What Is Range Trading

Markets trend about 30% of the time which means the other 70% is a trading range.

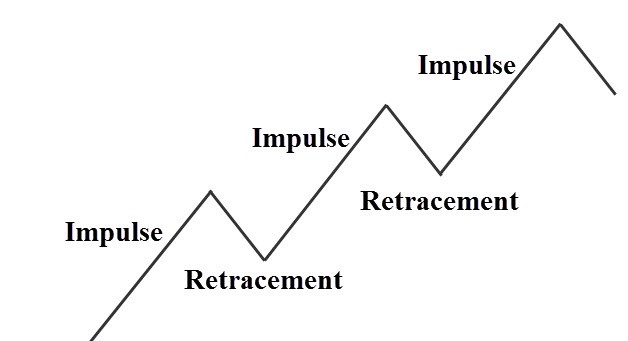

When a market is trending, you will see a stair-stepping pattern of higher highs and higher lows in the case of an uptrend. There is an imbalance of buyers and sellers and you can generally see the difference between an impulse move and a corrective move.

Impulse moves are stronger and bigger in scope than a corrective move.

Once that condition stops, markets tend to find themselves range-bound – stuck between a high and a low and continue to oscillate between these two points. Buyers and sellers have found a point of relative equilibrium and you can find yourself in a very choppy environment if attempting to trade between the extremes. This will happen in any trading time frame.

Range trading ignores the overall trend direction and will trade price moves between two easily defined price levels.

- This instrument is trending down and puts in an obvious low at #1. For the downtrend to continue, you would need to see this low taken out to continue our pattern of lower highs and lower lows.

- Price rallies and when the price starts to drop, we have the top of our trading range put in.

- Here we have a potential higher swing low which may start the uptrend

- Price takes out the high which looks like a trending market

You will later see that price falls back and takes out the #3 low and you can clearly see that price is not in a trending pattern. You have the extremes of our range labeled as #1 and #2 but #4 highlights an important fact about these levels: High and low points are zones, not always specific price levels. When looking at these turns, consider them to be zones with a margin of error both outside and inside the range.

Range trading will take into account both extreme zones and a trader will look to position a trade against the potential zones of support and resistance that form the range.

Types Of Trading Ranges

When range trading, the shape of the consolidation can vary and make going long or short more difficult.

Expanding Trading Ranges

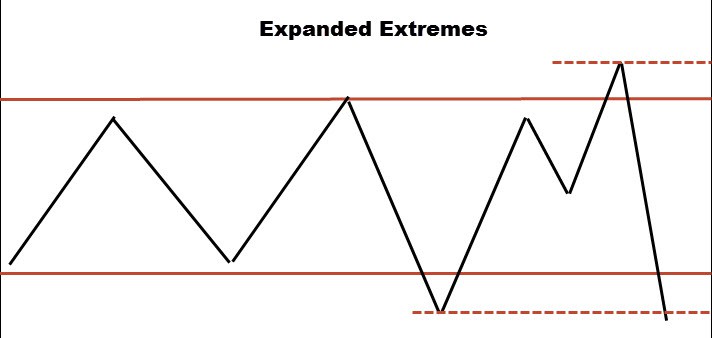

When you see price breakout out of both extremes and failing to trend, plus each swing is larger than the previous you get a range that is expanding. These are not something I want to take part in as the market has no clear cut consensus on what it wants to do. Also, if taking a position in this type of environment, where would you put your stop?

Being unable to define the stop on the trade can interfere with your risk profile for your trading plan.

Keep in mind that a simple breach of either extreme does not invalidate the range as the range could simply be expanding to a larger size.

This is quite different than erratic swings in each direction and while it may turn into an erratic expansion, at this point we can still find positions.

Converging Range

While there are different names for each chart pattern, I keep it simple and if the market is not in a trending state, I call it simply a range-bound market.

This is the opposite of the expanding range and here price appears to zero in on a particular price point. Compression is occurring and generally, a trader will look to position themselves in the breakout of the move when it occurs.

Noting there is compression is important because when it breaks, there could be strong movement behind it. Given that, looking to fade breaks of these types of compression ranges is probably not a wise trading plan.

Using Range Trading Indicators

Trading indicators can aid in your decisions when range trading and oscillators can have a place as part of a trading plan. Let’s look at the slow stochastic trading indicator as a tool you can use when looking to trade the extremes of the range.

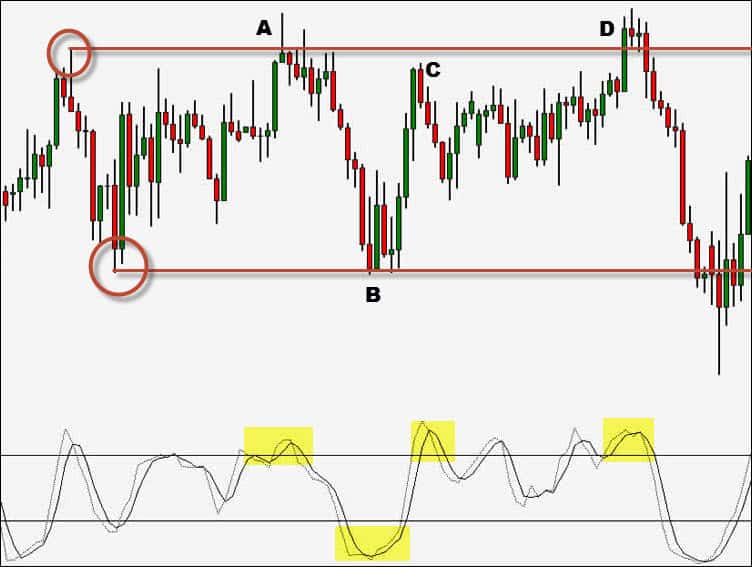

The extremes are marked by the circles but you can see later that the top gets exceeded in a breakout failure type of action.

At “A”, price pushes into the extreme and sets up a reversal candle. The indicator plots into the overbought area (not a signal by itself) and you have a shift in momentum which is shown by the cross of the indicator lines. It’s a combination of each event that may/may not constitute a trade.

Price drops to the lower extreme at “B” and you get an engulfing candle, an oversold indicator plus a momentum line cross.

- Is “C” close enough to the new extreme put in at “A”?

- Is there a reversal type of candle pattern?

- Is there a slowing of momentum seen in the price?

Besides the indicator position, I don’t see much enticing with this trade especially since price action did not show any sign of a potential reversal. Finally, at “D” price pushes to the new extreme, shows weakness while the indicator is overbought and you see a momentum line cross.

The indicator is part of an overall range trading plan and should not be the only variable you use for making a trading decision.

Best Range Trading Strategy Outline

Simple still works in trading and the key is discipline and consistency. Without those, any type of success will be short-lived regardless of the merits of your trading system. As you head into the trading strategy, keep in mind everything you’ve covered up to here.

The best trading strategy is often the simplest.

Step 1. Find Our Trading Range

Trading ranges are formed with support and resistance zones. You can look for current ranges or find trending markets that are starting to slow down. Ranges turn to trends and trends turn into ranges.

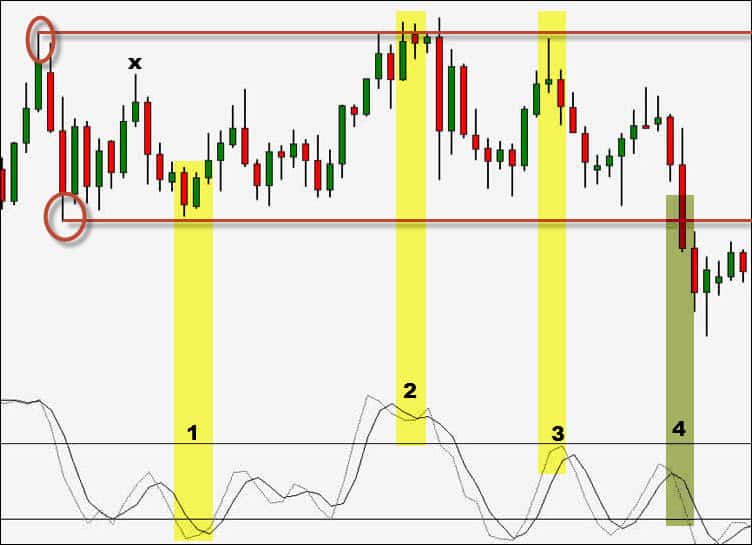

This chart has an uptrend in play and then the price started to pullback. The high is marked off and once the pivot low is in place, that is marked as well.

For the trend to continue, you need to see a higher high. If that does not develop, you can start thinking of a range play. The chart shows that price didn’t advance into a trend continuation after the low as you put in a lower high marked “X” but fail to make a lower low.

I choose a not so perfect example of a range as showing perfection is always easy to do.

Step 2. The Location Of Price Matters

With the extremes of the range marked off, you now have areas where you can monitor what price does and if you have a trading opportunity. In our example chart, the yellow highlights areas of interest.

- Price revisits the low. The indicator is oversold. Momentum line cross. Inside bar candlestick.

- High is tested. Consolidation below extreme calls for caution. Candlesticks start showing a lack of momentum and inside pattern. Indicator oversold and cross.

- Price fails before an extreme test. Indicator not in the overbought zone. Good reversal pattern but no trade.

- The indicator in the middle zone. Bearish momentum cross. No reversal pattern. Price breaks through extreme.

We needed a price to make an attempt at the extremes. When that condition was met, we wanted to see an oversold/overbought indicator position. A bullish/bearish momentum cross helped build our case for a trade and then we needed to see a reversal pattern in the price action.

Step 3. Place The Protective Stop

You would think that placing your stop just outside of the extreme would make sense. After all, you often read that you should place the stop where you would be proven wrong.

The problem is that you can have the extreme broken and the trade (and range) is still valid. Think back to the expanded range chart and you can see that the range play is still a valid trading opportunity. The range still exists but with different extremes.

There is a pattern called a failure test that needs to break an extreme and can take you out of your current trade when you should actually be getting into a trade.

- What about a distance away from the extreme?

- How far is far enough?

Given that most people base their position size on their stop size, this could lead to very small positions or, depending on the market and your capital, no trade.

Inside the range? Thinking about where the majority of people put their stops (textbook stops), where do stop runs usually go?

If you know that most traders use either the extreme or a little bit beyond, those that can run the stops know that as well. Depending on the market and trading volume, a stop run could have traders exiting at prices beyond their stop due to slippage.

If you were short from the extremes and your stop was placed just outside the extreme, you’d be taken out before the trade is able to mature. If stopped out, this trade may have had slippage giving you a worse risk profile than you planned for.

If the price is going to come close to the extreme, it is probably going to test the extreme and slightly beyond. A stop just inside of the extreme will have you out of the trade before the stop runs trigger.

The fact is there is not a perfect location for the stop that will still allow an optimum position size. I use the ATR for all my stop-loss positions.

Thinking of yourself as a risk manager will aid you in your stop placement decision.

Why Range Bound Trading Works

Once a range has formed and you have determined where the extreme zones are, you now know exactly where you are to look for a trading opportunity. There’s no guesswork involved. The price will either break out of the extremes, reverse at the extremes, or expand at the extremes.

The middle of the range is not an area you want to play in.

Support and resistance levels make up the extremes of the range and S/R are zones that garner a lot of trader interest. You will have some type of action around these levels that can range from a clean test of the level to price whipping around the zone.

The key is to have a trading strategy that sets up what you are looking for and how you are going to trade it.

- What type of price rejection are you looking for?

- Where will you place your stop?

- Will you use other tools to help with your decision?

Just remember that ranges end and a trend will begin. Before that happens, taking trades while in a trading range can offer up another opportunity for those looking to make money in the markets.