- January 30, 2023

- Posted by: Shane Daly

- Category: Trading Article

Swing trading is a rather misunderstood trading style. While it is often associated with the length of time a trader holds onto a position, swing trades entail participating in one single swing in the market. To accomplish this, traders generally use trading indicators such as moving averages or oscillators to discern potential entry and exit points for a particular asset.

Advanced technical traders may also employ strategies like scalping or momentum trading during their swing trades. This could also include day trading around a swing trading position.

No matter what type of indicator is used, swing trading can be an exciting and rewarding way to make profits especially if you’ve latched onto a newly formed trend.

However, it does require skill and discipline to pull off successful trades on any given day.

Swing Traders – Price Action and Patterns

While the temptation to rely solely on technical indicators for swing trading signals is real, a trader must also possess some knowledge of price action and price patterns if they want to know how to properly read the market in real-time.

Technical indicators are great for providing direction and understanding market conditions using past price action, but they don’t show every big and small fluctuation, which can be crucial for recognizing important support and resistance levels.

Being able to perfectly assess risk and find the probability of future direction requires an understanding of the natural movements of price over the short, medium, and long terms. Having this kind of knowledge will enable you to get ahead of trends just before they start to move and also make more informed decisions when swing trading.

What Is Swing Trading And How Does It Work

If you day trade, you know that you are often prone to news events and a slip of the tongue from a politician that can send markets falling. Day trading can be a hectic way to make a living.

Swing traders aren’t as affected by the minor hiccups in price as intraday trading is prone to. While not a prerequisite, many swing traders will trade daily charts and come in after the closing price of the day has been reached. During this time, they can scan for setups that fit their trading criteria.

Essentially, within a larger trend in the market, there are smaller moves in both directions. Swing traders, depending on their trading approach, will look for either a reversal or continuation movement in price.

Many believe that swing trading is time-frame dependent. Unlike their conclusion, I look at swing trading as, essentially, trading a swing.

With a reversal, swing traders will look for a pullback in price. At some point, the pullback will end and the price will reverse. Traders will look to enter a trade in the direction of the reversal. Some traders will use the longer trend structure direction while others will use what price action on the short-term trend points to – a long or a short.

By being open to trading in both directions, traders can have twice the opportunities to trade depending on the trading strategies they use.

Swing traders aim for continuation which are a pause in the current direction. Once the price breaks from the pause and continues to move, a swing trader will look for a position.

Once in a position, the price is allowed to advance until either a profit target is hit, or momentum starts to reverse.

If there is adverse price action, swing traders will exit their positions as their original trade signal isn’t working out.

Understanding Swing Trading Indicators

Indicators come in three categories: Momentum, trend, and volume. All swing indicators will use either the price of the instrument and/or the volume of trading activity in the calculation.

Momentum indicators: Designed to show how strong price movement is. Can also be used to trade divergence and to measure overbought and oversold zones in an instrument. The most common momentum indicators are the RSI (relative strength index) and MACD

Trend indicators: These show the general direction of price, including lack of direction, and are generally moving averages of different lengths. These smooth out the price bar information on the chart and display it as a moving line on your chart. Moving averages are the most popular as are properly drawn trend lines. Traders will generally use exponential moving averages. The EMA will give more weight to the most current price making it react faster than the SMA (simple moving average) to the price.

Trading Volume Indicators: Shows the amount of buying or selling taking place at a moment in time on the chart. There is no best volume indicator but you need to be able to read low-volume and high-volume in the instrument.

Traders will design a trading strategy using none to all of these technical analysis indicators to help determine the time to buy or sell. As mentioned, knowledge of price action and the ability to read a chart is vital for a trader.

Best Indicators For Swing Trading

What I find to be the best may be different than what others suggest. The truth is, we are all right. If an indicator presents information for you that leads to successful trading and trading signals, then it is the best, for you.

I will present my opinion based on experience. Although my primary chart is the daily chart, these swing indicators can be used in any time frame and for position trading as well. Use this as a guide to perfect your technical approach to trading.

All swing traders identify what works best for them, their trading style, and their trading strategy.

As my trading evolved, I changed indicators and eventually got rid of most of them. From the best indicator list, you can design your swing trading strategy and keep in mind, that complex is not better than simple.

Use what you need, and discard the rest.

Trading Indicator #1. Moving Average – Decode Market Trends

There are many different averages you can use including simple moving averages, Hull moving averages, and weighted moving averages. All have different calculations but they need the one thing you can see on your chart, price bars.

Moving averages are used as a trend indicator, use the closing prices, and help smooth price volatility.

Which EMA is best for swing trading?

There is also the rabbit hole of different lengths. The most popular are the 10 and 20-period averages and you can use the EMA or SMA formula. My money has always been on the 20-period exponential moving average.

To determine the trend, we don’t need to rely on crosses of multiple moving averages. Looking at this chart, the only question you need to ask is, “what side of the moving average is the price generally on?” If you wait for a cross of price on the average, the slope of the average, or a moving average crossover, you will learn why they call these “lagging indicators”.

From the 20 EMA, we can see a few things. When the price pulls away from the average, we determine the volatility has picked up and could see at least a short-term trend reversal. Depending on price action, we may see exhaustion and short trade potential. We could also see the price pull back to an area around the moving average where a trader can look for a reversal back in the direction of the trend. Pullbacks make up some of the best swing trading strategies for most traders.

With an understanding of reversal chart patterns, traders could buy around the lows of the pullback. With an understanding of volatility as seen on the left, traders could sell around the high of the move. You won’t get the exact bottom or top of the swings but the meat in the middle is a good path to profits.

Trading Indicator #2. MACD

The MACD (moving average convergence divergence) is a momentum indicator that uses moving averages to determine momentum. While the standard MACD settings are 12,26,9, I prefer the 3,10,16 settings otherwise known as the 3-10 Oscillator.

With the MACD 3 10 settings, traders can use the fast line as a read on momentum and the slower line as a general trend direction. With the swings of the fast line, we can also determine if divergence is taking place on the chart.

I have marked the divergence with the letter “D”. Price makes a lower swing low while the indicator puts in a higher low. Swing traders would look for a price action that led trade entry to enter a long position.

The red lines show how momentum is used. The MACD fast line puts in a high which is higher than the recent swing highs on the indicator. This shows that there is momentum to the upside. Swing traders would consider that a strong leg up and look to take advantage of a further move to the upside.

In our example, the price has consolidated at the highs of the momentum move. Swing traders would be looking for a move to the upside from this tight trading range.

Using divergence and the fast line momentum swing is a good approach to this indicator. I never used the crossing of the lines as an indication of anything.

Trading Indicator #3. Bollinger Bands

The Bollinger Bands will show the volatility and momentum in the market. This is a popular trading indicator and it does have merit depending on how you use it.

Using three lines, the BB uses a standard deviation (2) calculation from the middle moving average, usually 20 periods.

The upper and lower band will contract and expand depending on the volatility of the market. The upper and lower bands are commonly referred to as overbought and oversold levels.

There are different ways to use the Bollinger Bands as a swing trading indicator. A good use for any technical indicator that uses bands or channels is to look for prices to engage with the bands.

With this chart, whenever the price pierced the upper or lower band, we would look for a pullback to around the midline. The issue becomes when volatility compression comes into the instrument.

Once the bands shrink and stay in the condition, a pullback no longer becomes viable as there is no price swing to exploit.

Swing traders would want to consider the formation of a trading range. Playing a breakout of the range for one clean swing would be the goal.

The effect where the price fluctuations for the bands to balloon apart is one reason I prefer Keltner Channels that use an ATR over using these bands. Some traders like this balloon effect as, to them, it tells them information about the market. I find it distracting.

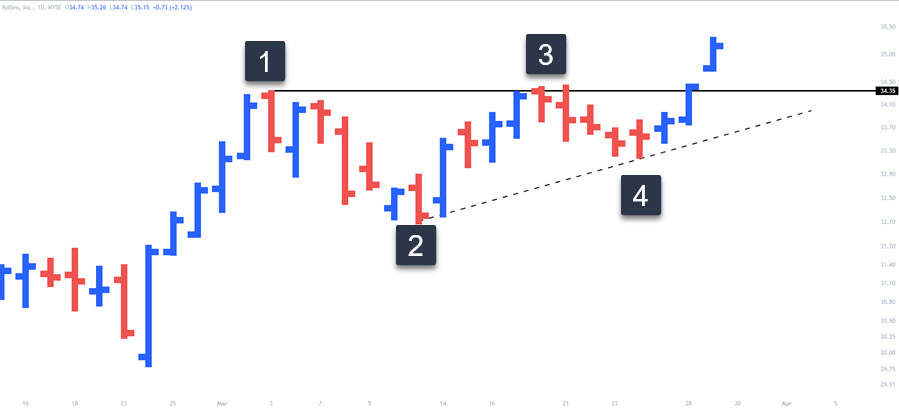

Trading Indicator #4. Price Patterns

While not an indicator in the traditional sense, price patterns do indicate certain conditions in the market. I suggest you spend time with this section.

Technical Analysis With Price

There are many chart patterns available for a swing trader to use with many different names. I don’t concern myself with the textbook definition of the pattern and consider most of them a consolidation in price movements.

Patterns look great in textbooks but reading them on the chart is a different story. To keep it simple, look for a pause in the advance or decline of price, connect the highs and lows of price action, and look for a break for a trading opportunity.

Notice I just have the 20 EMA to help frame the market trend. Can you build a swing trading strategy this simple?

Yes, you can.

You need to break down what your trading process will be from finding setups to managing risk.

See the black arrow? Do you need a momentum indicator to tell you something has changed? Probably not.

Learning to decipher price action clues during technical analysis, is a worthwhile skill to learn.

Swing Trading Indicators: Conclusion

With only a few swing trading indicators, you can define a trading strategy for any instrument whether trading stocks of currencies. Your selection will depend on your beliefs about the market.

My approach is to look for a momentum move in the market and then to get into the next swing if there is one.

If you go back to section four on the list, that is a fairly good representation of my approach.

One of the great things when considering swing trading as taking one clean swing is momentum can help manage risk.

When a swing trader sees momentum coming out of the current move, reducing risk by moving the protective stop loss helps avoid a full 1R loss.

Design A Strategy

While I could have broken all this down into a working strategy, there would have been a little benefit. There are enough tips in this article about what to look for and how to use these indicators. Your next step is to piece the parts together and ensure you cover risk protocols.

Feel free to go through our entire blog. There are too many articles to list that can get you on the path to designing a swing strategy for yourself.

3 Comments

Comments are closed.

Dear Shane,

Great presentation of a lesson for beginners and those traders who have been net losers for quite some time. It is so well-written and your explanations so clear and persuasive, that I shall keep the URL for this web page in my wallet to give to those who ask me what is a “swing trader” and what exactly do I do for a living?

Sam Barroqueiro, CFM

(Retired Stockbroker from Merril Lynch, E.F. Hutton, and Shearson Lehman Brothers)

How can I get these indicators?

They should be on every charting package