- January 9, 2025

- Posted by: Shane Daly

- Category: Trading Article

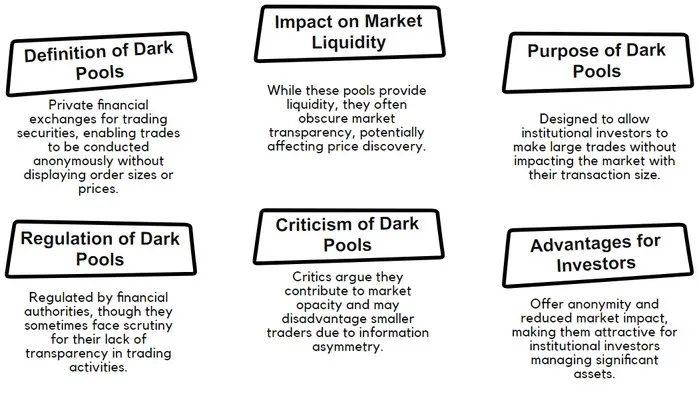

A dark pool is a private financial exchange where institutional investors can trade large blocks of securities away from public markets. These traders use these venues to execute significant trades without causing immediate price movements that typically occur on traditional exchanges. Think of it as a private marketplace where big players like mutual funds and pension funds can buy or sell massive amounts of stocks anonymously.

While dark pools operate under SEC regulations, they offer less transparency than public exchanges, which helps protect sensitive trading information. Understanding how these private venues function reveals fascinating perspectives into modern market dynamics.

TLDR

- Dark pools are private exchanges where institutional investors can trade large volumes of securities without public visibility.

- They operate outside traditional stock exchanges, allowing anonymous trading to prevent market price impact.

- Prices in dark pools typically mirror public exchanges, often using the midpoint price as a reference.

- Major users include hedge funds, pension funds, and investment banks seeking to execute large trades discreetly.

- Trading in dark pools accounts for approximately 14% of market volume and helps minimize price disruption.

Understanding Dark Pool Trading

In the financial markets, dark pools operate as private exchanges where large institutional investors can trade securities away from the public eye. These alternative trading systems serve a important purpose in modern markets, particularly for executing large block trades without disrupting public market prices.

They offer several appealing advantages for institutional strategies.

- They provide much-needed anonymity, allowing large traders to execute substantial orders without revealing their intentions to other market participants.

- You’ll find that transaction costs are typically lower in dark pools, and the reduced market impact can lead to better execution prices.

- Through broker-dealer networks and electronic communications systems, dark pools match buyers and sellers based on sophisticated algorithms and precise order-matching mechanisms.

The private nature of dark pool trading helps prevent information leakage and protects against front-running, making these venues particularly attractive for pension funds, mutual funds, and other institutional investors seeking to minimize their market footprint while maximizing execution quality.

Core Features of Dark Pools

At their core, dark pools operate through automated order execution systems that match trades internally without manual intervention, utilizing sophisticated methods like crossing networks and VWAP matching to improve results.

One of the most distinctive characteristics in dark pools is their emphasis on anonymity and price protection. When you analyze large institutional trades, you notice how dark pools effectively shield these transactions from public view until execution, helping prevent adverse market impact and maintaining price stability.

You’ll find that traders can use various trading strategies through multiple order types, including market, limit, and iceberg orders, each serving specific purposes in trade execution.

The technological infrastructure supporting dark pools has evolved significantly, incorporating AI and machine learning to boost efficiency. While traditional exchanges display their order books publicly, dark pools maintain confidentiality by linking their prices to public exchange rates, typically using the midpoint between best bid and ask prices.

Understanding win-loss ratios in trading systems becomes important when executing large block trades through dark pools, as it helps institutions measure and optimize their trading effectiveness.

Market Impact and Price Discovery

How do dark pools influence market dynamics and price discovery?

These “alternative trading venues” have a complex relationship with market behavior, primarily through their ability to mask large trades from public view. When institutional investors execute substantial orders through dark pools, they can significantly reduce immediate market impact and prevent dramatic price swings that might occur on public exchanges.

In the analysis of market volatility, dark pools can both stabilize and destabilize markets, depending on trading volumes. While they often help reduce price volatility by allowing large trades to execute without causing market disruption, I’ve seen that excessive dark pool activity (particularly above 14% of total trading volume) can actually harm market stability and price dynamics.

Dark pool volume during the AMC pump actually hit 70%!

Through my experience studying these, I’ve found that dark pools contribute to price discovery in somewhat contradictory ways. They can improve efficiency by reducing noise in the price process and minimizing the impact of uninformed trading, but their lack of transparency can also make it challenging for retail investors like you and I to access accurate pricing information and make fully-informed decisions.

Key Players in Dark Markets

Major institutional investors dominate the dark pool trading world, with hedge funds, mutual funds, pension funds, and investment banks serving as the primary participants.

Firms like Renaissance Technologies, BlackRock, and Goldman Sachs utilize these for anonymous transactions, often seeking to minimize market impact while executing large trades.

High frequency traders, including companies like Virtu Financial and Citadel Securities, play a important role as liquidity providers in dark pools.

These sophisticated players use complex trading strategies and advanced technology to take advantage of price inefficiencies, helping maintain competitive pricing across venues.

Their presence is actually important in facilitating quick order matching and narrowing bid-ask spreads.

Corporate participation adds another layer to dark pool market dynamics, with major companies like Amazon and Apple using these for strategic purposes.

These corporations capitalize on dark pools primarily for stock buybacks and large-volume transactions, carefully managing their market footprint while optimizing execution costs.

Their involvement, alongside institutional investors and high-frequency traders, creates a complex ecosystem of participants seeking efficiency in anonymous trading environments.

Risks and Regulatory Concerns

While dark pools offer certain trading advantages, they present serious risks including market manipulation threats and challenges in regulatory oversight that we must carefully consider.

The lack of transparency in these private exchanges can lead to price discovery issues, making it difficult for investors to determine fair market values and potentially creating disparities between dark pool prices and public exchanges.

Setting SMART trading goals can help investors deal with the complexities and risks associated with dark pool trading more effectively.

As a market participant, you should understand that these concerns have prompted increased regulatory scrutiny, particularly regarding the enforcement of trading rules and the prevention of predatory practices like front-running.

Similar to how true range calculation provides clarity in traditional markets, dark pools would benefit from enhanced price transparency mechanisms to better reflect actual market behavior.

Market Manipulation Threats

Despite rigorous regulatory oversight, dark pools present significant market manipulation risks due to their inherent lack of transparency and limited regulatory supervision.

These private trading venues can create opportunities for sophisticated players to exploit information, potentially leading to price distortions and unfair trading practices that undermine market integrity.

| Manipulation Risk | Impact | Regulatory Challenge |

|---|---|---|

| Hidden Trading | Distorted Pricing | Limited Oversight |

| Information Asymmetry | Unfair Advantage | Difficult Detection |

| Price Manipulation | Market Inefficiency | Inadequate Monitoring |

| Front-Running | Investor Losses | Enforcement Gaps |

| Systemic Risk | Market Instability | Resource Constraints |

The need for regulatory reforms has become increasingly apparent as we witness cases like the Barclays Dark Pool Scandal, which exposed serious vulnerabilities in the system.

While dark pools serve legitimate purposes in executing large trades without market impact, their lack of transparency creates fertile ground for market manipulation.

Oversight Enforcement Challenges

Regulatory agencies face three critical challenges in overseeing dark pool trading venues: limited transparency, complex monitoring requirements, and enforcement difficulties.

When you examine the oversight challenges, it’s clear that the absence of a publicly available order book and real-time trade data makes it difficult for regulators to detect market manipulation and unfair practices.

The enforcement issues become more clear when we look at high-profile cases like Barclays and Credit Suisse, where significant penalties were imposed for misusing dark pool data. These cases highlight how the secretive nature of dark pools can hide improper activities from immediate regulatory detection.

While the SEC and FINRA have strengthened their surveillance systems and mandated more thorough disclosures, the complexity of monitoring high-frequency trading and internalization within dark pools remains a challenge.

Regulators are making progress through improved disclosure requirements and regular audits, but the fundamental lack of transparency of dark pool operations continues to create barriers to proper oversight.

The balance between maintaining confidentiality for institutional investors and ensuring adequate regulatory supervision is still a critical industry concern.

Price Discovery Issues

A fundamental concern with dark pool trading is its potential to disrupt efficient price discovery mechanisms in financial markets.

| Aspect | Traditional Exchanges | Dark Pools | Impact |

|---|---|---|---|

| Price Formation | Open bidding | Use reference prices from public markets | Potential information asymmetry |

| Trading Volume | Fully visible | Substantial volume hidden | Difficulty in aggregating accurate price information |

| Price Discovery | Direct contribution | No direct contribution | Reduced overall informational efficiency |

| Trader Composition | Mix of informed and less-informed | May concentrate less-informed traders | Potential for exploitation by high-frequency traders |

| Order Book | Public | No public order book | Challenging to assess true liquidity and fair pricing |

| Market Impact | Can be significant for large trades | Reduced market impact | Beneficial for large trades, but can lead to price distortions |

| Execution Price Assessment | Relatively straightforward | Complicated | Difficulty in determining ideal execution prices |

Let me explain why all this matters: when price discovery is compromised, you might not be getting the most accurate market prices. The lack of a public order book makes it challenging to assess true liquidity and fair pricing.

While dark pools serve a legitimate purpose in reducing market impact for large trades, we must recognize that they can lead to price distortions and complicate the process of determining whether traders are receiving ideal execution prices.

Modern Trading Landscape Changes

The digital revolution in financial markets has fundamentally transformed how we trade, with electronic platforms and algorithmic systems now dominating the our trading world.

Dark pools came on as a significant force within this evolution, offering institutional investors new ways to execute large trades while minimizing market impact and information leakage.

As markets continue to evolve through technological advancement, we’re witnessing an intricate interplay between traditional exchanges, dark pools, and automated trading systems that shapes today’s complex trading environment.

Digital Revolution Reshapes Markets

Over the past decade, technological advancements have transformed the trading landscape, shifting markets from traditional floor-based operations to sophisticated digital platforms.

This digital transformation has democratized market accessibility, allowing traders of all backgrounds to participate in previously exclusive trading environments through user-friendly interfaces and automated systems.

I’ve seen how the integration of artificial intelligence and machine learning has changed market analysis, enabling traders like you to process vast amounts of data in real-time.

The emergence of blockchain technology and smart contracts has further improved transaction security and transparency, while electronic trading platforms have significantly reduced operational costs and execution times.

As someone that is involved in the markets, I can see that this evolution has created both opportunities and challenges.

While algorithmic trading and automation have improved efficiency, they’ve also introduced new forms of market volatility that require careful navigation.

Success in today’s markets needs a blend of technological proficiency and traditional trading wisdom, as we continue to adapt to an increasingly digitized financial ecosystem.

Dark Pools Transform Trading

Modern trading landscapes have been reshaped by dark pools, private exchanges where institutional investors can execute large trades anonymously without impacting public markets.

I’ve seen (AMC for one) how these provide significant institutional advantages through their ability to handle massive transactions while maintaining trading anonymity, shielding price-sensitive information from the broader market.

In an analysis of dark pool operations, I can tell you that they’ve become increasingly sophisticated, employing advanced electronic trading platforms and algorithmic systems to optimize trade execution.

When you look at how they function, you’ll see they match buy and sell orders internally, often breaking down large trades into smaller pieces to minimize market impact.

This fragmentation process, combined with real-time data access and AI integration, has transformed how institutional investors approach large-scale trading.

What’s particularly interesting is how dark pools maintain fairness through price-pegging mechanisms while operating under SEC regulations as Alternative Trading Systems.

While they’ve improved market efficiency for large players, we must acknowledge that they’ve created an information asymmetry between institutional and retail traders. We know who always wins in the end and it isn’t the retail trader.

Your Questions Answered

How Long Does It Typically Take to Execute a Trade in Dark Pools?

Execution speed in dark pools varies significantly, ranging from milliseconds to several minutes, depending on order size, market liquidity, and trade efficiency mechanisms used to match buyers and sellers.

What’s the Minimum Trade Size Required to Participate in Dark Pools?

Minimum trade sizes in dark pools vary by venue and jurisdiction, though traditional requirements have diminished. While some regions propose minimums like Canada’s 5,000 shares, many now accept trades below 150 shares.

Can Retail Investors Access Dark Pools Through Specialized Trading Platforms?

Most retail investors cannot access dark pools through specialized trading platforms, as these access methods are typically restricted to institutional clients and professional traders with significant capital.

Do Dark Pools Operate 24/7 or Follow Standard Market Hours?

Dark pools typically follow standard market hours, aligning with public exchanges. While trading technology enables extended-hours trading through some brokers, most dark pool operations remain restricted to regular market hours.

What Percentage of Global Stock Trading Occurs Through Dark Pools?

Dark pools account for approximately 13.75% of US equity trading and 7.5% of European markets, offering advantages like reduced market impact for institutional investors executing large trades.