- December 9, 2021

- Posted by: Shane Daly

- Category: Trading Article

Gold and silver are the most talked about metals but we can’t forget about copper.

Copper is used in everything from smartphone and computers, to infrastructure and electric vehicles.

In fact, some are calling copper “the new oil” givens it’s role in electric vehicle batteries. We just saw; “U.S. government to end gas-powered vehicle purchases by 2035 under Biden order”. With over 650,000 vehicles and a purchase of 50K on average a year, those are big numbers. I expect other countries will follow suit.

We all know the push to a “green economy” is pushing forward. With the infrastructure changes taking place as well as the EV market increasing, copper could be more in demand.

Copper is less expensive to own than gold or silver and could be a good place for a trader interested in metals, to start to look.

Who is Dr. Copper?

That is actually an inside nickname given to copper because of the way in can “predict” turning points in the economy.

With its “Ph.D. in economics” and it’s widespread use in some many sectors, it’s demand is a reflection of the contraction or expansion of the economy.

- If copper orders are dropping or being cancelled, it can point to big projects being put off and less workers are needed

- An increase in orders, we see big projects moving forward which will require more people on the job

A study by ABN AMRO Dutch Bank in 2014 showed a strong correlation between the price of copper and world trade/growth. It can give a rough idea about the shape of the economy but it is not infallible.

Keep in mind that prices also rise and fall on the basis of supply and demand. A shortage of copper will increase the price even when orders for the metal are slowing down. You would not want to base all your decisions on the price of copper.

But that brings up an important question; Is there a risk of low supply?

Is Copper Scarce?

The International Energy Agency (IEA) is ringing the alarm bells about the supply of copper.

Over 40% of the mined output of copper comes from two countries, Peru and Chile. The largest copper mine in the world is in Chile and is thought to have reached “peak production”. There are other deposits being explored, most notably in the Congo, and is projected to become the largest mining operation in the world.

The world is going to need it.

The most used metal in renewable energy is copper. Any project that is related to energy, including the retrofit of existing infrastructure, will depend on the use of copper for a variety of reason including how effective it conducts electricity. It is not hard to see how the demand for copper is set to rapidly increase while the supply fails to easily meet the demand.

Goldman Sachs predicts that in the next ten year, we are looking at a 600% increase in the demand of copper. For the end of 2021, GS is projecting copper pricing to be $5/lb. As of this writing, the price is $4.33

There are signs pointing to a bullish overtone for copper and could be an opportunity to develop further. If governments continue the drive towards retrofits and a greener economy, we continue to see a lower supply with increasing demand, higher prices may be the outcome.

How To Take Part In Copper

There are a few ways a trader, if they desire, can take part in what could be an explosion in copper pricing.

Physical Ownership

From a practical standpoint, owning actual copper bullion, while possible, may not be realistic for you.

There are companies that will sell you high quality copper in bars or coins. You will also have to ensure you have an easy way to sell those pieces if you are looking to speculate on price.

Exchange Traded Funds

You can find ETFs that center around metals such as Invesco DB Commodity Index Tracking Fund (DBC) that tracks 14 precious metals. This type of ETF may suit a trader looking to have access to other metals including copper.

For those looking at ETF that cater strictly to trading copper, the United States Copper Index Fund (USCF) could be a candidate. With assets under management of US$274.27 billion, you could certainly pick a worse candidate.

Currently a consolidation at all time highs, traders would want to see some signs of strength to the upside. Positioning at the low of the range is my general strategy.

I personally like ETFs when looking for position trades especially the no commission aspect at my broker.

Trading Copper Futures

Another entry into the copper market is through Futures where each contract is 25,000 pounds of copper. Check with your broker regarding the amount of margin you would need to trade copper.

After a long run up from March 2020 of almost 150%, price is consolidating near the highs of this weekly chart. These types of consolidations after such a large increase are normal.

If looking to trade off the daily charts, the following is an example using the Daily Chart Trading Strategy.

This is a choppy instrument due to the higher level consolidation which would have probably had a trader not trading when price failed new highs. A general rule is when price is whipping back and forth a moving average, you are best to either drop to a lower time frame or skip the instrument.

I have just marked the entries, either long or short direction depending on the moving average as per the trading strategy. The red X would have been a no trigger due to the ATR buffer.

Mining Stocks

Another way to take advantage of copper indirectly, is through the mining company stocks.

While it won’t track the price of copper directly due to company issues such as financial positions or management, a ramp up in the company could take place with increased demand for copper.

BHP has pulled back from the highs and in a price zone we could expect a bounce from. We would need to see strength entering this stock. Hedge fund activity in the 3rd quarter increased by 196K shares.

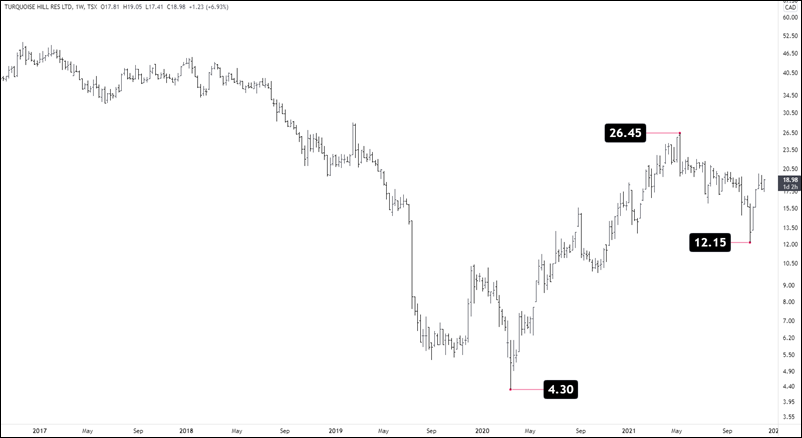

TRQ is another company to look for. Turquoise Hill is expanding the Oyu Tolgoi mine in Mongolia and looking to be one of the biggest mines in the world.

This company was on a bullish run over the last year and this could be just a correction on the quest higher. While hedge fund interest decreased last quarter, the fundamentals for ROE and asset growth were positive at 5.4% and 6.27%

I do not have positions in the companies mentioned.

As a trader, you need to follow your trading plan and you can use this information as interest only.

Conclusion

There is a strong case for a rise in copper prices and traders looking to diversity their holding may find interest in this metal.

When will they rise?

That can’t be answered but as the push to greener solutions increases and infrastructure around the globe continues to be built, copper is well positioned.

If it is accurate that there is an actual supply crunch that is not cyclical but a true lack of supply, the rules of supply and demand take over.

We are big fans of trading options however with the mining stocks, there may not be enough volume to approach using an options strategy.

Buying shares, given the low price of the stocks, could be an avenue to explore. BHP has average volume traded around 3 million shares per day. TRQ has less than a million. The low cost of shares can also be a good way for a new trader to get their feet wet with stock trading.

Whatever you choose, ensure you have a trading plan in place before attempting to trade.