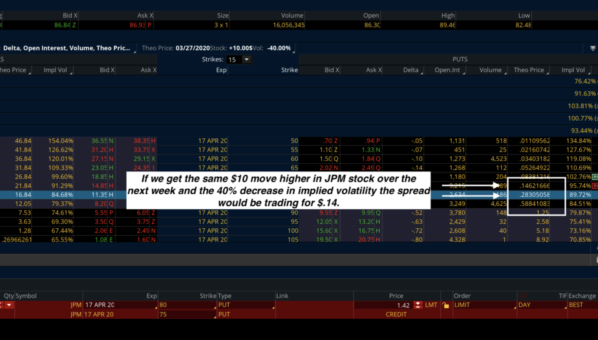

Trade #2 – Selling A Put Spread

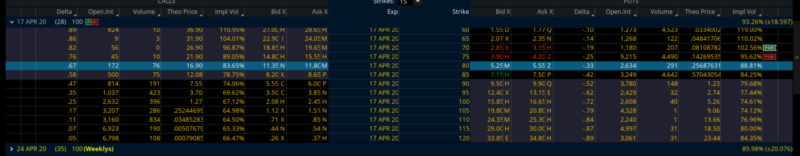

For our example, we will take a look at selling the April 80/75 put spread for $1.42.

- $142 collected to put the trade on which is our max profit

- $358 max risk on the trade

- We make money if the stock stays above $78.58

- We also make money from time decay adding up and volatility decreasing.

If we get the same $10 move higher that we talked about earlier with a 40% decrease in volatility we would be able to close the short put spread for $.14. This would give us a 36% return on our capital in 1 weeks time while also giving us 5 ways of making money on the trade instead of only having one way of making money with the long call.

Conclusion:

While both trades were bullish positions, the short put spread will give us a better probability of making money in a high volatility environment. The big difference is the short put spread gives us 5 ways of making money instead of only have 1 way of making money with the long call. This will result in a more forgiving trade that can work in a wide range of market conditions.

Using the flexibility that options give us allows us to react to any type of market condition that we are seeing. Doing so will produce better consistency from our trading over time.