- October 26, 2022

- Posted by: CoachShane

- Category: Trading Article

Vertical Spreads in general are one of the most versatile tools that we have in our tool belt as traders. Credit Spreads in particular open up a world of opportunity to us because they can be done using either put options or call options. This gives us a lot of flexibility to trade in different market conditions.

We can use credit spreads on individual stocks as well as ETFs and they work well in both volatile markets and slow markets.

One of the things we love about credit spreads is that they offer better probabilities of success than just buying long calls or long puts. When done correctly, credit spreads can produce consistent returns over time which is why we think every trader should learn how to trade them.

Conservative Bearish Position – Call Credit Spread

A call credit spread is a bearish options strategy used when the investor expects a neutral to moderate decline in the price of the underlying asset. It is created by selling an out-of-the-money call option and buying an even further out-of-the-money call option.

The trade is opened for a net credit, which is the difference in premiums between the two options. The maximum profit is equal to the credit received, and it is achieved if the price of the underlying asset falls below the strike price of the short call at expiration.

The maximum loss is equal to the difference between the strike prices of the two options less the credit received, and it occurs if the price of the underlying asset rallies above the strike price of the long call at expiration.

Although this strategy limits profits in comparison to other bearish strategies, it also limits losses, making it a good choice for investors who want to take a conservative stance on a price decline.

When it comes to options trading, one question that often arises is whether to trade weekly or monthly options. There are pros and cons to both approaches, and the answer ultimately depends on the trader’s individual goals and preferences.

Should I Use Weekly or Monthly Options?

Weekly options offer a shorter time frame and can therefore be more responsive to changes in the underlying stock price. However, they can also be more volatile and less forgiving than monthly options.

For traders who are just starting out, we recommend using monthly options with 20-40 days left to the expiration date. This gives you a little more time to get comfortable with the strategy before moving into the more volatile weekly options.

Ultimately, it’s up to the individual trader to decide which approach is best for them. There is no right or wrong answer, but we always recommend new traders take the conservative approach when first learning to trade.

Building the Trade

The credit spread is a simple yet effective options trading strategy that can be used in almost any market condition. The key to success with this strategy is to choose the right options and to manage the trade carefully.

To construct a credit spread, the first step is to decide whether you will be using weekly or monthly options.

The next step is to select the strike prices for the options. We recommend selling the call option that has a 65% chance of closing out of the money and buying a call option that is further out of the money. We look to collect between 30-40% of the distance between the two strike prices. With proper management, this trade can provide a consistent profit.

How Much Can We Make

The potential for profit on this trade depends on the premium we received for selling the call credit spread.

If the premium was $.50, then the most we can make is $50 per spread. As long the underlying price stays below the strike price of the option we are selling, we make money.

Defined Risk Makes Life Easier

As soon as we place the trade, we know exactly how much we can lose if we are wrong. The most we can lose on this trade is the difference between the strike price minus the credit we received.

Imagine you sell a call credit spread that is $2.00 wide at $.50. Our risk is $2.00 – $.50 =$1.50 or $150.00/ contract. The most we can lose is $150.00 but the most we can make is $50.00.

Sound stupid to risk more to make less?

These trades have a higher probability of success and we have 5 ways we can make money. Also, we don’t let the reward risk get too skewed. For example, 1:2-3 is acceptable but a 1:5 ratio would be unacceptable.

Different Ways To Make Money

Having 5 ways to make a potential profit makes these some of the best options trades we like to do.

We earn a profit from a Call Credit Spread if the stock price rises, falls, or trends sideways–as long as the value doesn’t surpass the strike price of the option we sold. This is why we want to have a bearish outlook on the underlying asset.

Every day that passes and the options get cheaper, we make money. This is called time decay.

When volatility decreases, the options get cheaper and we look to close the position by buying the spread back at a cheaper price than we sold it at the opening.

Trade Management

Proper trade management is crucial to book profits on a trade. The only way to maximize profits is to hold the trade until expiration, but that is not always practical.

The next best thing is to close the trade early when 50-75% of the maximum profit has been achieved. For example, if a trader collected $.70 to open a trade, they would look to close the trade by buying it back for $.17-$.35, which would allow them to keep 50-75% of the original $.70 profit.

By managing trades in this way and not looking for home-run trades, traders can increase their chances of booking profitable trades.

Trade Example

Using SPY, we determine that we want to place a neutral to bearish position using a Call Credit Spread. We go with the Oct 16 monthly options that have 15 days left to expiration

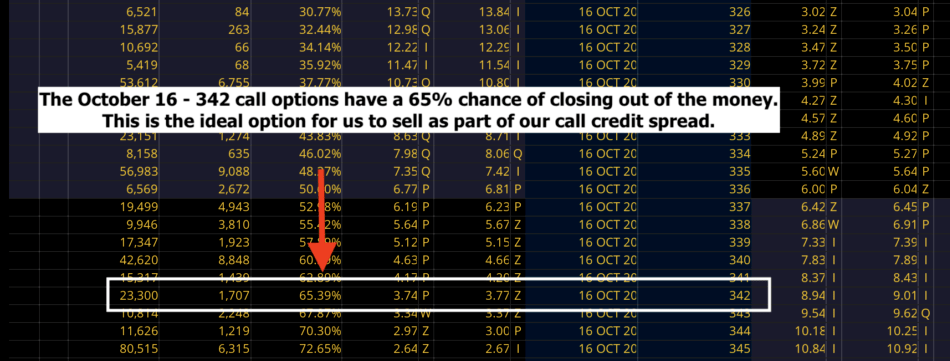

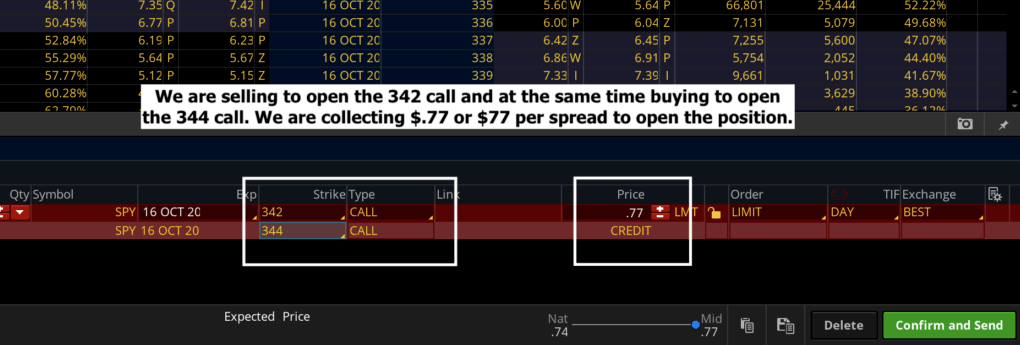

We go to the 342 out-of-the-money call option that has a 65% chance of closing out of the money and sell that option as part of the spread.

We will also buy the 344 call at the same time to make sure we are in a risk-defined trade.

There is a $2 difference between the strike prices which means we want to collect between $.60 and $.80 as that will allow us to collect between 30-40% of the $2 difference between the strikes.

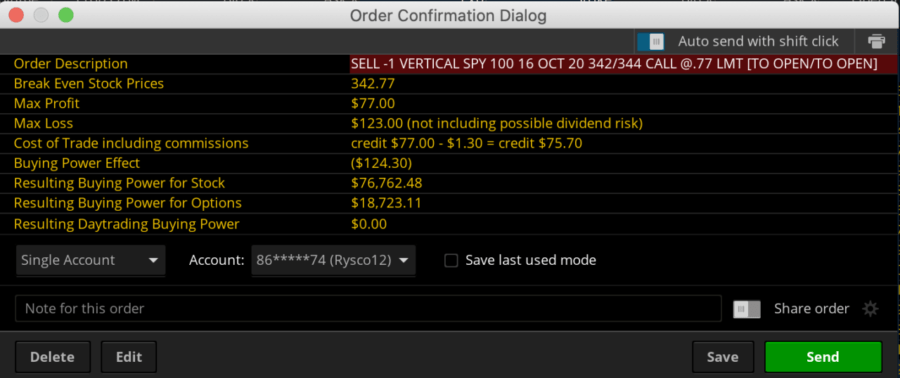

Selling this spread to open for $.70 will allow us to collect $70 per spread. This $70 is the most we can make on the trade.

Our max risk on the trade is $1.30 or $130 per spread which is calculated by taking the $2 difference between the strike prices of the options and then subtracting the $.70 that we collected to open the trade.

Our breakeven point on this trade is $342.70. This is calculated by taking the 342 call strike of the option that we are selling and adding on the $.70 that we are collecting to open the trade.

If SPY moves higher, lower, or sideways, we will make money as long as the stock price stays below $342.70.

We also make money from time decay adding up and from volatility decreasing.

While we could hold to expiration hoping to keep the full $.70 or $70 profit per spread, we don’t like the risk of holding to expiration. We prefer to close the trade out early when we can keep between 50-75% of what we collected to open the trade.

In this case, we would look to buy the spread back for between $.17-$.35. While the maximum gain would be nice, there is something to be said for ensuring you bank a big percentage of the potential

Using proper position sizing is crucial on this trade.

These have good profit potential and the odds are high that we will make money, but it’s still just an individual trade that could win or lose for us. Using large amounts of capital on one big trade is the wrong way to approach your trading.

We recommend keeping the risk on each trade at between 2-5% of your account.

If you do have a losing trade, using this conservative approach, it’s not going to wipe your account out. If you get your sample set of trades big enough you will make money over time.

Quick Faqs

1. A call credit spread is bearish to a neutral options strategy that involves selling an out-of-the-money call option and buying an out-of-the-money call option with the same expiration date.

2. The goal of this trade is to collect the premium (the difference between the two options’ strike prices) and hope that the stock price stays below the breakeven point.

3. The maximum profit is the premium collected when entering the trade. The maximum risk is the difference between the strike prices of the two options minus the premium collected.

4. It is important to use proper position sizing and risk management when trading call credit spreads.

5. This trade benefits from time decay and volatility decreasing. It is often closed out early to keep a portion of the premium collected.

Wrap Up

When trading options, you have to be prepared for anything the market might do. The Call Credit Spread is a great way to place a more bearish trade while still having potential for profit and minimizing risk. You’ll have a good probability of success with the trade, and the position will be far more forgiving.

To make money, you don’t need to be perfect in your market direction. It’s a much less stressful method than other methods, which is why it’s a go-to strategy for most successful options traders.

Your Free Guide

Ready to trade two of the world’s most high-performing markets?

Our One Day Options Trading Strategy gives you the opportunity to enter and exit the market the very next day. You’ll have immediate access to this valuable information, so you can start trading right away.

These markets are known for their high potential profits. With our unique strategy, you can maximize your earnings while minimizing your risk.

Download our Two Favorite Markets Plus Our Unique One Day Options Trading Strategy now! Absolutely free.