- January 30, 2023

- Posted by: Shane Daly

- Category: Trading Article

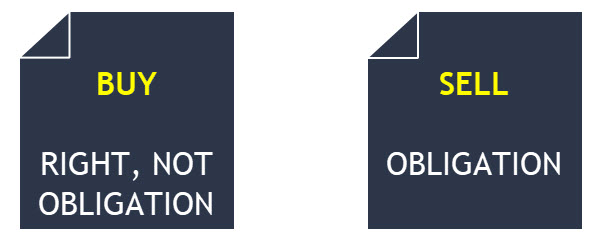

A call option is a contract between two parties that gives the buyer of the option the right, but not the obligation, to buy an asset at a specified price at any time up until the expiration date of the option.

Learning how to exercise a call option can help you maximize your profits and give you greater control over your financial position. Let’s take a look at what exercising a call option entails.

Why Would You Exercise The Option

Someone would exercise a call option they bought if the current market price of the underlying stock is higher than the strike price of the option. This is because exercising the option allows the investor to buy the stock at the strike price, which is lower than the current market price.

The investor can then sell the stock at the market price and realize a profit from the difference between the two prices.

The investor can then sell the stock at the market price and realize a profit from the difference between the two prices.

Exercising a call option can be a profitable strategy if the market price of the underlying stock is higher than the strike price. It is important to carefully consider the risks and potential rewards of exercising an option before making any decisions. It is also recommended to consult with a financial professional before exercising an option.

Longer-term traders or investors may also exercise to hold the stock for a longer period for retirement or dividend purposes. This allows them to offset the risk of buying the stock at the current price to buying it when it has increased in value.

Steps for Exercising a Call Option

Exercising a call option requires you to understand when it is time to do so and then decide whether or not you would like to go ahead with it. Here are the steps for exercising a call option any time before expiration:

Determine if It Is Time to Exercise the Option

The first step in exercising a call option is determining if it is time to do so. Generally, this means that there will be some sort of financial incentive for you as an investor for it to make sense for you to exercise your call option. This generally means that the stock price has risen above the strike price past the breakeven price.

Decide Whether You Would Like To Exercise or Not

Once you have determined that it is time to exercise your call option, then you need to decide whether or not doing so would be beneficial for you financially. If it looks like there will be some kind of profit in doing so, then this might be worth considering depending on your financial goals and risk tolerance. Depending on the current premium, some traders may find it beneficial to exercise and sell the actual stock as opposed to simply selling to close their option position.

Place The Order To Exercise Your Option

Once you have decided that it makes sense for you financially to go ahead and exercise your call option, then all that remains is placing the order with your broker or through an online trading platform. This will involve paying any applicable commissions associated with exercising an options contract as well as any other fees associated with trading securities on an exchange or through a broker-dealer firm.

Process

Pay the exercise price for the option, which is the strike price multiplied by the number of shares. For example, if the strike price is $50 and you are exercising 100 shares, you will need to pay $5,000 (100 shares x $50 per share).

Your broker will then buy the underlying stock at the strike price and deliver it to you.

If the stock price is higher than the strike price when you exercise the option, you will realize a profit from the difference between the strike price and the market price if you sell them.

For example, if you bought a call option on XYZ Corporation with a strike price of $50 and the stock is currently trading at $55 per share, you can exercise the option and buy the stock at $50 per share.

You will pay $5,000 to exercise the option and receive 100 shares of XYZ Corporation. You can then sell the stock at the market price of $55 per share and realize a gross profit of $500 (100 shares x $5 difference between the strike price and the market price). You must also factor in the cost you paid to buy the call option.

In our example, if it cost you $2.00/share premium ($200) and you sold the stock at a $5.00/share gain, you net before fees, $300.00.

Benefits of Exercising A Call Option

There are several benefits associated with exercising a call option including having more control over your financial position as well as being able to potentially profit from increases in stock prices without incurring too much risk.

For example, if the underlying asset rises above its strike price before expiration, then exercising your call options allows you access to those profits without having invested too much upfront capital into purchasing shares outright on the open market which could have been very risky depending on market conditions at that time.

Additionally, purchasing shares at their predetermined strike price instead of what they may cost on the open market gives investors more flexibility when positioning their finances long-term since they know exactly how much they will pay no matter what happens between now and when they decide to sell their shares down the road (if ever).

Risks Involved With Exercising A Call Option

Just as there are benefits associated with exercising a call option, there are also risks involved that should not be taken lightly either before making such decisions about one’s finances and investments portfolio overall.

Some key risks include potential losses due to changes in stock prices post-exercise (stock price drops); opportunities costs due to waiting too long before deciding whether or not one should exercise; missed chances of profiting from increases in stock prices if you immediately sell; and transaction costs associated with executing such transactions (e.g., commissions).

Conclusion

All things considered, understanding how exercising call options works can help options traders make better decisions when trying to maximize their returns while minimizing their risks when investing in securities markets overall.

However, since exercising such contracts involves taking both risks and opportunities into account beforehand – making sure one has done enough research before making any decisions is paramount! Ultimately, educating yourself thoroughly about such topics can only benefit traders over time who are looking towards optimizing their performance when investing across various markets worldwide!

Quick Summary

Exercising a call option involves buying the underlying stock at its predetermined strike price and selling it for a higher price to benefit from an increase in market value (or hold).

Benefits of exercising call options include control over financial position, potential profits without too much risk, and access to predetermined prices instead of uncertain open markets.

Risks of exercising call options include potential losses, opportunity costs, missed chances of profiting from increases in stock prices, and transaction fees.

Educating oneself about these topics is essential for traders looking to maximize returns while minimizing risks when investing in securities markets overall.

Understanding how exercising call options works can help options traders make better decisions when attempting to optimize their performance in various markets.

You could be making more money in less time!

Imagine if you had a list of the 101 best dividend stocks to own today. That would give you a major head start when it comes to finding high-yielding investments that could help you achieve your financial goals. And we’ve got just that – a free download that will get you started on the right foot.

Imagine how great it will feel when you finally have enough passive income coming in to cover all your bills and then some. With our list of top dividend stocks, it’s easier than ever to make that dream a reality.

So don’t wait – download our free report now!

Click here to get your free copy of our report on the 101 top dividend stocks!

2 Comments

Comments are closed.

great lesson!

My option knowledge can only improve with Shane’s guidance and coaching.

Appreciate it by Mike here at Netpicks is the real Options goto person.