- January 7, 2018

- Posted by: Mark S

- Categories: Cryptocurrencies, Trading Article

The public awareness of Bitcoin and alt currencies is increasing which is the first stage of public acceptance. A simplified version of how growth occurs:

- Small % of the mainstream has awareness of X and growth is slow

- As news continues to cover X, more of the mainstream becomes aware and growth matures

- Once X is known and adopted on a global scale, the growth becomes more rapid

The growth of Bitcoin and cryptocurrency trading in general has not shown any sign of slowing down:

“The largest bitcoin exchange in the U.S., Coinbase, added about 100,000 accounts between Wednesday and Friday — just around Thursday’s Thanksgiving holiday — to a total of 13.1 million.” – Altana Digital Currency Fund

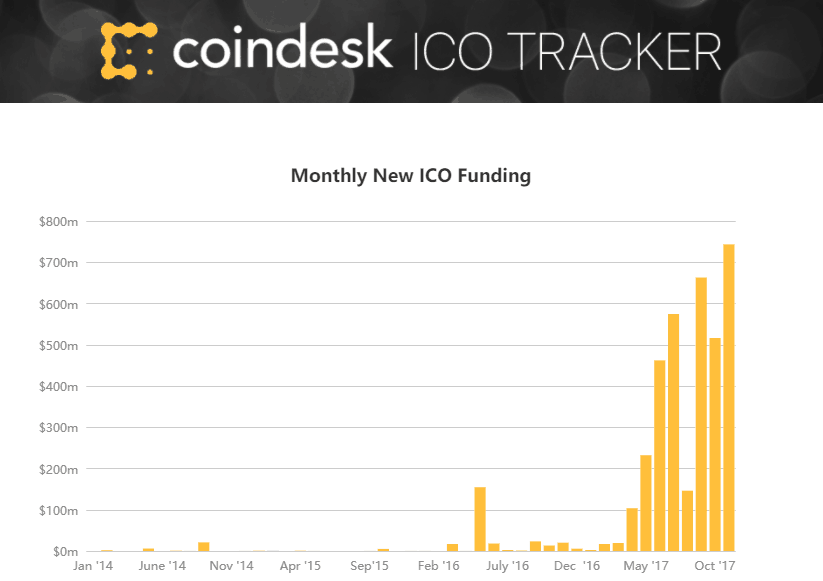

We also can’t ignore the amount of funding that is going into ICO (initial coin offerings) and if you believe that investment capital is risked on probabilities, there is a lot of positive thoughts about the continued growth of cryptocurrencies.

Whether you invest directly with one of the currencies or other investment opportunities surrounding the technology, there appears to be a wind at the back of this potentially explosive development in virtual currencies.

Basic Terminology Reference

There is a number of terms floating around and for people just learning about Bitcoin and alt-currencies, they can often be confusing. Here is a quick list of the more common terms you will come across and their meaning.

Cryptocurrency

Cryptocurrency is a digital resource (e.g. Bitcoin) that acts as a medium of exchange using data encryption to secure the transaction that is taking place. There are two parts to this word and the first part, crypto, refers to cryptography (encryption) that is done through public and private hash keys.

The public key combined with your private key acts as your digital signature through any transaction.

Public And Private Key

Think of these keys as a long combination to a lock. Everyone gets both a public key, which identifies you in the system and a private key that only you know.

You must never divulge your private key and must keep it safe in a hardware wallet!

How this works in layman terms: I want to do a transaction with you and use your public key on the system to encrypt it. Your private key must match the public key in order for this transaction to take place.

Blockchain

Blocks are a group of transaction that take place over a period of time and every new block carries an encrypted copy of the previous one that have been verified through mathematical computations. Think of it as a virtual record keeping service where all transactions are verified.

One of the opportunities surrounding cryptocurrencies is advancement in development of blockchain technology. A report from Markets and Markets stated “the blockchain technology market size will be worth 2.3 billion by 2021, increasing at a compound annual growth rate (CAGR) of 61.5 percent”.

Ledger

In the crypto world, the blockchain is the ledge that holds records of every transaction that has taken place. A copy of this ledger goes to everyone who is running a full node – a program that validates the transactions and the blocks.

Technically, any computer that connects to the network is a node. The amount of full node users is tough to measure due to firewalls, and closed ports but estimates are in the thousands.

The importance of the ledger is if there is a catastrophic event and most servers were disabled or cleaned out, it just takes one to recover the blockchain.

For those of you interested in the size of the Bitcoin network worldwide, you can take a look at this Global Distribution map.

Cryptocoins

There are simply entries on a ledger (see above) with a chain of signatures that represent a value on a that ledger. The history of the cryptocoin is recorded and will have a history of that transaction made with it.

Unlike the money you spend at a store, each transaction made with cryptocoins can be tracked.

Imagine I want to send over the value of the coin that I have to you. Like signing a check, I will use my digital signature, my public and private key and an encryption of the previous transaction that took place (remember “chain”) , and add your public key to the ledger.

By matching my public and private key, I’ve virtually approved the transaction.

I have assigned you the coin easily by adding your public key to the global ledger. Sounds simple but there is a lot going on in the background to make this not only happen, but to happen securely.

Miners

The nodes referenced earlier are miners. These are the computer that administer that transactions that take place and remember, these transaction are put into a block with other transactions. When a new block is added, coins are produced so the miners can be paid for the work that they do.

Running a mining rig can be expensive and it is competitive which is why IEEE Spectrum wrote “these dynamics have resulted in a race among miners to amass the fastest, most energy-efficient chips”

Just Want To Trade Cryptocurrency?

Some will argue that you don’t need to know how something works to trade it. While that is true, it does not hurt to know some of the common terms that are used with Bitcoin and alt currency trading.

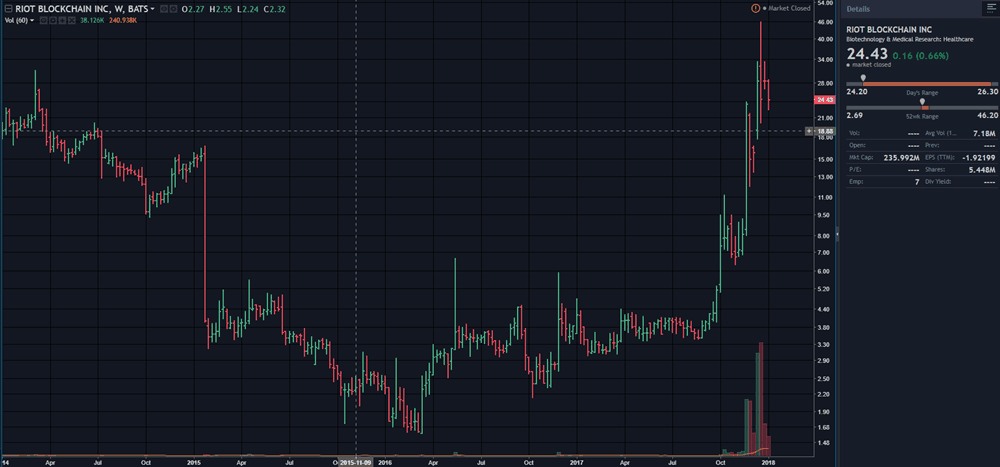

Were you even aware that you can invest in companies via stocks that focus on block chain technology? I’ve read that the technology opportunity may be a better long term investment than cryptocurrencies.

Netpicks has put together an online information guide called Getting Started With Bitcoin And Crytocurrency Trading where you can read about:

- Why you don’t need the full price of a Bitcoin to trade it

- The dangers of investing in ICO

- Opening an account and protecting your key

- Types of trading you can focus on

- Sign up for free crytocurrency trading signals

Whatever you decide to do, there are opportunities available from a short to long term perspective from trading the actual currency to investing in companies on the technology end.

Any trader looking for a potentially lucrative opportunity may want to do their due diligence and investigate what people are calling a “one in a lifetime opportunity”.