- May 16, 2018

- Posted by: Shane Daly

- Categories: Basic Trading Strategies, Trading Article

When I mention the words “simple trading”, I am not talking about randomly putting on a trade and hoping for the best.

You need a trading (hopefully simple) strategy that has an edge and along with risk management under control, you let the edge play out over time.

But simple trading is often overlooked by many traders – to their detriment.

Easy access to squawk boxes, news releases, trading indicators, trading forums and anything trading related, has resulted in information overload that is not productive.

Trading decisions are made only after consulting every indicator and even the cycles of the moon. Ever seen a new traders chart? It is a bundle of indicators and many giving the same type of information which just adds to chart clutter and in the end, analysis by paralysis.

Think of this: if a lot of information is what is required for successful trading, then with all the studies and advice that is out there, the number of flame outs should not be as high.

Day traders that trade with clutter can cause them to miss the bulk of a price move. If you must consult 8 different indicators plus price action and chart patterns to validate a setup, when do you place the trade in order to not miss the move?

Simple Trading Does Not Have To Be Naked Trading

I am not saying to delete every trading indicator off of your chart in order to trade your market of choice with a simple strategy. Sometimes trading indicators can frame price action and give some context to the market.

You could learn to trade simple by deleting from your charts redundant trading indicators. Yes, every trader, from Forex to Futures and Options, is looking for something to tilt the probabilities of successful trading in their favor.

If you buy into the saying that trading is simple but not easy, should your trading strategy approach the market in that manner? Should you not strive to make things as simple as you can to trade but not remove important pieces of information?

Yes.

I put together a trading article on trading indicators you should know and I am going to highlight a few of the ideas in this trading tips article.

When using too many variables for your trading plan it can be hard to stay consistent each time you look for a trading setup. One main rule that we follow at Netpicks is that if your trading strategy has a verifiable edge (and it should before you trade the strategy), then you must apply the strategy and the plan consistently every time.

How Do Markets Move? A Simple Trading Approach

This is a great start to developing a simple approach to trading and if we take a high level view:

- Markets trade in a trading range

- Markets breakout of ranges and trend often with momentum

- Reversion to the mean when price extends too far too fast

Let’s look at each of those three views of the market and see how we can take a simple trading approach and not get bogged down with redundancy.

Trading Ranges

How will you know if the market is in a trading range? A simple price action approach taking into account lower highs and low in a down trend to higher highs and lows in an uptrend. When that stair stepping stops, consider yourself in a trading range.

You could also consult a moving average and when price is whipping back and forth around the moving averages, consider a trading range.

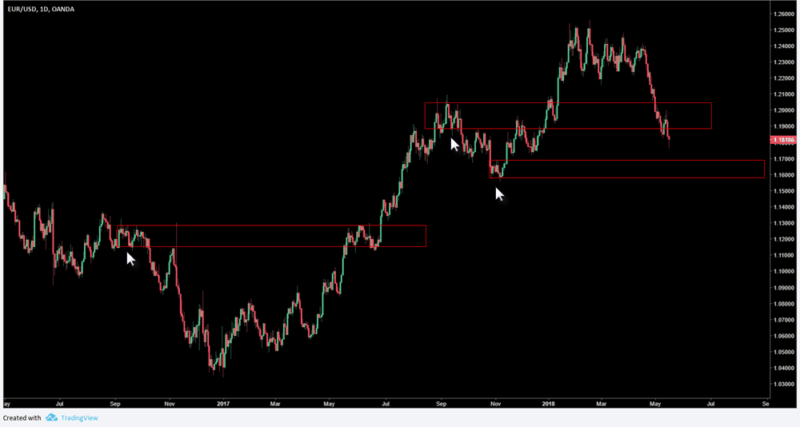

This is a 20 period simple moving average (SMA) applied to the daily chart of the EURUSD. The red lines indicate swing highs and low and you can see where the up trend price pattern of higher highs and higher lows, ends.

Price is whipping back and forth around the moving average and on this time frame, we are clearly in a range whether you use price action or the moving average.

Breakouts and Momentum

Trends must begin with a breakout of a trading range and although we can see that actual breakout (and often times the probability of a breakout), we can use momentum to show us that “hey, something has changed in this market”.

I plotted on the MACD indicator using the 3/10 settings that has become common on many charts thanks to Linda Raschke. I’ve made a few notations on the chart that I think are valuable and we will use the same EURUSD Forex chart as before

- We can see a double top has formed in price and the MACD indicator has registered a lower high than the previous. This is hinting that momentum is not as strong on this second push.

- Steady decline in the highs of the indicator

- This was a momentum low that was lower than any previous low in recent market action. This was a red warning flag that we were seeing a momentum shift and should not be ignored. This is where the price action started to show a range price pattern

- Price broke out and the MACD broke to new lows

Using two indicators like this for a simple strategy actually follows how markets move and can form the basis for a trade setup. Looking for a pause in trends with consolidations aided by a moving average and the resumption of momentum via breakout and the MACD, is a sound approach.

Mean Reversion

We are looking for a market to be extended from an average price and then for the “snap back” to occur. This can be an event you trade or just use the reversal of price as information. Either way works fine – keep it simple! Do not read too much into price movement – markets will do what they want to do.

Simple trend channels can help you see a market that is ripe for mean reversion as price moves in a rhythm. The first channel is broken with momentum and we are onto another channel. That is typical price movement where you get channel – impulse – channel.

When price hits the top of a channel in an uptrend, you may look for an exhaustion in price to take a counter trend trade. A better price action sign is when price breaks the top of a channel and pulls back like we see in the second channel. You can use the touches of channels as trading signals but ensure you have a full trading plan to guide you.

Support and Resistance – Is There A Simple Approach?

Too many lines on a chart that mean nothing. That is what many traders do as they use horizontal lines and diagonal. The question is, “how do you know your lines are not better than a random line?”

Support and resistance overuse has the same effect as too many trading indicators – analysis paralysis. If you decide to not take a trade due to a diagonal trend line or some horizontal line where you connected a few highs or low, how do you know you’re using something that has merit?

You don’t unless you stick to obvious zones on a chart.

There are no hidden levels in the market and even if there were, hidden would mean not many would see them and the only way support and resistance works is if enough flow happens at them.

The most obvious areas where flow can happen are….obvious zones on the chart and to narrow that down, look for a bundle of price action at certain areas.

Notice the cluster of trading activity I’ve marked and extended. Price reacts in the future to those zones and it’s in these zones you could use a simple approach to trading and look breakouts and momentum as discussed. See how many you can find that had reactions as an exercise.

I will touch on one way I personally draw support and resistance and it’s not at extremes – it’s inside the extremes.

The drawing shows three bars with the middle one being the extreme. As in the chart, I look below or above directly adjacent to the middle bar (think of a head and shoulders pattern where the two sides are lower than the extreme) and connect out from there. It can be subjective and for a more simple approach, you can use the extremes and perhaps bring the line into the extreme candlestick so you are not on the high or low.

Your Trading Strategy – Is Simple Best?

Only you can decide if the profits and results you are getting with clutter or convoluted trading strategies can be improved with simplifying your approach to trading.

An exercise you can go through is look through your last run of trades and determine whether you used (or ignored) some of the information your chart gave you. If you did, downsizing your approach may lead to better results and if anything, less information overload.

Read back about how markets move and base your trading strategy around those mechanics. You may find simple trading suits you much better.