- April 23, 2024

- Posted by: Shane Daly

- Category: Trading Article

Inflation is primarily caused by four key factors: cost-push inflation, which occurs when production costs rise; demand-pull inflation, resulting from high consumer demand; monetary devaluation, triggered by oversupply leading to currency depreciation; and changing consumption patterns.

Understanding Inflation Basics

What exactly is inflation?

Simply put, inflation is the rate at which the price of goods and services increases over time. It’s a measure of economic change that impacts every consumer and business, often reflected in the Consumer Price Index (CPI). This index measures the average cost of living, tracking price changes in a standard ‘basket’ of goods and services.

A more stable measure, core inflation, excludes volatile prices such as food and energy. It provides a clearer picture of underlying inflation trends. Additionally, the GDP deflator calculates the overall inflation rate for a country, considering the prices of all goods and services produced.

A more stable measure, core inflation, excludes volatile prices such as food and energy. It provides a clearer picture of underlying inflation trends. Additionally, the GDP deflator calculates the overall inflation rate for a country, considering the prices of all goods and services produced.

Inflation is a dynamic concept, influenced by a bunch of factors and reflecting changing consumption patterns. The CPI adapts to these changes, ensuring it accurately represents the cost of living. However, understanding the basics of inflation, from the CPI to the GDP deflator, is crucial for interpreting its impact on the economy.

Different Types of Inflation

In examining inflation, we identify several types, namely Cost-Push Inflation, Demand-Pull Inflation, and Monetary Devaluation, each characterized by unique triggers and effects on the economy.

| Type of Inflation | Cause | Catalyst or Consequence |

|---|---|---|

| Cost-push Inflation | Increase in production costs (e.g., raw materials and labor). | The uptick in commodity prices (like oil and metals) driving up the cost of goods and services. |

| Demand-Pull Inflation | Robust consumer demand outpacing supply. | Economic expansion and heightened consumer confidence lead to price surges due to constrained supply. |

| Monetary Devaluation | Oversupply of money in the economy. | Depreciation in the currency’s value over time propels inflation. |

Understanding these different types of inflation provides a perspective on how inflation can occur and the various factors that can trigger it.

The Role of Monetary Policy

Central banks use monetary policy as a powerful tool in managing inflation rates, utilizing strategies such as adjusting interest rates and controlling the money supply. These monetary policies are crucial in influencing inflation rates and are often dictated by the Taylor Rule, providing a framework for central banks to make adjustments based on inflation and economic conditions.

When interest rates are set low, this typically stimulates economic growth. However, too rapid of an increase in the money supply can lead to inflationary pressures.

When interest rates are set low, this typically stimulates economic growth. However, too rapid of an increase in the money supply can lead to inflationary pressures.

In the United States, the Federal Reserve plays a key role in this process. By adjusting the federal funds rate, the Federal Reserve can control inflation and keep it within a targeted range. Nevertheless, the relationship between interest rates and inflation is complex. Changes in interest rates can impact borrowing, spending, and investment decisions, and consequently, the overall inflation levels.

In essence, the role of monetary policy in managing inflation rates is a delicate balancing act. Central banks must carefully manipulate interest rates and the money supply to maintain stable economic conditions and prevent excessive inflation.

Key Measures of Inflation

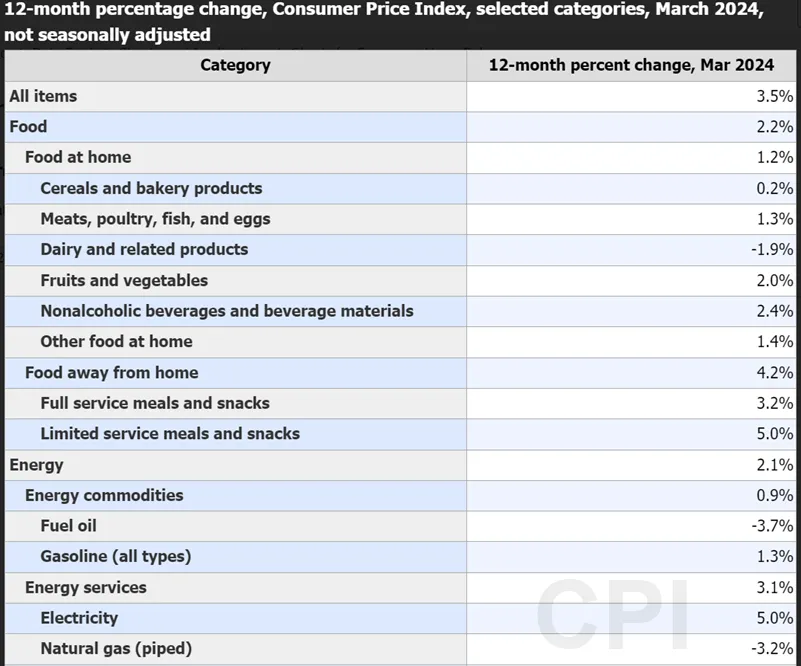

Understanding the level and rate of inflation in an economy requires the use of measures such as the Consumer Price Index (CPI), Producer Price Index (PPI), GDP Deflator, and Personal Consumption Expenditures (PCE) Price Index. The CPI measures the average cost of a fixed basket of goods and services typically purchased by households. This data helps you understand how inflation impacts the purchasing power you have.

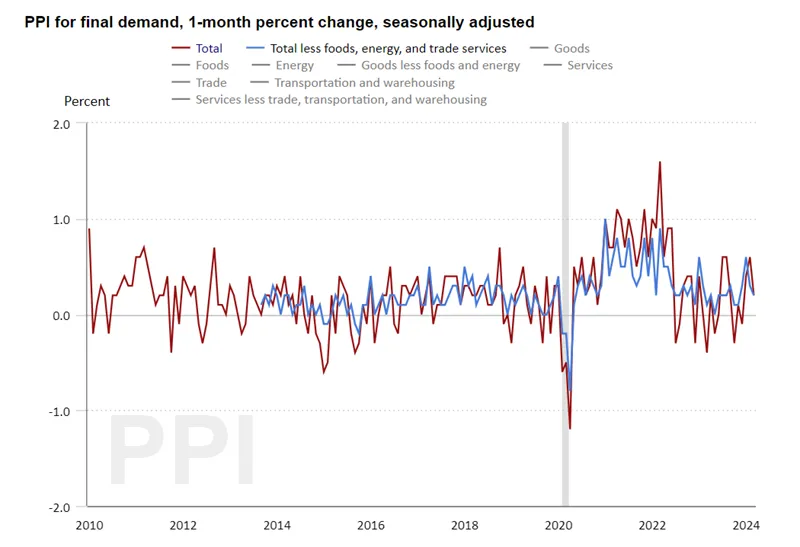

The PPI is another important indicator that tracks changes in prices received by domestic producers for their output. This index provides insight into inflation from the perspective of producers.

The GDP Deflator reflects price level changes in the economy as a whole and is instrumental in calculating real GDP.

Lastly, the PCE Price Index includes both goods and services consumed by individuals. It is extensively used as a key measure of inflation by the Federal Reserve. These key measures of inflation collectively provide valuable insights, aiding policymakers and economists in assessing the impact of price changes on consumers, producers, and the overall economy.

Strategies to Combat Inflation

To manage and mitigate the adverse effects of inflation, various strategies can be used, including contractionary monetary policies, fiscal policies, supply-side policies, wage and price controls, and the targeted use of inflation rates by central banks.

- Contractionary Monetary Policies: Central banks can raise interest rates to reduce the money supply in the economy which curbs inflation.

- Fiscal Policies: Governments can choose to reduce public spending or increase taxes, thereby decreasing the amount of money in circulation and reducing inflationary pressures.

- Supply-side Policies: Encouraging increased productivity and efficiency can reduce production costs, which can help control inflation.

- Wage and Price Controls: During periods of high inflation, governments can implement wage and price controls to prevent rapid increases that can exacerbate inflation.

Central banks can employ inflation-targeting strategies, setting specific inflation rate targets and adjusting monetary policy to meet these targets. This can provide stability and predictability for businesses and consumers, assisting in managing inflation expectations.

Using these strategies, governments and central banks can work to stabilize the economy and mitigate the potentially damaging effects of inflation.

Beneficiaries of Inflation

While inflation can pose significant economic challenges, it is important to note that certain entities and individuals stand to benefit from it. Companies, for example, can benefit from inflation as it allows them to charge higher prices for their goods and services. This leads to increased profits, provided that their costs don’t rise at the same pace.

Another group that benefits are individuals with adjustable-rate debt. As prices rise, the real value of their debt diminishes, making it less of an issue to repay. This scenario is a clear advantage of inflation to debtors, especially when the inflation rate surpasses the interest rate.

Real estate owners also stand to gain during periods of inflation. As prices increase, so does the value of property and the rental income that owners can earn from it. This elevation in property value and potential rental income can provide real estate owners with a significant financial cushion.

Negative Effects of Inflation

Despite the potential benefits to certain groups, inflation also carries several negative effects, particularly for fixed-income earners and lower-income individuals.

- One of the major disadvantages of inflation is the erosion of purchasing power. This particularly affects fixed-income earners, as their real income diminishes over time due to the rising costs of goods and services.

- Inflation can also cause economic instability. When prices increase rapidly, it creates uncertainty in the economy, leading to reduced spending and investment, which can slow down economic growth.

- Another negative impact of inflation is on savings and fixed interest rates. As the prices of goods and services increase, the value of savings decreases. Additionally, lenders who provide loans at fixed interest rates receive less valuable returns as the value of the repaid money decreases due to inflation.

- Lower-income individuals are hit the hardest by inflation. These individuals often struggle to adjust to the increased costs of basic goods and services, leading to a lower standard of living. Managing the rate of inflation is crucial for the health and stability of the economy.

Summary

To sum up, inflation is a multifaceted economic phenomenon influenced by numerous factors, especially monetary policy. Understanding its causes, types, and effects is important for economic stability and growth.

The use of strategies like the Taylor Rule by central banks can mitigate inflation risks. Despite the drawbacks, carefully managed inflation can also offer benefits.