- March 10, 2020

- Posted by: Shane Daly

- Category: Trading Article

I personally find the stories of traders such as those found in the Market Wizards books such an enjoyable read. Even better are the stories from those that were in the trading trenches long before we had the technology that we do today.

Even many of the popular trading indicators of today were not in use back when many traders were making serious bank trading. Trading with MACD started in the 70’s while Bollinger bands saw the light in the 80’s.

A lot of what these indicators show was seen by these traders just by looking at a price chart.

This is a far cry from traders of today who are always looking for the best indicator and often times, have charts with so many indicators that price bars are impossible to see.

I find the “old timers” quite inspiring and the trading wisdom they pass along is unmatched.

Which brings me to Richard Donchian.

Wisdom Of A Trading Legend

Donchian started dabbling in trading during the late 20’s and he lost money during the crash of 1929 just like many other traders. The difference was that he didn’t just quit. He went onto the study of technical analysis where he eventually developed an approach that is in use today, trend following.

His system was based on moving averages but unlike many who dabble in trading today, he had trading rules and guidelines that dictated how he traded.

Over the next several trading posts, I am going to highlight some of guidelines and thoughts that Richard Donchian had that I have found immense guidance from over the years and as I continue to develop as a trader. Some of them you have probably heard of, perhaps tried and discarded (jumping from concept to concept is a plague in this business), and others that may be new to you.

Trading wisdoms from Richard Donchian were published in the early 30’s and have stood the test of time.

1. Breaks of trend lines

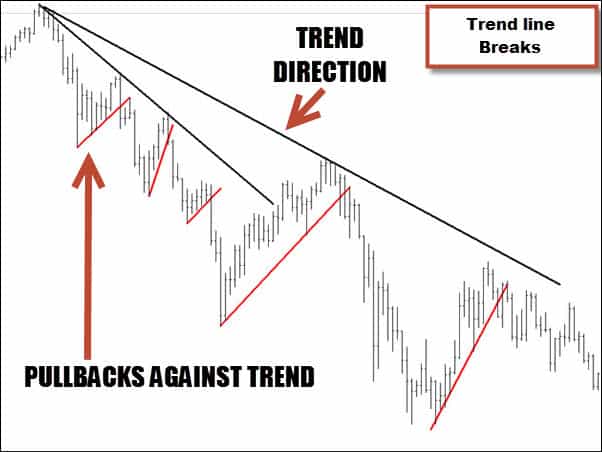

When trend lines that run counter to the major trend break, these are often great signals to take a position and are also often used to exit positions for those that trade counter to the major trend.

This chart shows the major trend using a trend line that is to the downside. During a trending move , we can expect pullbacks against the major direction and trading these pullbacks is a very popular method of trading. These pullbacks can be classified as mini-trends inside of the bigger trend. The issue becomes when is the time to enter.

Using trend lines that highlight the move back can show when price violates the smaller term move in an effort to resume the major move. Traders may place positions when the trend line break occurs or, by using a smaller time frame, they wait for a pause and a small range in the price action and enter their position inside of that. Stops are usually placed just outside the extreme of the pullback and just outside of the noise of the market.

2. Trend line crawl

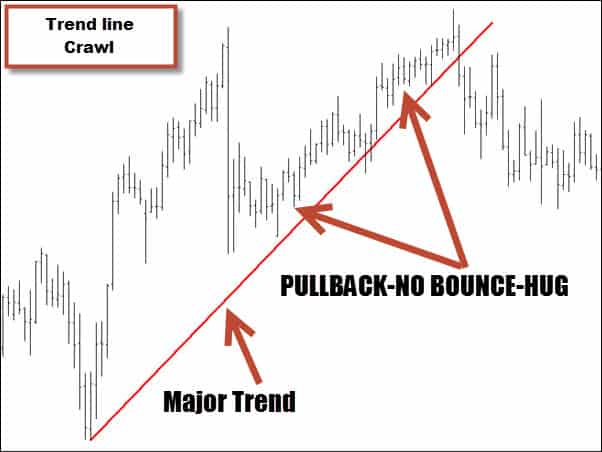

I didn’t have a better way to describe this guideline and it expands upon the trend line breaks that were just covered. This time we are getting a heads up that the trend may be about to turn. This is applicable to micro trends all the way to the long term position trading trends.

Price pulls back to the trend line and to see the trend stay intact, we would expect to see price bounce away from the trend line. In the one hour chart below, what happens tells a very important story.

-

- Pullback

- No strong bullish interest

- Price is hugging the trend line

It takes about 3 days and price is not showing much momentum to the upside as price simply trails up the trend line. Price breaks the trend line with what appears to be momentum and after a valiant fight, the bulls lose the battle and what you can’t see on this chart, price plummets.

Often times what can happen especially on the longer term trend lines is there are so many stops set under every low/high, that stops can cascade when the trend line breaks. When that happens, many people are caught on the wrong side and their exiting their trading position just adds fuel to the already gassed up price move.

The astute trader can make some huge gains in a short span of time when this occurs.

3. Let the profits run and cut the losses

This one is not new for anybody but many traders do the exact opposite.

Being in a profitable trade can be exciting but often times traders will take the profits without having a planned exit strategy. Perhaps it’s the fear of losing. Perhaps it is the excitement of turning paper profits into realized gains. Whatever the reason, taking profits outside of a risk reduction strategy or a set exit is a big reason why many traders never make a fraction of what the market is willing to give.

Adding to the problem is having a trade go against you and instead of taking action to limit losses, traders hope the price will return. Sometimes it does and you can exit for scratch. Often times it does not and your predetermined stop loss is forgotten as you hold on only to see your loss become a multiple of what you intended.

We know letting winners run is important and the question is when do you take profits? There are a multitude of ways including patterns and trailing stops but you have to find one that fits you as a trader.

The trading systems the Netpicks offers actually come with predetermined profit exits (plus stop losses) so it does take the guesswork out of the all important question…“when to exit”.

This is just some of the trading wisdom that I have found useful from Donchian and in future posts, I will expand on a few more that you may find of interest.

1 Comment

Comments are closed.

I always like to read a quality content having accurate information regarding the subject and the same thing I found in this post. Nice work.!!!!!!!

Equity tips