- November 17, 2020

- Posted by: Shane Daly

- Category: Trading Article

The Camelback Trading Strategy was designed by Joe Ross that uses both the long term and the shorter term trend direction.

I personally find nothing wrong with a trader looking at the mass of trading techniques on the web and seeing if they can make them a viable approach.

What I figured out years ago was:

- There is nothing new in trading

- Complex systems don’t outperform simple approaches

- Jesse Livermore was right: “It is not good to be too curious about all the reasons behind price movements”

Many strategies are tweaks from another and in the end:

- Can you be profitable trading it?

- Is it a method you are comfortable with?

- Is it simple to explain?

Why?

Can you be profitable trading it?

You know that giving a group of traders the same system will give different results. The human side can be our greatest enemy and no matter how simple the rules, too often your human side steps in.

If you are unable to follow the rules you have laid out, you may never find its full potential (if any). Just because you copy a successful system, it doesn’t mean you will find the same success.

Is it a method you are comfortable with?

Some traders swear by using Fibonacci in their trading. If you don’t believe there is an order in the universe, you won’t be able to follow any trading rule using that method.

The same goes for moving averages as dynamic support and resistance. If you believe that it’s an illusion and what is happening is simply the moving average catching up to smaller price ranges, you won’t follow it.

If the method is for scalping and your temperament is more swing trading, you won’t succeed.

Finding a trading technique that “fits” is paramount to finding success.

Is it simple to explain?

You’ve heard that if you can’t explain something to a five year old, it’s too complicated. If your trading approach requires an hour to explain, there is probably:

- Too much room for error

- Too many variables to find a trading setup

- Redundancy somewhere in your approach

Keep it as simple as it needs to be: Setup + Trade Trigger = Trade + Manage

Camelback Trading Strategy Breakdown

Using the Joss Ross approach, we want to find the longer term trend direction. To do so, Ross uses:

- 40 period simple moving average of the highs

- 40 period simple moving average of the lows

Could you use larger or smaller periods? All this is doing is giving you a trend direction and as mentioned earlier, the strategy you use must fit. So yes, you can adjust the length if you desire to.

He also includes a short term trend direction through the use of the 15 period exponential moving average.

When price is above the 40 SMA price channel, we are only considering long positions.

Price below the channel, short positions is the play.

Once price enters the channel, there is no trade. Consider price inside the channel a precursor to a potential trend change which is generally a volatile event.

The 15 EMA is used as a filter

If the 15 EMA is flat, no trades as we are looking at a potential trading range

If the average is sloping down in an uptrend, we stand aside. The shorter term trend is against our potential position. It will look like a deep pullback.

Upslowing average in a downtrend, stand aside.

How To Enter The Trade

Once price picks a direction either above or below the 40 period channel, we look to the 15 EMA. As long as the EMA is favoring the longer term trend direction, we can take a trade.

We look for price to make a new bar low for an uptrend or a new bar high for a downtrend

Place a buy stop over the high of the candlestick that made the new low – Buys

Sell stop below the low of the candlestick that made the new high – Sells

This is a 30 minute stock chart with 3 trade signals.

Ross used 1 tick above the high or below the low for the entry price. You may opt to use a small multiple of an ATR.

We will use the opposite end of the setup candlestick + buffer to place our stop loss.

- Valid buy stop above high of candle that made a new candle low.

- Price pulled back making new candle highs. Price spikes into channel however price must be outside the channel for a valid setup.

- New candle high and trade short

- New candle low and trade long

Ross would split the position into thirds:

- 1/3 scale out to cover cost

- 1/3 at profit target

- 1/3 to ride the trend

For profit targets, consider using an R multiple such as 1,2, or 3 times your initial risk.

Trailing stops would depend on the volatility of the market.

The price channel may be too far away from thrusting price action giving back too much while the 15 EMA may be too close during low volatile periods. You have to test this out and find what you are comfortable with. Both can cause you issues prompting you to break trading rules.

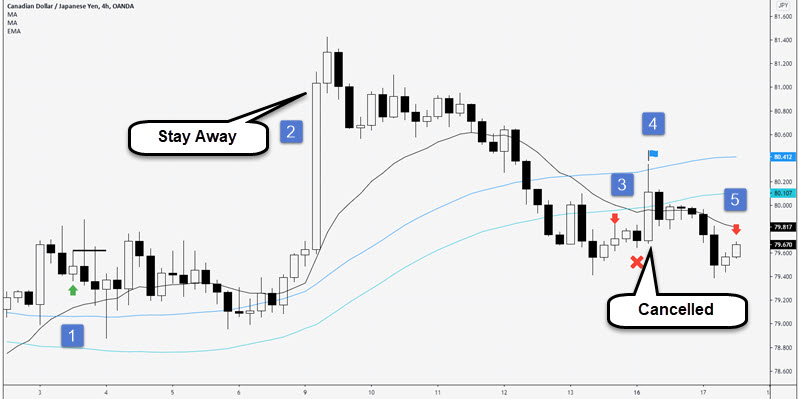

Let’s look at another example using 4 hour Forex charts.

Let’s break this chart down:

- Valid buy setup and eventually stopped out for a loss. You may have been able to scale 1/3 to cover costs. With the flat/downsloping 15 EMA, we have no other trades

- Huge momentum candlesticks often lead to snap backs in price. Price action traders generally stay away from these types of setups.

- Valid short setup and we would not trail up our entry price as those candlesticks are inside the setup candlestick

- This will invalidate the setup as price as now entered the moving average channel

- Valid sell setup but looks as if the 15 EMA is about to either flatten or point upwards

Understanding price action is a positive addition to this trading strategy. While you may miss trades, the odds are in favor of snapbacks against your position when price travels too far, too fast.

Trailing Stop And Profit Targets

Taking advantage of positive price movement is a worthy goal. You must determine your trade management rules to do so.

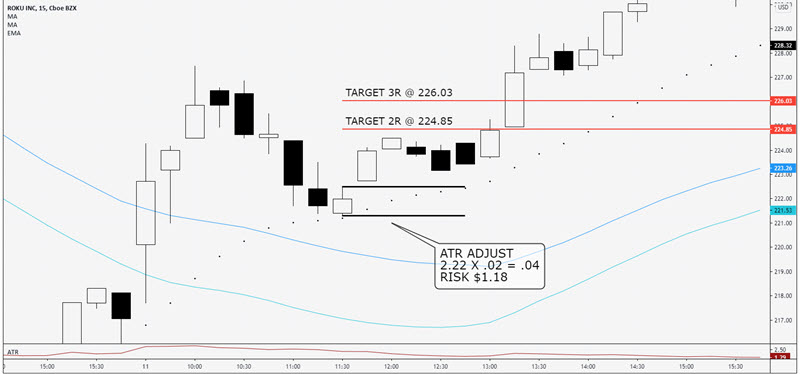

We will use one trade entry for this example.

The first example uses the 15 EMA for a trailing stop loss and this trade exits for a $183.65 gain.

The second example, same entry, will use the top of the channel. This would have run $570.33 before being stopped out.

Why is there a red X where it appears the white candle touched the channel?

That price of the channel would not be known until after that candlestick closes. Your stop loss would be set at the price for the prior days moving average price and you would not be taken out.

Profit Targets

There are many ways to set your profit targets and this is a simple multiple of risk technique.

I am use the 5 period average true range indicator and taking that reading and X .02. You can use any multiple of the ATR that you like.

For example, in this chart, the ATR at setup is $2.22 and .02 of that is .04 cents. I have added .04 to the high of the setup candle to give me a buffer for the entry price. The stop is the low of the setup candlestick subtract .04.

I have set the red lines at 2 and 3 X the original risk on the trade. You can see both are hit if this position would have been filled.

Summary Of Camelback Technique

Being based on the short and long term trend direction gives it some merit. Needing price to make some type of pullback, which this does, and needing price to resume in your direction through a stop order, adds to it.

Trader may choose to need to see more of a complex correction that would require, for a buy setup:

- Price makes a new candle low

- Price makes a new candle high

- Need price to make a new candle low for your setup

This may have you missing some moves but also takes advantage of a slightly deeper correction.

In this example, we ignore the first setup (with the X) and the 2 black arrows show valid setups. The last red bar is my preferred setup because not only has it made a new bar low, it made a new swing low.

The downside of this tweak is missing trades after one down period and the potential for a ranging market to be setting in.

There is a built in trailing stop feature with the moving averages which can allow you to make fantastic gains on markets that run.

I would not add too many other variables although a momentum indicator hook in your direction may give a slightly better edge.

You will also have to determine if/when you would consider add on trades or re-entry rules on stop outs. Try to get the trades once price crosses the channel lines and before it takes too far off from the channel.