- December 20, 2017

- Posted by: Mark S

- Categories: Cryptocurrencies, Trading Article

Since its inception in 2009, Bitcoin has overcome many obstacles and challenges. Without question, the digital currency is in much better shape regarding social acceptance versus eight years ago.

It appears bitcoin is on its way to becoming used as a medium of exchange on a global basis. However, there are still many threats and roadblocks which could prevent bitcoin from reaching its full potential.

Let’s review a few of the biggest challenges bitcoin will face over the course of the next few years and top it off with the number one threat to Bitcoin and all cryptocurrencies success.

Volatility Is Great For Traders But Not For The Public

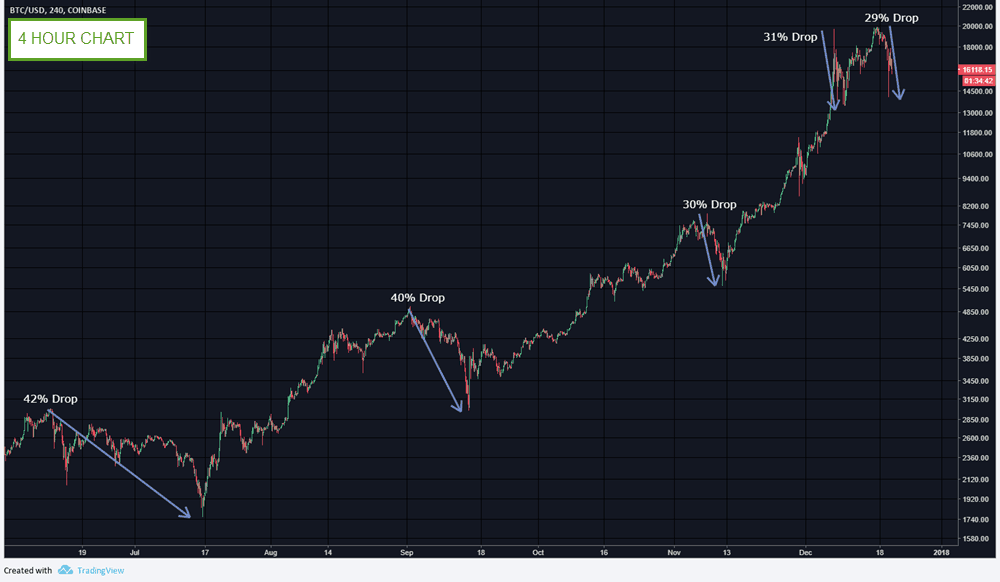

Bitcoin has been incredibly volatile since its inception. In 2017 alone, it has increased over 1,800%. It’s not uncommon for bitcoin to experience daily price swings of 30% and this type of price volatility is great for traders and speculators.

However, it certainly isn’t helping to fuel bitcoin’s popularity as a currency or medium of exchange. Consumers will never adopt a currency that rises & falls 30% in a single day.

Instead, consumers prefer their local currency to remain relatively stable over a long period of time. For example, the US Dollar generally fluctuates about 8 to 10% per year.

Any movement greater than 10% in a single year is considered a “big move” for the US Dollar.

These days, bitcoin is more akin to the Zimbabwe Dollar instead of the US Dollar. To be used as a daily medium of exchange, bitcoin’s erratic price behavior must be reduced dramatically.

Widespread Acceptance Is On The Horizon. But Not Yet

Bitcoin is making strides in regards to retail acceptance as a method of payment. Many retailers accept bitcoin and other digital currencies for payment of goods and services.

In fact, over 100,000 businesses currently accept bitcoin globally. The most popular companies include:

- Microsoft

- Overstock.com

- Subway

- Expedia

- Dish Network and WordPress

Despite the recent surge in popularity, bitcoin still isn’t anywhere close to being widely accepted by merchants and vendors. However, it does appear that the trend is moving in the right direction.

Too Many Hoops To Jump To Buy Cryptocurrencies

In comparison to the early years of bitcoin (2009 – 2012), it is much easier to buy, sell and use bitcoin today. Technological advances have certainly improved bitcoin’s usability features during the past few years. However, the digital currency needs to become significantly more user-friendly to achieve mainstream adoption.

For example, the simple act of purchasing bitcoin is a multi-step process which usually takes several days to complete.

The average consumer will never jump through multiple hoops to purchase a digital currency. Why? Because consumers are accustomed to high-speed digital transactions from companies like Visa and Mastercard. We are in the era of instant gratification and anything that pulls away from that expectations will have a tough time gaining traction with the Main Street public.

The transaction speed of bitcoin crawls along at a snail’s pace in comparison to the “big three” credit card companies. This problem must be solved before the general public will integrate digital currencies into their daily lives.

From Full Account To Zero Balance In A Flash

We all remember the Mt Gox debacle from 2014 when 850,000 bitcoins were stolen from the company. This company was processing 70% of all worldwide Bitcoin transactions and that would be enough to spook virtually every member of the public.

These are the types of events that prevent digital currencies from garnering the necessary trust from consumers. The digital currency universe is certainly moving in the right direction in regards to increased security measures. However, this has the potential to be a long-term chronic problem for all digital currencies; a problem that will not be solved any time in the near future.

Could the issue of theft turn out to be the “Achilles heel” of bitcoin? Probably not. However, this is an issue that bears watching as bitcoin and other digital currencies transition into the next phase of their respective life cycles.

Can Blockchain Handle Increased Load?

Very briefly, scalability is the capability of a system or network to handle a growing amount of work. Based on this definition, does bitcoin have a scalability problem? The short answer is, “Yes.” The underlying technology of bitcoin is the blockchain.

As it stands today, the blockchain limits the amount of information that can be contained in each block to one megabyte of data. This limitation allows for a maximum capacity of approximately 5 to 7 transactions per second. Consequently, as additional bitcoin trades and transactions are executed, the network will have a more difficult time keeping pace with the increased volume. This could easily result in enormous processing delays.

As we discussed in the “ease of use” section, bitcoin transactions are simply too slow to compete with major credit card companies. For the sake of comparison, Visa’s network processes over 2,000 transactions per second versus three transactions per second with bitcoin.

It’s quite obvious bitcoin must address its scalability problem if it wishes to compete against the likes of Visa and Mastercard in payment processing.

The Government Wants Its Cut Of Your Money

According to the Internal Revenue Service (IRS), digital currencies are considered to be “intangible property,” which means they are subject to capital gains. For example, if you purchase bitcoin @ $10,500 and sell it a few months later @ $18,000, this would generate a capital gain of $7,500. This transaction must be reported on your tax return.

To make matters worse, every time you use bitcoin to make a purchase, it has the potential to be a taxable event. Let’s assume you made a $5,000 bitcoin purchase in 2014. In 2017, you liquidate the bitcoins for $25,000 to purchase a car. Technically, this is a capital gain of $20,000.

As you can see, using bitcoin in your daily life has the potential to create a mountain of paperwork. For those who decide to conduct multiple transactions with bitcoin, it would certainly be a worthwhile idea to develop good recordkeeping habits.

Online Giant Amazon Has Passed On Cryptocurrencies As Payment

Out of all the potential technological problems and roadblocks that bitcoin will face over the course of the next several years, its biggest threat could come from the giant retailer known as Amazon. In 2016, Amazon amassed $94 billion in total sales. The company handles almost half of all American online purchases. It has an enormous presence across the entire globe.

Amazon is truly a juggernaut of the retail industry.

Despite offering a large variety of payment options, the company has steered clear of the digital currency arena. Its customers are unable to pay with bitcoin or any other digital currency.

Why has Amazon avoided digital currencies? What are they waiting for?

The most likely reason the company is bypassing bitcoin is due to the digital currency’s limited transaction speed. As we discussed previously, the blockchain technology allows for a maximum capacity of 5 to 7 transactions per second.

During Amazon’s 2017 Prime Day event, the company was handling over 600 transactions per second. Imagine for a moment if Amazon accepted bitcoin as a method of payment on Prime Day. This would have turned into a complete nightmare for Amazon. Customers would have been stuck waiting for hours for the bitcoin blockchain to approve their transactions.

Amazon prides itself on providing excellent customer service. Forcing customers to wait several hours in the checkout line is certainly not Amazon’s idea of a great customer service experience. Therefore, until bitcoin solves its scalability problem, it seems highly unlikely that Amazon will accept bitcoin as a method of payment.

Does This Mean Amazon Will Never Accept Cryptocurrency?

Most likely, the answer is, “No.” Eventually, the company will find a workable solution to the scalability problem. In fact, the most likely solution could involve Amazon creating its own digital currency.

Since its inception in 1994, the company has a history of disrupting industries by building a better mousetrap. For example, Amazon has completely disrupted the traditional retail industry by developing a superior online shopping experience for its customers. The company has also dramatically altered the publishing industry through its creation of the Kindle. e-reader.

If Amazon is capable of changing both the retail and publishing industry, the company is certainly talented enough to improve digital currencies. Based on Amazon’s previous track record, the company will probably develop its own digital currency.

At the end of the day, the biggest threat to bitcoin could emerge from Amazon. Of course, one could also argue that Amazon’s entry into the world of digital currencies could spark a new wave of enthusiasm in digital currencies. If so, bitcoin could benefit from an Amazon digital currency.

Certainly, bitcoin has enjoyed remarkable success during the past few years. It has easily exceeded the expectations of even the most optimistic bitcoin enthusiasts. However, bitcoin still has many threats and obstacles to overcome if it wants to become a legitimate medium of exchange.

2 Comments

Comments are closed.

This article presents the roadblocks to making purchases with Bitcoin very clearly, but has the ability to allow purchases ever fueled Bitcoin’s success? I’ve come to look at Bitcoin more like gold and less like dollars. Is Bitcoin’s rarity and rapidly increasing price not the core of its appeal?

That is correct that the fixed number of bitcoin to be released ever, and the slow, methodical release helps retain value. However, there are real challenges in a number of countries in purchasing bitcoin easily, there are wildly varied prices due to the lack of centralized exchanges and a number of regulatory hurdles in different countries. All likely to eventually resolve, but for now do represent real challenges.