Gain futures have some very unique properties that make them very good to day trade. However, many people don’t understand the market or are so locked into the typical markets that they are familiar with.

For example, everyone seems to want to trade The ES or S & P Emini or the NQ (Nasdaq) or YM (Dow). This is because they hear and see about how it does each day. The nightly news tells you if the DOW went down 100 points or that the S&P gained 1 %.

You don’t hear how much Corn, or Soybeans or Wheat when up, unless it is dealing with a related story about food costs going up because the Grain prices are going up.

How are grain futures traded?

They are traded almost exactly like all of those other futures I mentioned and that you are familiar with. They are traded on the same Exchange the CME out of Chicago. They are traded in 5,000 bushels and move in ¼ tick increments at $12.5 a tick. This price action is exactly the same as the ES.

One contract per point (4 ticks) is worth $50. So, you see it can be traded just like a market that you are familiar with. However, there are some major differences in how it trades that make it very nice for the retail trader.

These are some of the key differences.

- The Market does not respond to the typical US market news like a Jobs report or the Fed statement. This means that it is not correlated with the US market and so you can trade it and not worry about someone giving a speech or many of the news events that move the US market up or down.

- Diversified markets. You can trade Corn, Soybeans or Wheat. You can pick the best one that is giving you the best trading signals. They trade differently and respond more to weather news or crop reports. So, you want to get educated on the market you are looking to trade and know which contract month to trade.

- Trading hours. They use to start trading at 0830 CST and end about 2:00 CST. However, now with electronic trading. They trade from 5 PM CST to 2 PM. They still have the big surge of traders at the old “Pit Open” at 0830 CST, but now the market is only closed for about 3 hours in the afternoon and they are open all night and all morning.

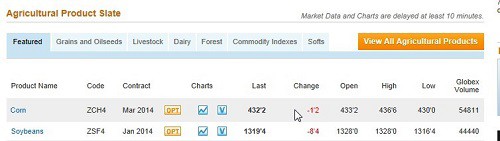

I talked about getting to know your market. Everything you need to know about the market and volume and current contracts are on the CME site. www.cmegroup.com Look at the chart above from the CME site and you can see that Corn is trading the March 2014 contract and the volume is about 55,000.

This way you know the exact symbol to use for each market and then the current month with the most volume.

You will also want to pay attention to some of the Agriculture news, unlike the standard US market or world news. Often the market will start a nice trend, based upon expect crop reports or if there are some major storms that might affect the harvest of various crops. That is one of the very nice things about Grains.

They trend very well and move in large waves. This is a good site for news on Crop reports and Harvest reports. www.agweb.com

So, take a look at a market that gives you great diversification, non correlated with US markets, and one that trends better than many of the standard US Markets.

It is easy to trade and with a little bit of education on the market. I think you will find that you can make a great living just trading the Grains.